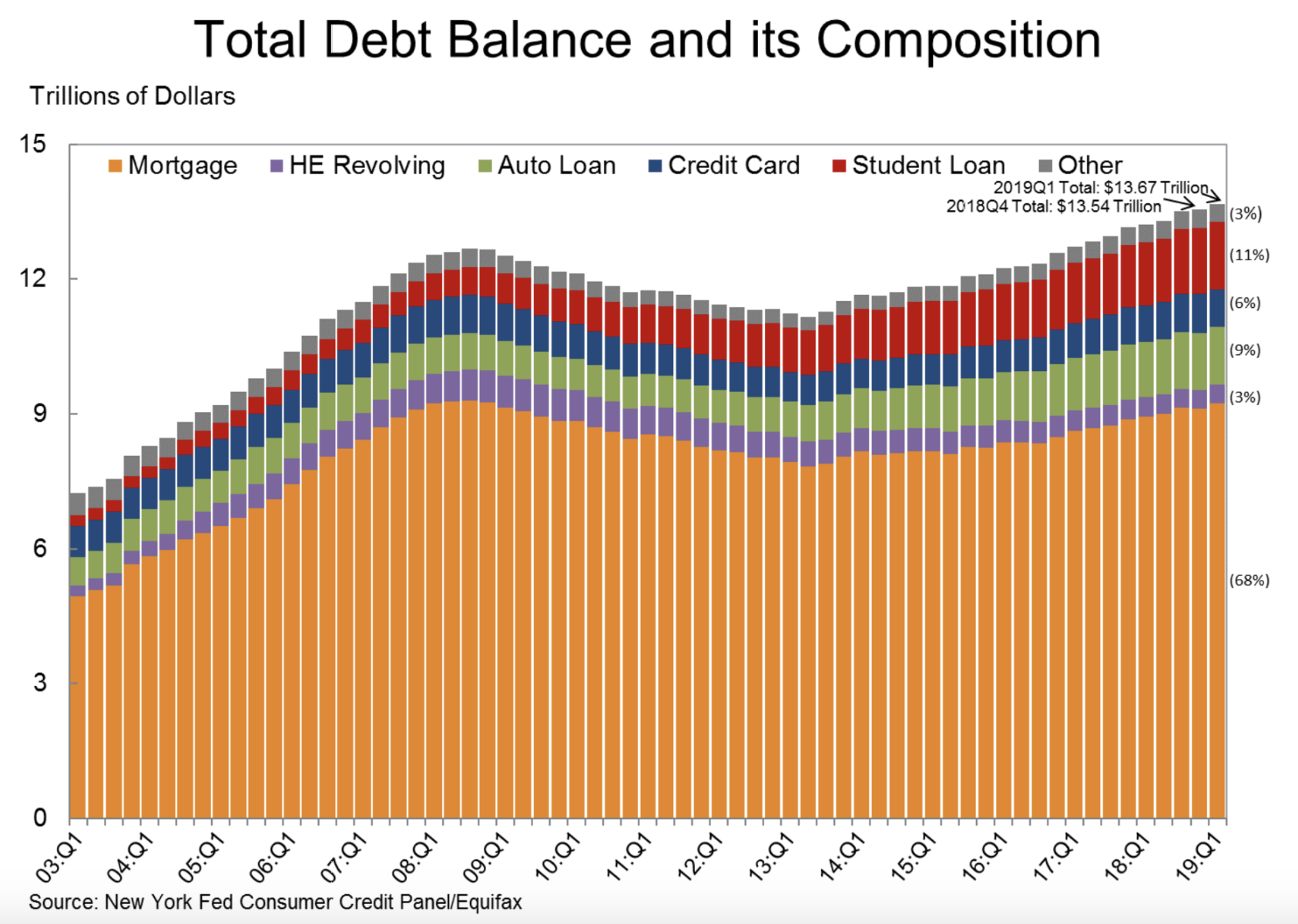

Total U.S. mortgage, student, auto and credit card debt 1Q 2019

The New York Fed just put out data on how much debt we all had in Q1 2019. Let’s dig in for the important stuff.

– U.S. total household debt is $13.67 trillion, up $124 billion (0.9%) from Q4 2018

– Mortgage debt at $9.2 trillion, a $120 billion increase from Q4 2018

– Home equity lines of credit balances down $6 billion to $406 billion total

– $344 billion in new mortgage debt in Q1 2019 (only 1% delinquent)

– 11.7% of mortgages in early delinquency (30-60 days late) transitioned to 90+ days delinquent, lowest rate since 2005.

– Student loan debt at $1.49 trillion, up $29 billion from Q4 2018 (less than 11% of total debt)

– BUT 10% of student debt is 90+ days late on payment or in default

Check out the big picture below. Remember this composition when someone tries to ring the alarm about debt as a systemic risk—most debt is mortgages, and the mortgage debt market is healthy. More on this to come.