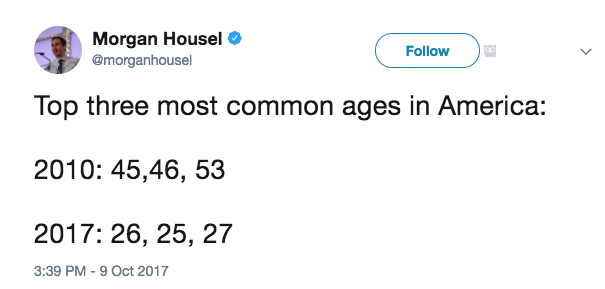

Top 3 Most Common Ages In America

Millennials are mostly like every other early career group that came before them: noncommittal on many matters, and like to party and spend money on frivolous things. The difference is they have real-time access to all financial, housing, and other services and data.

And now we’re in a phase where the three most common ages in America are 26, 25, 27. I bought my first house when I was in this range, and I was a total noncommittal, partying, expensive breakfast kind of guy. But I was always dead serious about my career and financial progression.

This massive group is no different. They’re just better informed. But they still need guidance, especially on housing. Wealth management has gotten so sophisticated, consumers can park X amount of their paycheck in a robo-advisor service and let it grow at a fraction of the fees they would’ve paid a broker just 10 years ago. That’s because stock and bond markets are highly efficient and most market information is known to all market participants.

The same isn’t true for real estate. Even with amazing data from Zillow and others, housing is wildly inefficient and many factors that create appeal and value in a home are only known if you can physically observe it on the ground.

For individuals (as opposed to institutions), home buying and investing still requires street to street and house to house knowledge. Data services today enable you to “walk” properties and neighborhoods, but most people still don’t make final buying decisions without physically walking, and this is likely to remain the same for quite some time—especially for a primary residence buyers—because you have to envision what it’ll be like to live and have a family in a certain area. And you have to observe certain housing market inefficiencies that data services can’t observe.

This hit home for me today with this WSJ piece on how millennials are staging elaborate photo shoots for social after they close on homes. This tells us that no matter how young and data driven you are, and no matter how much of an investment mindset you have about buying a home, the place you live is deeply emotional.

I hear countless market gurus talk housing as purely business and sell the idea of cold, hard rent vs. buy math with no emotional attachments. Fake news! The majority of these messengers have owned homes for years, are raising kids in those homes and neighborhoods, and would be devastated if it all changed. Even these most business-minded investors will admit they’re emotionally attached to their home if they’re telling the truth.

And for the average 26, 25, 27 year old consumers who are now dominating the marketplace, housing is easier to digest than traditional investing as a vehicle to start investing hard earned early career money while also getting great utility and enjoyment out of it.

Social media will only make the emotional connections stronger. Once people broadcast their new home owning life to their people, and their people validate that life for them with likes and comments, it becomes/reinforces how they see their life and who they are.

So two takeaways:

1. Talk of technology killing off realtors and loan officers is still exaggerated

2. Social technology will only increase emotional attachment to housing

___

Reference:

– After closing on new homes, millennials staging elaborate social media photos (WSJ)