Will there be a First Republic Bank run? Here are risk factors and strengths.

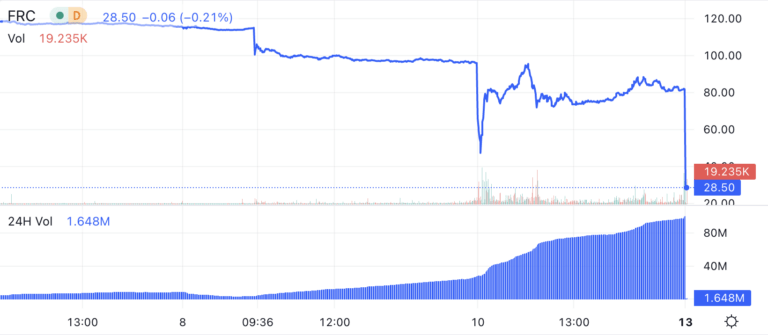

After the FDIC took over Silicon Valley Bank (SVB), other banks sold off, including San Francisco-based First Republic, which had $213b in assets and $176b in deposits as of December 31. Shares continued to sell Monday, March 13, with First Republic leading a broader bank selloff. Will there be a First Republic Bank run, even though their business isn’t as exposed to tech as SVB?

First Republic disclosed March 10 that:

