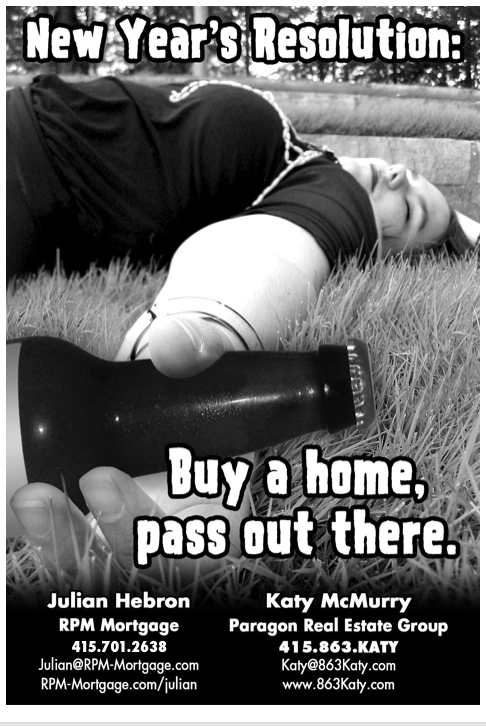

New Year’s Resolution: Buy A Home, Pass Out There

Back in 2005 when The Onion first came to San Francisco, I did a year-long advertising campaign along with one of my realtors. I wrote the ads in a style that fits their humor. Just came across this one, and it still made me laugh. As the year goes on, I may post more of this series.