Romney Hasn’t Even Provided Enough Taxes To Get A Mortgage In This Country

In light of the debate over whether GOP presidential candidate Mitt Romney should provide more than the one year of filed tax returns he’s provided so far, here’s a dispatch from the retail mortgage banking trenches: two years of filed tax returns are required to get a mortgage in America.

Romney hasn’t even provided enough taxes to get a home loan in the country he wants to run.

Two years of filed tax returns is a loan approval requirement of Fannie Mae and Freddie Mac, which own or back more than half of the $13 trillion in U.S. mortgage debt, and they guarantee $100 billion (or three of every four) of new loans originated each month.

Fannie and Freddie are owned by the federal government Romney wants to oversee. They’re so key to the economy that they were taken over by Treasury on September 7, 2008—as they were collapsing under the weight of bad loans made without enough tax disclosure from borrowers. The Fannie/Freddie takeover was the second in a series of bailouts the Bush administration rightly did to stem a spiraling global financial crisis (the first was Fed financing for JP Morgan to take over Bear Stearns).

Lack of disclosure led to the crisis and bailouts.

Full disclosure is very slowly rebuilding the system.

With that backdrop, let’s try to answer this question: is it ok that you have to provide more information to get a mortgage than a politician does to be president?

First, let’s understand the basic rules that voting masses must follow.

WHAT VOTERS & CANDIDATES MUST DO TO GET A MORTGAGE

To get a home loan in this country, all lenders—even the ones making “Jumbo” loans that aren’t eligible for purchase by Fannie/Freddie—start from the Fannie/Freddie template requiring borrowers to provide two years of filed federal tax returns.

If a borrower provides 2010 tax returns plus a 2011 filing extension along with draft 2011 returns as Romney has, this isn’t sufficient to approve and fund a mortgage. In this scenario, the borrower must also provide the filed 2009 returns to complete the approval and funding process.

The exception to this under Fannie/Freddie rules is if a borrower only has W2 income (Form 1040, line 7). Then they can get a loan with one year of filed returns. But if a W2 borrower has unreimbursed expenses (Schedule A, line 21) on filed 2011 returns, their filed 2010 return will also be required.

Or if a borrower has any sort of income beyond straight W2—such as dividend, interest, 1099/Self-Employed earnings, income from owning part/all of entities/properties, capital gains, or anything else on lines 8-21 of Form 1040—two years of filed returns must be provided so the lender can root out income AND losses. Lenders subtract losses from income to qualify borrowers.

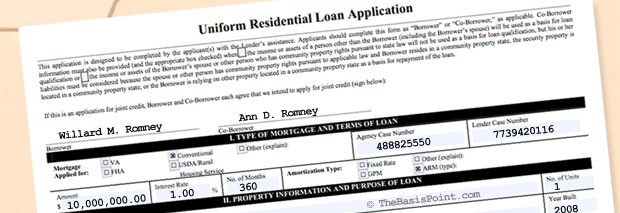

Romney has income/losses on lines 8, 9, 10, 12, 13, 14, 17, and 21 of his 2010 filed return. So he’d have to provide another year if he was applying for a loan. His 2011 draft would be ignored because it isn’t filed, and 2009 would be required.

The reason returns must be filed with the IRS is so the borrower can’t defraud the lender.

Lenders verify the filings too. They make borrowers sign IRS Form 4506, which allows them to pull the borrower’s filed tax transcripts from the IRS so they can compare those with what the borrower gave them.

Sound stringent and painstaking? Absolutely.

And it’s even more stringent for wealthy borrowers like Romney who might be getting Jumbo loans above the $417k-$625k Fannie/Freddie limits.

It’s counterintuitive, but Jumbo borrowers are more risky. Here’s why:

The role of Fannie/Freddie is to buy and securitize loans up to those limits from lenders. For loans above those limits, lenders either have to sell the loan to another lender after funding, keep the loan and all associated risk permanently, or keep the loan long enough for the Jumbo mortgage securitization market to thaw. In all three cases, it’s more risk. More risk means more disclosure to get approved.

“WE’VE GIVEN YOU PEOPLE ALL YOU NEED TO KNOW”

Ann Romney’s perturbed “we’ve given you people all you need to know and understand about our financial situation” comment last week hit home for me because wealthy clients say exactly that to me every week.

My reply is always the same:

“I’m truly sorry it’s such a painstaking and intrusive process. We know you and we understand your profile. And we’re keeping this loan for now. But we do reserve the right to sell the loan. Future buyers of this loan don’t know you. Future analysts and auditors of a mortgage bond this loan may be part of don’t know you. So your profile must documented and packaged meticulously. That way, any future party can easily understand how and why the loan was approved.”

