JP Morgan On Home Prices: Down 4-5% More, Bottom By Mid-2012

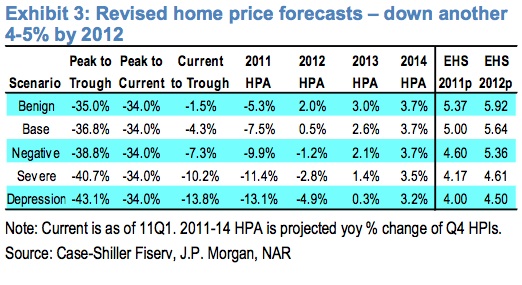

In their June Home Price Monitor, JP Morgan revised down their peak-to-trough home price forecast to -37%. This means they’re estimating home prices to drop 4-5% lower than today to reach bottom in mid-2012. They acknowledge that local home price variability is wide. Below are key excerpts, a table, and link to the full report.

We revise our base case home price forecast, largely based on existing home sales coming in lower than expected

Our new base case is down 37% from the peak level, or another 4-5% from here (Q1 2011) to a bottom by mid-2012. Regional variation will magnify

Home prices declined more than expected in the first quarter, falling to a new low post-2006. The Case-Shiller and the FHFA index dropped 4.2% and 3.5%, respectively, in the first quarter

However, the CoreLogic home price index was up 0.7% in April, the first monthly gain since last June. This suggest some stability of the summer months

Housing data and economic reports in April have disappointed. Housing demand weakened, inventory continued to rise, housing permits dipped again, and payrolls sharply slowed

Leading indicators for futures sales are poor. Pending home sales were down almost 12% in April and mortgage applications still linger at very low levels

Despite continued low mortgage rates, demand continues to disappoint. A looming question is when/if lending standards will ease enough to boost demand

CME housing futures pointed to a bottom in home prices at the end of this year, or 5.8% lower from last year, which is slightly better than our revised base forecasts

JP Morgan Home Price Monitor: June 2011