COVID Impact On Home Prices, Inventory, Homebuyer Demand: HouseCanary Report

HouseCanary is a leader on housing data from pricing to market behavior. In this latest report, they provide listing volume, new listings and median listing price information for 41 states and 50 MSAs from CODID eye of the storm March 2020 to March 2021. Highlights include:

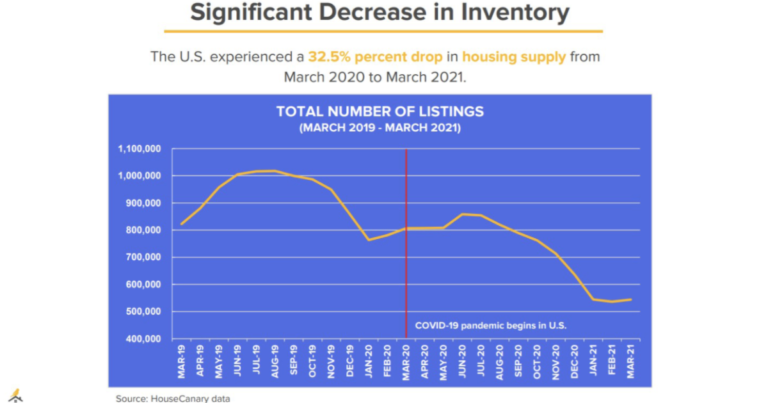

– There was a significant decrease in housing inventory. The U.S. experienced a 32.5% percent drop in housing supply from March 2020 to March 2021. This record decline was partially the result of rising costs of supplies, such as lumber, which have been hard to come by during the pandemic due to global supply chain issues.

– Homebuyer demand grew stronger. The number of listings under contract rose 4.6% during the first year of the pandemic, outpacing 2019’s figures. This spike in demand occurred as mortgage rates sat near historic lows, government relief arrived, and millions of Americans yearned for more space in the new work-from-home environment.

– Americans moved faster than prior to the pandemic. Homes spent a median of 12 fewer days on the market compared to the same period the year prior. This was fueled, in part, by an increasing number of buyers chasing an ever-shrinking set of available inventory throughout 2020.

– Prices soared. Across the U.S., the median listing price increased by 15.0% while the median closing price jumped 18.7% from March 2020 to March 2021. During the same period, the median listing price per sq ft increased by 19.0% and the median closing price per sq ft rose 17.5%.

HouseCanary's latest data on home listing volume, new listings, median listing price information for 41 states and 50 MSAs from March 2020 to March 2021.

___

Check It Out:

– COVID Impact On Home Prices, Inventory, Homebuyer Demand: HouseCanary Report