Wells Fargo CEO John Stumpf: 3 Point Plan To Fix Mortgages

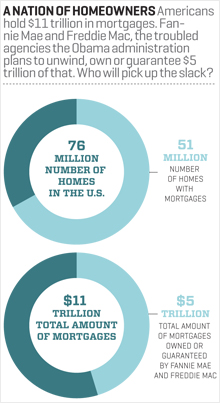

Here are a couple Monday morning questions: Is the rise of non-bank lending a good thing? Does the GOP’s rush to dismantle Fannie & Freddie threaten a fragile housing market?

Here are a couple Monday morning questions: Is the rise of non-bank lending a good thing? Does the GOP’s rush to dismantle Fannie & Freddie threaten a fragile housing market?

And the biggest question of the day, or any day, is how do we fix the mortgage mess? Wells Fargo CEO John Stumpf offers a three point plan in Fortune magazine. In short it’s: (1) make lenders have skin in the game, (2) make government backing of loans explicit, not implicit, and (3) uniform underwriting standards at all banks. Number 1 and 2 are covered by Finreg with details being sorted out now. Number 3 warrants a bit more commentary.

In a world where a bank knows its customers intimately, they might make a special loan concession for an old customer who’s fallen on hard times and doesn’t quite fit the loan approval mold. But in a world where a bank has to sell their loans (even if they’re keeping a percentage of all loans sold as required under Finreg), all the loans must conform to a certain set of standards to the securities the loans end up being part of can be rated, priced, and sold with transparency.

Stumpf’s comments are relevant, including that third point, but only the small firms will be able to meet the needs of borrowers who don’t quite fit the mold and also meet underwriting standards required for securitization. Big firms’ underwriting processes are all about box-checking and volume, so anytime every box isn’t checked, that borrower is going to be out of luck.