Or put another way: give us full line item history of your employment, income, credit, assets, and debts or you don’t get the loan.

Eventually people provide what’s necessary because they want to achieve their goal.

If your goal is to be president of a country that was taken down by a lack of disclosure, you shouldn’t be screened less stringently than someone getting a home loan.

IN POLITICS & MARKETS, NOTHING MATTERS MORE THAN FULL DISCLOSURE

One absurd argument in this Romney disclosure debate is that he’s disclosed enough, there’s no rule that says he has to disclose more, and it shouldn’t matter.

Dead wrong. Nothing matters more. There were (almost) no rules that said people must provide tax returns to get a mortgage during the 2000s. This led to a home price bubble underpinned by undocumented loans that were securitized, incorrectly rated as top-quality credit, and sold globally. And of course it all ended with the worst financial crisis since the Depression.

The system is being rebuilt by transparent mortgage loans, many of which are also being securitized. These securities have remained the safest bet going for global investors since November 2008. Global investors believe U.S. mortgages—vetted and approved using government-owned (Fannie/Freddie) methodology—are the way out.

But we won’t be out of the woods until the non-Fannie/Freddie mortgage securitization market reemerges. At their peak, non-Fannie/Freddie securitizations totaled $1.2 trillion in each of 2005 and 2006. Since Fall 2007, total issuance has totaled less than $3 billion.

Once again, the ONLY way this market ramps up is to painstakingly vet jumbo borrowers with profiles like Romney’s. That’s who comprises underlying loans that make up the non-Fannie/Freddie securitization market today. But if we ever want private markets to take the burden off Fannie/Freddie—and Romney’s party shouts the loudest about this goal—then full disclosure is the only solution.

THE ROAD TO RECOVERY RUNS THROUGH HOUSING

So make no mistake: the road to economic recovery runs through housing. The road to people owning and keeping homes runs through mortgage approval standards. And mortgage approval standards require more than the guy who wants to lead the recovery is willing to provide.

This leads back to the question we began with: is it ok that you have to provide more information to get a mortgage than a politician does to be president?

A BusinessWeek report last week suggested that perhaps Romney’s losses for 2009 means he paid little to no taxes that year and that’s what he might be afraid of.

So what? Release them anyway and fight it out. Just like all the voters are forced to fight it out when they’re trying to get a loan but they’ve lost jobs, or changed jobs, or had their pay cut in recent years.

Romney’s a guy running on the promise that he understands what we’re going through. But how could he possibly? He’s got an estimated $18 million worth of personal residences. And no mortgages.*

Romney can talk about making things better all he wants. But his unwillingness to disclose underscores the root of this country’s financial problems. That’s not just evasive. It’s scary.

Romney’s American Dream is to be president. A voter’s American Dream is to own a home. It’s totally unacceptable that the voter has to disclose more to realize his dream.

___

Related:

– What’s Romney Hiding In His Tax Returns? (BusinessWeek)

– Who are Romney’s billionaire backers and what do they want? (RollingStone)

– USC Law Professor On Romney’s Tax/IRS Compliance (CNN)

– How Many Years of Taxes Have Past Candidates Provided (NationalJournal)

– Romney’s Tax Returns (2011 unfiled, 2010 filed)

– Obama’s Tax Returns (2000-2011 filed)

– Financial Crisis Timeline (St.Louis Fed)

___

*Romney’s filed 2010 Schedule A itemized tax deductions list $226,356 in real estate taxes paid (see Schedule A, line 6). The IRS says this deduction can only “include taxes (state, local, or foreign) you paid on real estate you own that was not used for business, but only if the taxes are based on the assessed value of the property.” In English, this means property tax on a primary residence is deductible and so is any property tax on a second home(s). Lenders use an average 1.25% for property tax rates when qualifying loans. So if we divide $226,356 property tax paid on personal residences by a 1.25% property tax rate, we get a property value of $18,108,480. There are $0 in mortgage interest deductions (Schedule A, lines 10-12). It’s the same for Romney’s draft/unfiled 2011 return. As for Obama’s filed 2010 and 2011 returns, they show he paid $26,863 and $25,742 in property taxes respectively, suggesting an average value for personal residences of $2,104,200 during those years. And in mortgage interest for 2011 and 2010, Obama paid $47,564 and $49,945 respectively. If we divide the average 2 year interest paid by a 4.5% jumbo mortgage rate which was common for those years, we get a mortgage loan size of $1,083,433. These are my own estimates from viewing tax returns of the candidates, and no other sources.