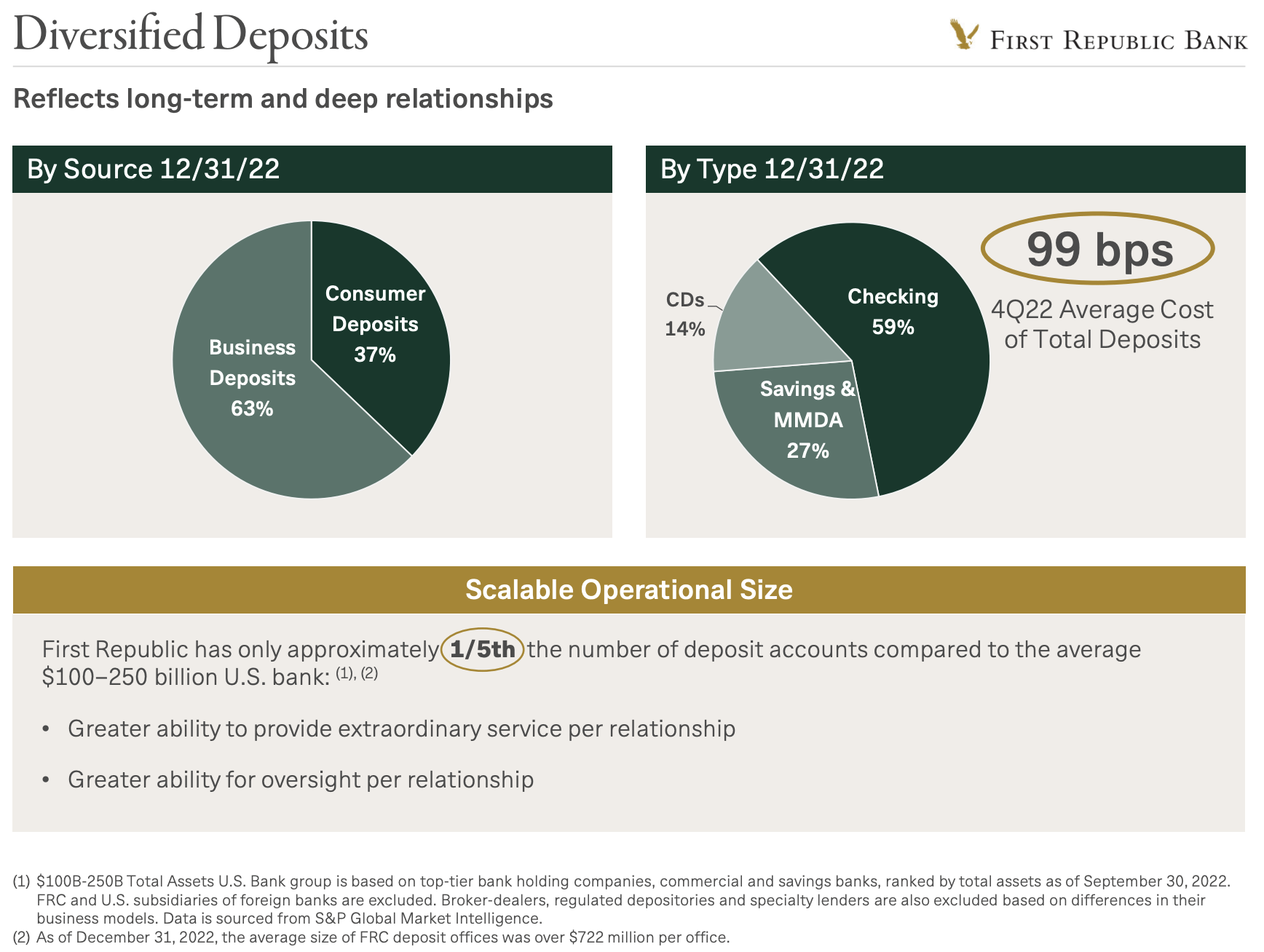

– Their consumer deposits have an average account size of less than $200,000 and business deposits have an average account size of less than $500,000.

– Within business deposits, no one sector represents more than 9% of total deposits, with the largest being diversified real estate.

– Technology-related deposits represent only 4% of total deposits.

– They have $60 billion of available, unused borrowing capacity at the Federal Home Loan Bank and the Federal Reserve Bank. [UPDATE 3/12: this is now $70b – see link below.]

– Their investment portfolio is less than 15% of total bank assets. Of this, less than 2% of total bank assets is categorized as available for sale.

– Their nonperforming assets are only 6 basis points of total assets.

Still, regional bank strain remains acute (trading halted after sharp sell offs), so it’s worth watching for a First Republic bank run.

The good news is First Republic is comprised much different than SVB. First Republic built their asset and deposit base largely on deposits from and home loans to high net worth individuals.

Here are 4 other ways First Republic’s business model doesn’t appear to be reliant on the tech sector or even involved in the crypto sector.

===

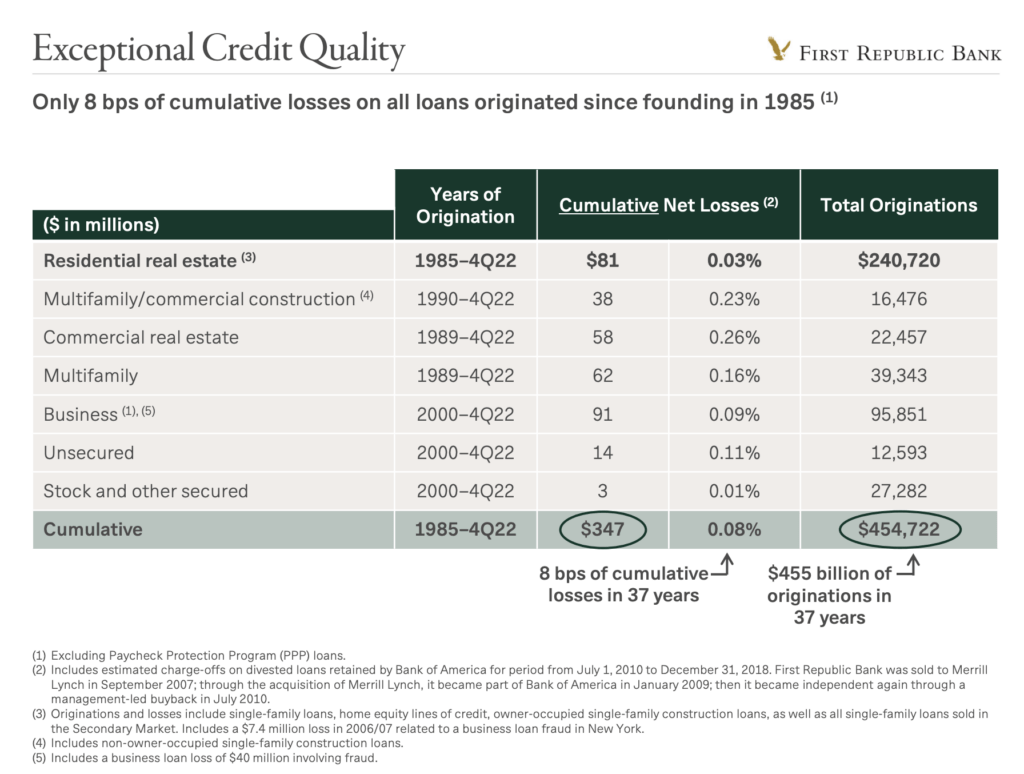

First, residential real estate is 53% of all First Republic loans, which collectively have a low 60% loan-to-value ratio. Here’s the rest of their loans by category. These assets are far from the tech sector, but a key risk factor here is by how much and for how long interest paid to depositors would exceed interest received on real estate loans. This dynamic is a function of how we went from crazy record low mortgage rates to rapidly rising deposit rates as the Fed hikes rates to fight inflation.

