WeeklyBasis: Rates Near Record Lows After Jobs Flop

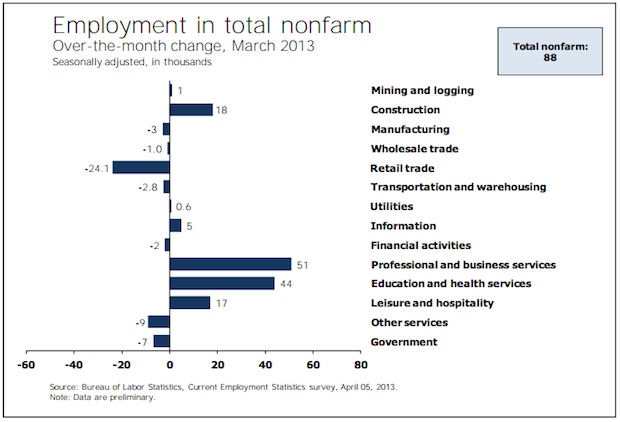

Rates are down today after a BLS report showed the U.S. economy added 88k nonfarm payrolls in March, way below expectations of 190k, and February was revised up from 236k to 268k.

The March number brings the average monthly gain over the last 6 months down to 169,000. The chart above shows industries with biggest positive and negative impacts on payroll growth.

This non-farm payrolls figure is from the ‘Establishment Survey’ component of the jobs report which doesn’t count actual people, but rather counts how many companies opened or closed, then uses that data to estimate the number of jobs gained or lost.

Unemployment dropped from 7.7% to 7.6% according to a different component of the jobs report called the ‘Household Survey’ which counts people. There are 11.7 million people unemployed. Plus another 7.6 million people are working part time because their hours were cut or they can’t find a full time job.

Not pretty.

The only good thing about this report is that it adds fuel to a massive bond rally this week, which has caused rates to drop to near record lows.

RATE REACTION

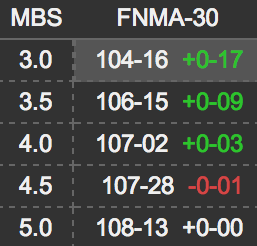

Rates drop when mortgage bond (MBS) prices rise on a buying rally, and this table* shows that rally today in key Fannie Mae MBS coupons that lenders use as benchmarks for consumer rate pricing.

Rates drop when mortgage bond (MBS) prices rise on a buying rally, and this table* shows that rally today in key Fannie Mae MBS coupons that lenders use as benchmarks for consumer rate pricing.

The Fannie 30yr 3% coupon is up sharply on the day and the week. Today alone it’s up 17 ticks (a tick is 1/32) to 104-16. And if you compare today to the pre-Easter-weekend close, Fannie 3s are up 38 ticks.

This reverses a rate spike that’s prevailed so far in 2013: rates are down about .125% today, on top of another .125% drop since Monday. So rates are down .25% this week, and this erases most of the .375% rate spike for the year. We’re now only .125% above record lows last touched mid-January.

2013 RATE RECAP

Rates started rising January 3 when markets interpreted December Fed meeting minutes as indicating that the Fed would end quantitative easing (aka QE, which is Treasury and mortgage bond buying to keep rates low) by the end of this year.

There was a brief reprieve as MBS recovered and rates touched all-time record lows (of 3.25% for a 30yr fixed loan up to $417k) for two days on January 15-16.

But then MBS selling resumed and rates were .375% above all-time record lows within a couple days, and they held that higher level until a few factors started reversing the trend: Fed chairman Bernanke reaffirmed a commitment to QE last month, geopolitical unrest spooked markets this week and fueled a bond rally, and U.S. economic data has been weaker in March and April, taking the 10yr Note yield down with it—see chart below, and note that MBS generally follow the direction of the 10yr Note.

Again the takeaway here is: We’re now within .125% of record lows, so rate shoppers who slept last time we got this low now have another opportunity to capture the lows.

Including some other important rate and jobs report links below.

___

Reference:

– A Deep Dive On The March Jobs Report

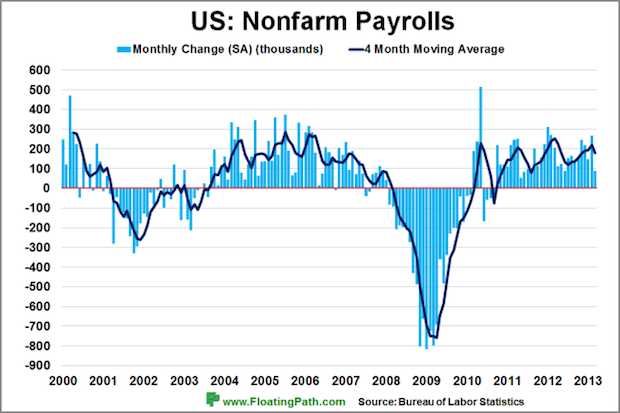

– Jobs report CHART FEST – by FloatingPath

– Jumbo Mortgages Ramping Up, FHA Winding Down

– $MBB, $TLT, $ZN_F, $TNX, $MACRO

*Table used with permission from MortgageNewsDaily