Investors are worrying the economy into a recession

What *actually* causes the economy to go into a recession?

Julian outlined one of the classic recession models yesterday in 2020 Recession Watch 101.

Basically, when investors see weakening economic data, they get worried about their return on investment. That makes them allocate less to riskier stocks and allocate more to less-risky bonds.

This drives stock prices down, and bond prices up.

Then companies look at the stock market turmoil that follows and decide they need to cut spending and costs.

Those cuts trickle down to you and me, and we either have less money to spend or voluntarily cut our spending, which slows the consumer spending that fuels economic growth.

Then poof, a recession.

Is it really that simple? Can recessions start from investors worrying too much?

Well, yeah. One of the largest banks, Bank of America, basically said the same thing in research out today.

THE WORD ON RECESSION FROM WALL STREET

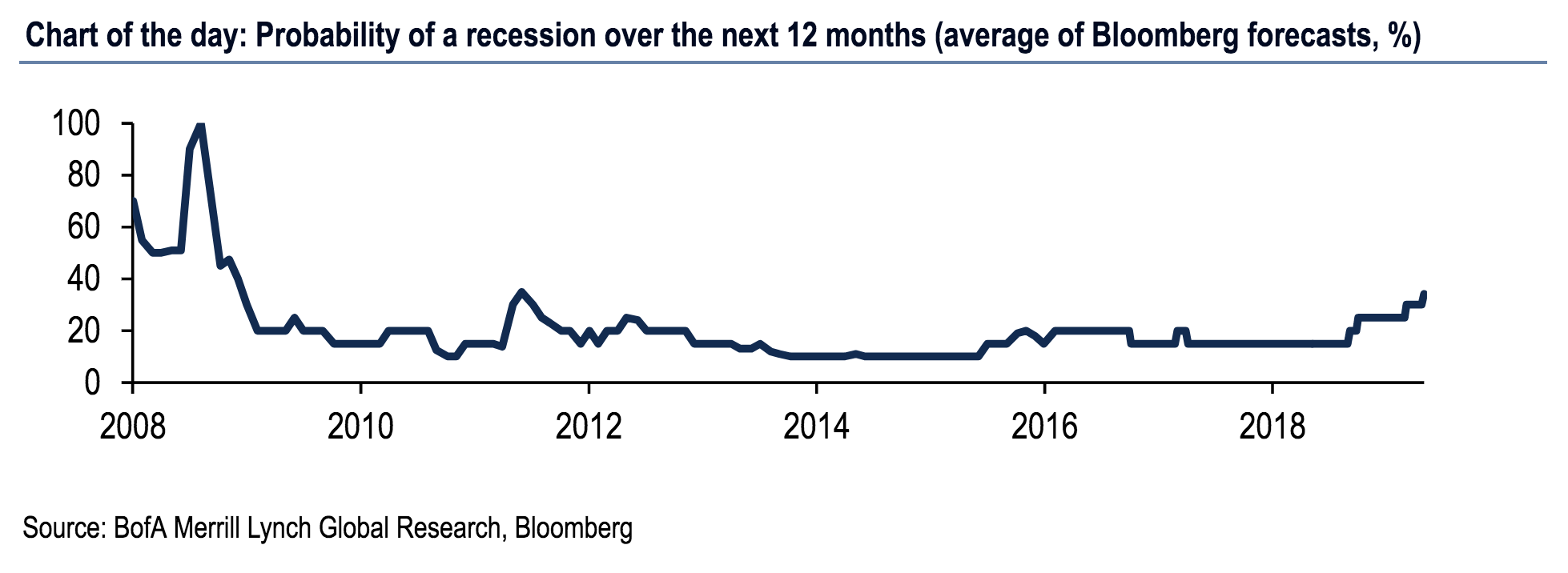

In a research note titled “Can you worry yourself into a recession,” BoA admits that the economic outlook right now is fairly weak. It cited Bloomberg’s survey of economists, a survey of Wall Street investors, and comments from officials at the Federal Reserve—and large segments of all three groups expect a recession in the near future.

Here’s where the worrying comes in. BoA says one of the biggest factors complicating the economy is the U.S. trade war with China. According to the Wall Street survey BoA cites, it’s the biggest worry on the minds of money managers.

If the trade war drags on, the turbulence it creates in the stock markets could eventually ripple to a recession. Or, we could continue the modest growth the U.S. economy has seen in the last few years.

BoA sums it all up here:

The collective judgment of economists and market participants is that the outlook is looking worse than it did even a few months ago. The US-China trade negotiations seem to be moving in the wrong direction: taking two steps back, one step forward. There is limited growth potential in the US. Fiscal stimulus is fading quickly and the labor market is starting to show signs of cooling off.

Best case is that the US remains resilient in the face of shocks, growing modestly above trend. Worst case is the trade war brings the longest expansion on record to an end. One thing appears certain: it will be a turbulent ride.