===

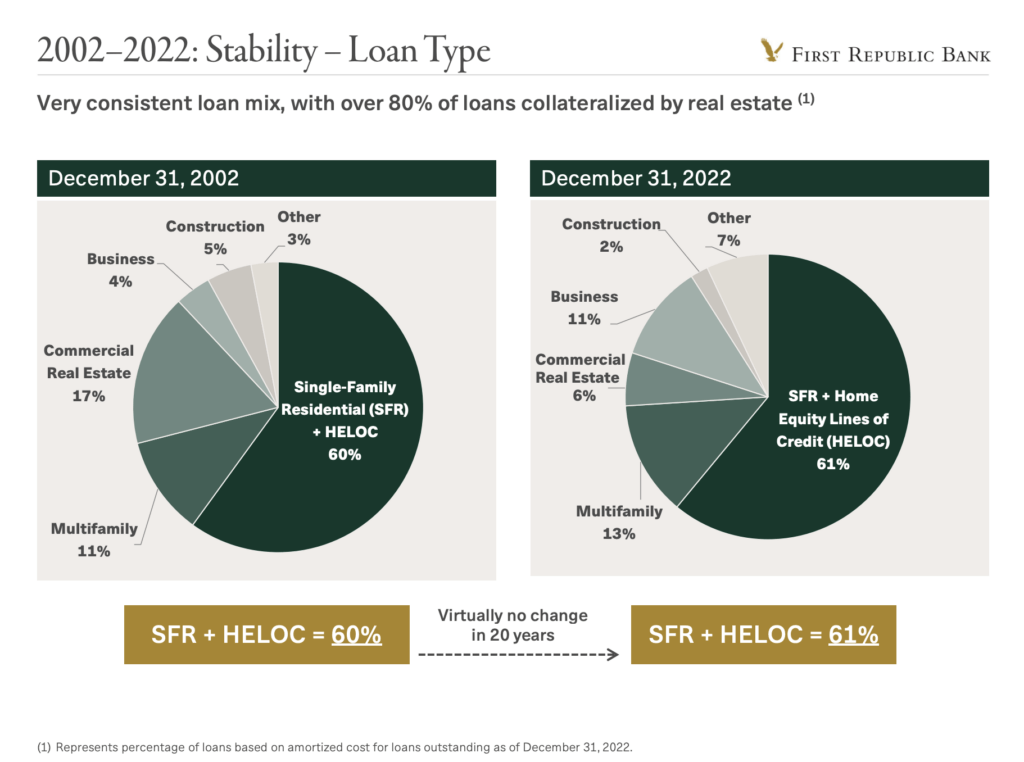

Second, 80% of First Republic loans are collateralized by real estate. Here’s the breakdown. The same key caveat as noted in item one above applies here.

===

Third, the average cost of all First Republic Bank deposits is 99 basis points as of 4Q22. The Fed hiked a total of 1.5% from November to February, so these dynamics will have changed since this report. But if First Republic’s business deposits comprise the majority (63%) of deposits, don’t pay interest, and aren’t tech companies, that may help stability.

