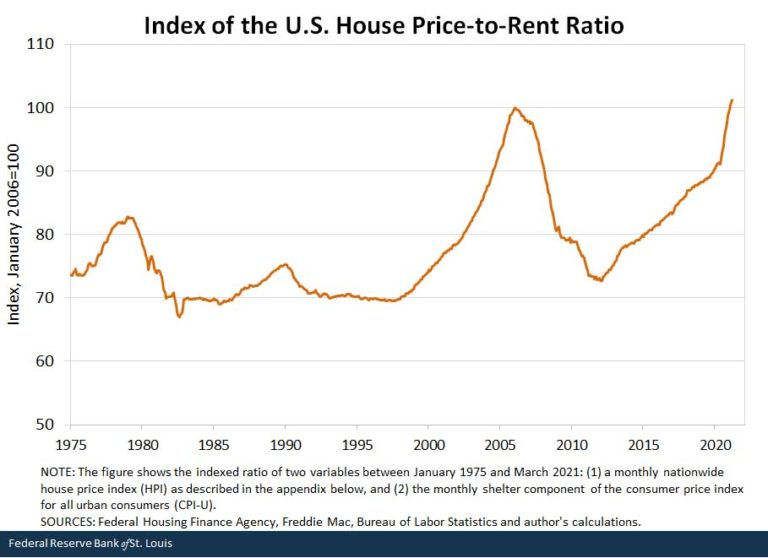

U.S. home price-to-rent ration highest since 1975, meaning the average house sells for way more than its “fair value”

The nationwide house price-to-rent ratio, a widely used measure of housing valuation that is analogous to the price-to-dividend ratio for the stock market, is at its highest level since at least 1975, as shown in the figure below.

Rapid house price appreciation since last May, combined with a slowdown in rent growth, resulted in a surge in this ratio.

By February 2021, the national house price-to-rent ratio had surpassed the previous peak reached in January 2006; in March 2021, the ratio was 1% higher than its level at the peak of the housing bubble.

This suggests the average house now sells for quite a bit more than its “fair value,” as explained [in the link below].

Rapid house price appreciation since last May, combined with a slowdown in rent growth, resulted in a surge in this ratio.

___

Check It Out: