Redfin buying Bay Equity for $135m adds $8.5b in mortgage volume & creates one-stop home buying, selling, financing for consumers

Seattle-based digital real estate brokerage Redfin — a public company worth $3.6 billion — is buying Bay Area-based Bay Equity Home Loans for $135 million. This serves both firms and consumers well. Here are a few quick notes on the deal:

– The deal grows Redfin’s mortgage operation almost 10x overnight.

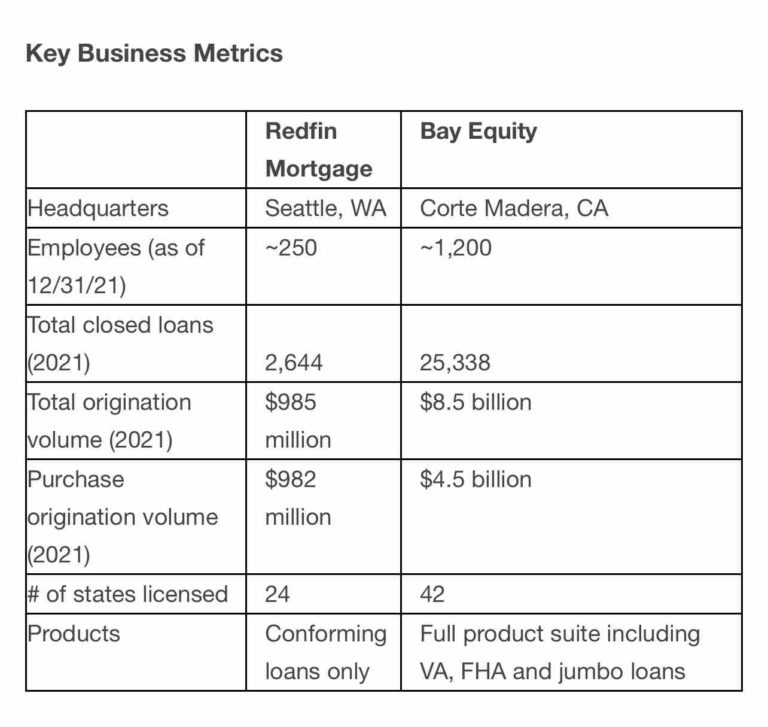

– It adds Bay Equity’s $8.5 billion annual loan production to Redfin’s $985 million (see image).

– Redfin buying Bay Equity for $135 million is 2.16 times Bay Equity’s balance sheet as of 12/31/21 (excluding goodwill, aka the brand value). This proves how great mortgage operations can be great buys. It should also prove how much value can be grown when combining a great mortgage operations with complementary non-mortgage businesses.

– Redfin buying Bay Equity gives consumers one place to buy, sell, and finance homes.

– The deal is an important proof point in this one-stop shop vision lenders and real estate brokerages have been pursuing for almost 5 years.

– It’s important for lenders and real estate brokerages because cyclicality hurts valuations of both. Deals like this add revenue diversity for full market cycles.

– It’s important for consumers because buying, improving, selling, and financing homes is very complicated and a singular experience makes it easier. This makes consumers more loyal.

– Redfin sells $25 billion in real estate per year and has 40 million consumers visiting its digital platforms each month.

– Redfin buying Bay Equity marries Redfin’s digital marketing expertise in real estate with Bay Equity’s local ground game in lending.

– The McGovern brothers have been friendly competitors and collaborators of mine here in San Francisco since they founded Bay Equity in 2007. They truly get consumer care, scale lending, and the reality of humans in digital transformation.

Congrats to both teams on this deal.

I feel for team members subject to headcount adjustments as teams are combined (see first link below for details).

And I look forward to seeing what it means for Redfin’s valuation and future lending, fintech, and real residential estate dealmaking.

Without question, this will set the tone for more 2022 deals. Please comment below or reach out directly with questions.

___

Reference:

– Redfin buys Bay Equity to create one-stop home buying, selling, financing for consumers

– 5 Trends (Including M&A) Reshaping U.S. Mortgage Industry

– How Mortgage Lenders May Finally Get The Fintech Respect (and Valuations) They Deserve