Rates Even After Manufacturing Contracts 3rd Month

Mortgage bonds and rates are about even today after weaker manufacturing data, which would normally cause an MBS rally leading to lower rates, but we’re even for now as markets hold for European Central Bank meeting results Thursday.

Here’s a more detailed rate outlook for this week, and below is a recap of today’s U.S. economic data…

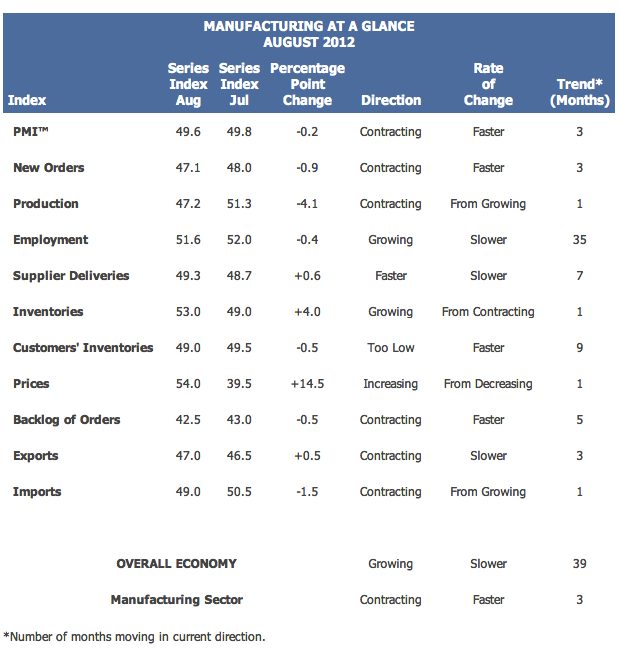

ISM Manufacturing Index (August 2012)

– Index Level was 49.6, mild contraction and below previous 49.8

– 50 is dividing line between expansion and contraction

– Below 50 for 3rd straight month

– Manufacturing will be hurt for months by slowing growth in EU and China

– Table below and here’s full report

– Also here’s a good writeup from Bespoke

PMI Manufacturing Index (August 2012)

– Index Level was 51.5

– This indicates modest growth

– New Orders component was at the lowest level since recovery ended

Construction Spending (July 2012)

– Month/Month Change -0.9%.

– The two previous months had gains.