More homeowners taking cash-out mortgages, but it’s different from 2008 financial crisis for 2 reasons

Analyst Bill McBride has been writing the CalculatedRisk blog since early in the financial crisis, and has always been known for his housing analysis.

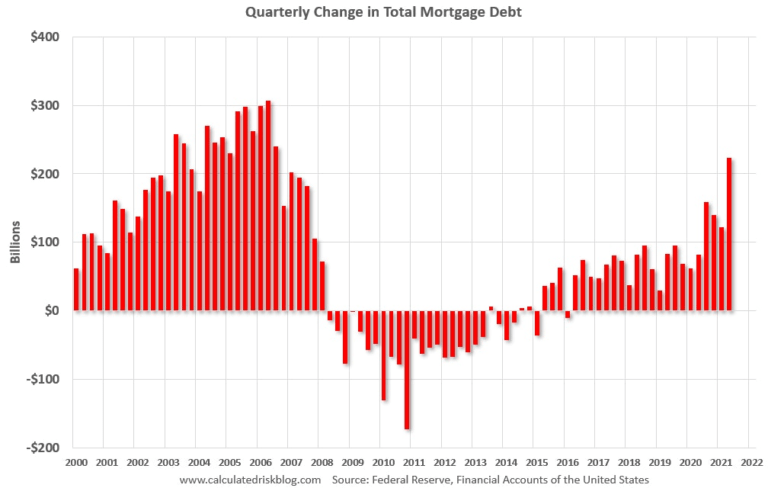

He’s got a piece out comparing today’s rise in home equity extraction with that of the crisis/housing bubble era. Are homes again becoming ATMs? No. For 2 reasons as he outlines in his piece.

The bottom line is the recent increase in mortgage equity is not concerning – it is far less as a percent of disposable personal income than during the bubble, and most homeowners have substantial equity.

___

Reference: