Newly signed deals to buy homes down 37.8% this winter. Should buyers put heads in snow until Spring?

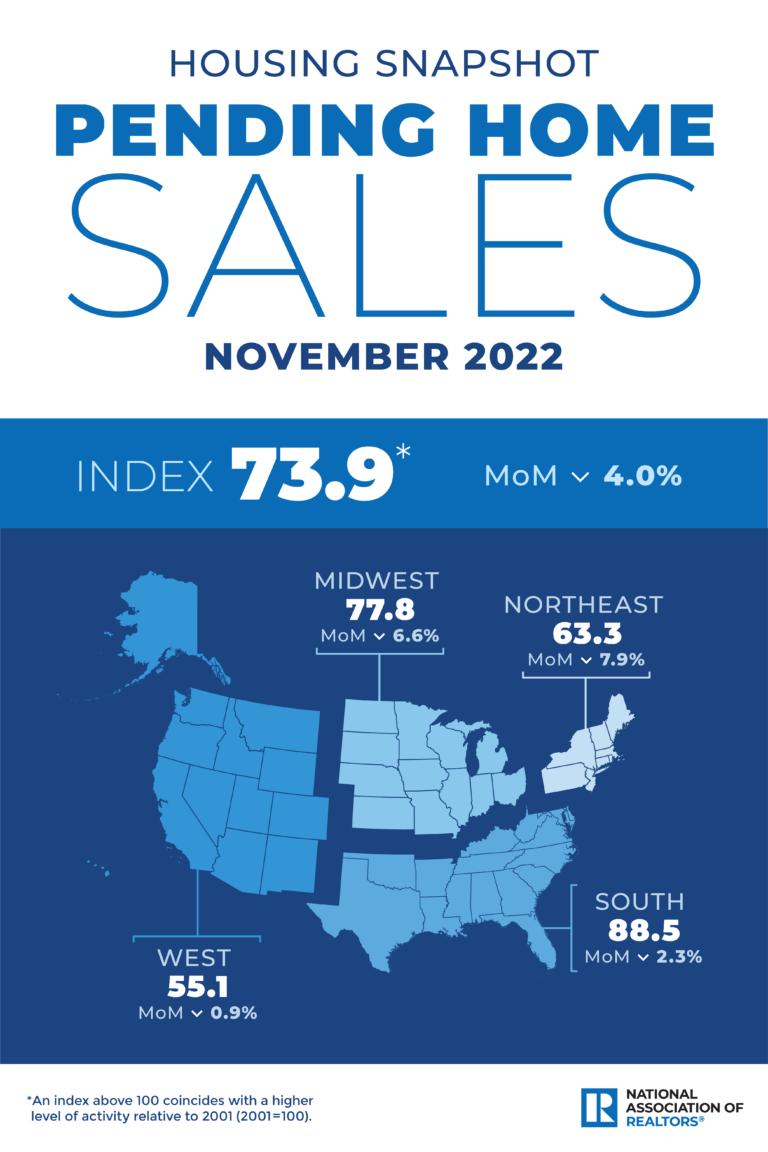

The NAR’s pending home sales report measures how many people are signing deals to buy existing homes, and November’s reading showed new contracts down 37.8% from a year ago, and down 4% from October to November.

But remember this: mortgage rates peaked October 20 at 7.375% and have been down between .75% and 1.125% since then.

So we may see that November’s pending home sales report, the second-lowest monthly reading in 20 years, puts us close to the bottom of new contract activity.

No surprise that the peak of the great 2023 rate spike caused buyers to pause, but the new year will bring opportunity as the Fed’s inflation battle progresses and mortgage rates moderate.

Remember this too: Fed rate hike actions impact rates on overnight bank-to-bank lending, not mortgage rates. Mortgage rates are impacted by daily trading in mortgage bonds, and mortgage bond investors will buy — bringing rates down — when they see inflation moderating.

If you’re a home buyer, don’t put your head in the snow until Spring. Because dealmaking opportunities start warming up when headlines are coldest.

Example: Existing home sales (which this pending home sales report measures) are 90% of the market* and have slowed the last 10 months straight. This created dire headlines last week.

But slower existing home sales have brought median existing home prices down from a June peak of $413,800 to $370,700 in November.

With 10% down, that’s $2622 per month (using a 6.625% 30-year fixed rate and including property taxes and insurance), and you can qualify for that making $74,000 per year if you have no other monthly debt. If you had $600 in car, student loan, and/or credit card debt, you can qualify for this home purchase price making $91,000 per year.

Please comment or reach out directly with questions.

___

Reference:

– Pending Home Sales Slid 4.0% in November (NAR)

– Mortgage rates down 1.125% from 2022 peak as core inflation drops second straight month

* The other 10% of home sales in America are sales of newly built homes, and new home sales have actually increased the past 2 months as 60% of builders (per NAHB) have offered rate buy-downs, home upgrades, and other attractive incentives to buyers. Current median new home prices are $471,200. With 10% down, that’s $3307 per month (using a 6.625% 30-year fixed rate and including property taxes and insurance), and you can qualify for that making $92,300 per year. if you have no other monthly debt. If you had $600 in car, student loan, and/or credit card debt, you can qualify for this home purchase price making $109,000 per year.