Latest on jumbo mortgages. Big 4 banks’ loans down, deposits up.

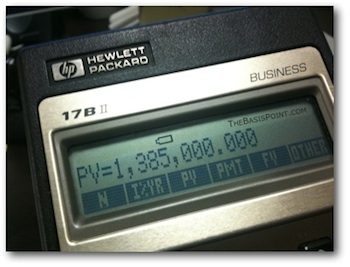

Jumbo mortgage volume is very dependent on location. So what are borrowers in high cost areas thinking when it comes to obtaining a jumbo loan? Linda Stern of Reuters reminds us that conforming loan limit caps for high cost areas will be reduced from $729,750 to $625,500 effective October 1, and says that some borrowers are rushing to get jumbo loans before this impacts the jumbo market.

Jumbo mortgage volume is very dependent on location. So what are borrowers in high cost areas thinking when it comes to obtaining a jumbo loan? Linda Stern of Reuters reminds us that conforming loan limit caps for high cost areas will be reduced from $729,750 to $625,500 effective October 1, and says that some borrowers are rushing to get jumbo loans before this impacts the jumbo market.

Wells Fargo does a decent business in jumbo loans (at least in its retail and wholesale channels), but earnings results show an industry trend of loan growth that’s flat or down:

Wells Fargo loan growth was flat to down in most loan categories, including a 32% drop in mortgage production. During the first quarter, “Home mortgage applications of $102 billion, compared with $158 billion in prior quarter, home mortgage application pipeline of $45 billion at quarter end, compared with $73 billion at December 31, 2010, home mortgage originations of $84 billion, down from $128 billion in prior quarter, and a residential mortgage servicing portfolio of $1.8 trillion.” You can scroll to page 10 in this supplement for more, including layoffs.

Generally speaking, in the first quarter the four largest banks here in the US saw average loans outstanding drop 7% from a year earlier, but deposits increase by 5%. From a bank’s point of view, the demand for credit has dropped and may not pick up again until the economy shows more improvement.

And, as we found out a few years ago, making loans for the heck of it doesn’t pay off. For some banks, SBA, auto, and commercial lending sectors are showing some growth, but Chase is dealing with WAMU’s legacy, Bank of America with Countrywide’s, and Wells Fargo with Wachovia/World Savings’. And so, very basically, they sit on the cash, and earn the spread between what they pay on deposits and earn on loans.

Private mortgage insurance companies, on the other hand, wish they had more cash. MGIC has lost money in 14 of the last 15 quarters. It is the largest MI company in the US, so therefore used as an indicator of the health of the industry. Yesterday’s release surprised the market, causing stocks of Radian, PMI, MGIC, etc., to tumble. (For the year, MGIC is down 27%, Radian down 33%, and PMI down 44% – don’t look for a lot of free spending at the upcoming conference in NY!) In theory MI companies pay lenders when homeowners default and foreclosures fail to recoup costs – but rescissions are a big issue. MGIC stated that, “The benefit from rejected claims, or rescissions, was about $200 million in the first quarter, compared with annual totals of about $1.2 billion in 2009 and 2010…Rescissions will not continue at the same rates, as a percentage of claims received, we have previously experienced.”

Domination of Government Jobs

A job market story from the Wall Street Journal recently noted, “If you want to understand better why so many states-from New York to Wisconsin to California-are teetering on the brink of bankruptcy, consider this depressing statistic:

Today in America there are nearly twice as many people working for the government (22.5 million) than in all of manufacturing (11.5 million). This is an almost exact reversal of the situation in 1960, when there were 15 million workers in manufacturing and 8.7 million collecting a paycheck from the government. More Americans work for the government than work in construction, farming, fishing, forestry, manufacturing, mining and utilities combined. We have moved decisively from a nation of makers to a nation of takers. Nearly half of the $2.2 trillion cost of state and local governments are the $1 trillion-a-year tab for pay and benefits of state and local employees. Is it any wonder that so many states and cities cannot pay their bills?”

Besides Wisconsin and Indiana, every state in America (including Pennsylvania and Michigan!) has more government workers on the payroll than people manufacturing industrial goods. Wyoming and New Mexico “lead” the nation with more than six government workers for every manufacturing worker.