Retail Sales Fall, Pointing to Slower GDP Growth

Rates holding record lows today on stronger MBS buying after weaker retail sales. One optimistic data point today was a better than expected Empire State Manufacturing survey. Details on today’s fundamentals below.

Retail Sales (June 2012)

– Retail Sales, Month/Month change -0.5%

– Retail Sales less autos, Month/Month change -0.4%

– Retail Sales less autos and gasoline Month/Month change -0.2%

Not only were Retail Sales extremely poor in June but the previous month was revised downward making the hits even worse.

May Retail Sales were revised from +0.2% to -0.2%.

Also, Retail Sales data is NOT adjusted for inflation.

With Consumer Spending making up the majority of GDP, this translates into extremely low GDP growth for 2Q2012.

Consumer Spending is the force which drives the economy (GDP) and this economy is not driving but rather is parked.

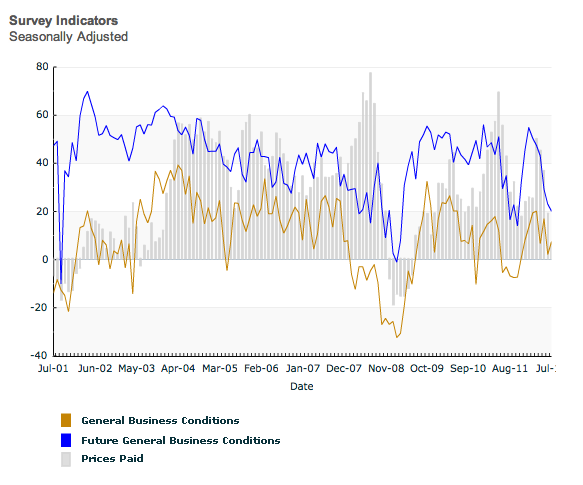

Empire State Manufacturing (July 2012)

– Index of manufacturing conditions in NY region +7.4, above the +2.3 expected

– Zero is the dividing line between expansion and contraction

– Full Report and chart below

Business Inventories (May 2012)

– Inventories for May were +0.3%. Businesses were more optimistic about what consumers would spend and we will see inventories start to contract because of slower Retail Sales.