Rates Up After FOMC: Side By Side Fed Statements

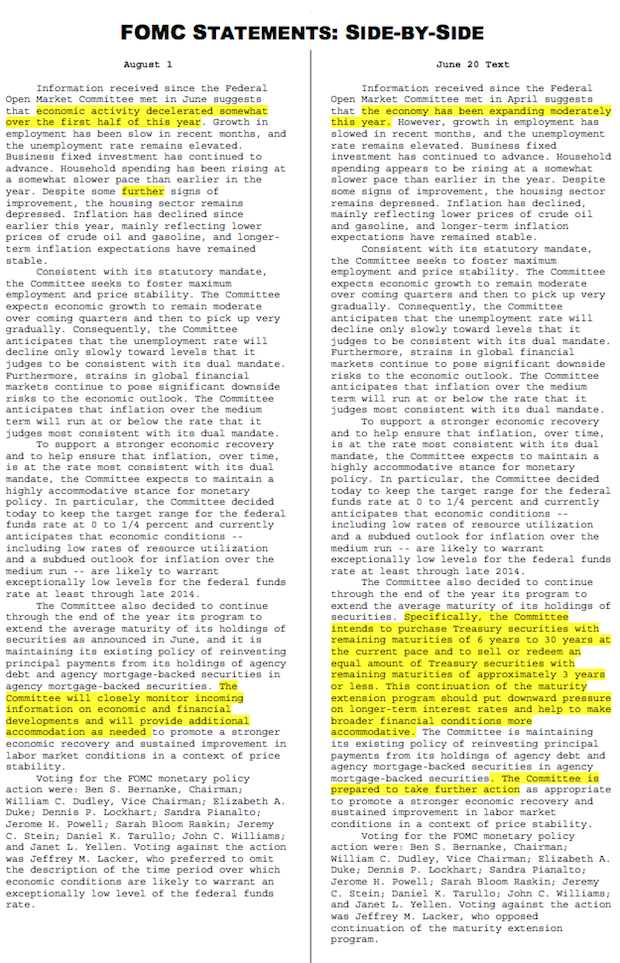

Below is a side by side comparison of Fed statements from today vs. the last Fed meeting June 20. They re-confirmed the extension of Operation Twist, a program where the Fed trades shorter term debt for longer term debt. They also re-confirmed purchasing more mortgage bonds (MBS) with the proceeds of principal payments received on existing MBS purchased during previous quantitative easing (QE) efforts. This helps keep rates low because rates drop (or stay low) when MBS prices rise (or stay high) on higher demand.

Conversely, rates rise when bond prices drop on a selloff and that’s what’s happening today as MBS markets see the announcement as a letdown (FNMA 3.5 coupon -20 basis points).

The Fed today clarified they’re “prepared to take further action” but didn’t explicitly mention QE3. This means they’ll continue monitoring global macroeconomic conditions until their next rate policy meeting September 12-13. Links below with more on this topic—including rate impacts of a possible QE3 in September.

Tomorrow morning is the ECB’s policy announcement. Previews here, here, and here.

___

See Also:

– Why Rates Could Rise If QE3 Is Announced

– Fed Moving Closer To QE3 – plus QE1, QE2 recap/timeline