===

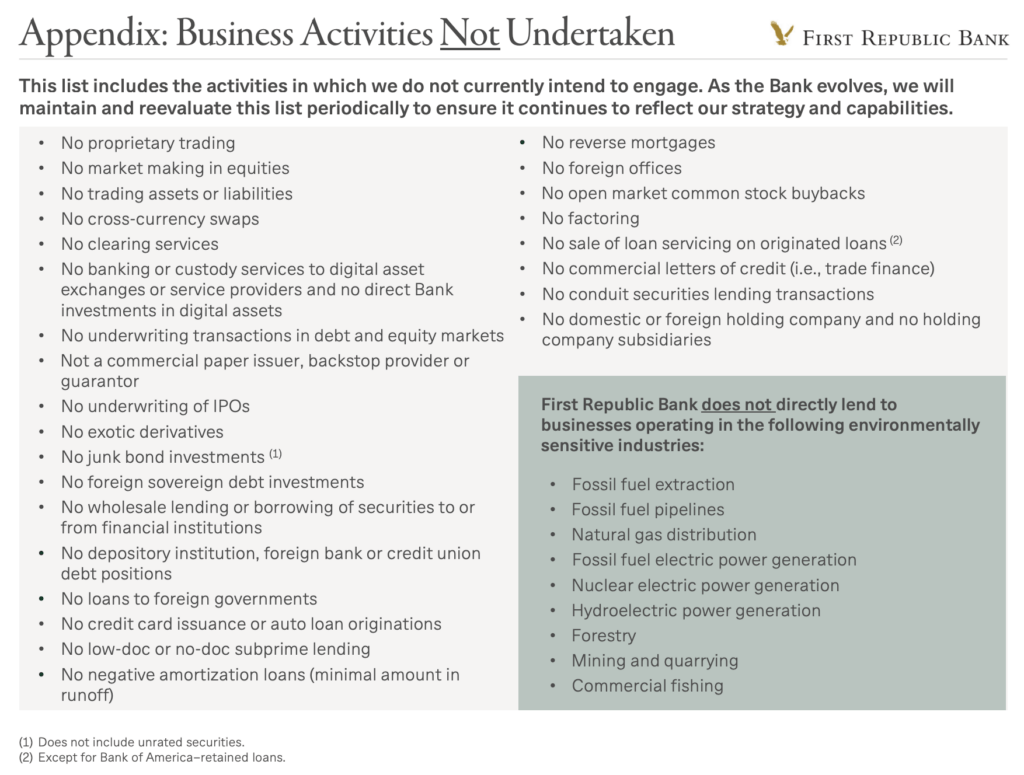

Fourth, here’s a long list of business activities First Republic does NOT engage in, including no banking or custody services for digital asset exchanges or service providers, and no direct First Republic investments in digital assets.

===

As for First Republic bank run risks, here is WSJ’s Jonathan Weil:

Investors have grown wary of First Republic for reasons similar to those that caused concern at SVB. Like SVB, First Republic showed a large gap between the fair-market value and balance-sheet value of its assets. Unlike SVB, where the biggest divergence is in its portfolio of debt securities, First Republic’s gap mostly is in its loan book.

In its annual report, First Republic said the fair-market value of its “real estate secured mortgages” was $117.5 billion as of Dec. 31, or $19.3 billion below their $136.8 billion balance-sheet value. The fair-value gap for that single asset category was larger than First Republic’s $17.4 billion of total equity.

All told, the fair value of First Republic’s financial assets was $26.9 billion less than their balance-sheet value. The financial assets included “other loans” with a fair value of $26.4 billion, or $2.9 billion below their $29.3 billion carrying amount. So-called held-to-maturity securities, consisting mostly of municipal bonds, had a fair value of $23.6 billion, or $4.8 billion less than their $28.3 billion carrying amount.

Another point of concern that echoes SVB is First Republic’s liabilities, which rely heavily on customer deposits. At SVB, those deposits largely came from technology startups and venture-capital investors, who quickly pulled their money when the bank ran into trouble.

First Republic’s funding relies in large part on wealthy individuals who increasingly have a range of options to seek higher yields on their cash at other financial institutions as interest rates have risen.

Total deposits at First Republic were $176.4 billion, or 90% of its total liabilities, as of Dec. 31. About 35% of its deposits were noninterest-bearing. And $119.5 billion, or 68%, of its deposits were uninsured, meaning they exceeded Federal Deposit Insurance Corp. limits.

Uninsured deposits can prove flighty since they can be subject to losses if a bank fails. At SVB, it isn’t clear based on the FDIC’s statement if uninsured depositors will be made whole.

===

As this shakes out, First Republic will see outflows from depositors seeking to cap deposits at the FDIC insured limit. And they’ll see their share of inflows from SVB customers.

I hope there’s no net First Republic bank run. It’s not productive for anyone.

Good luck to all teams impacted by the SVB events, and please reach out to compare notes on your decisions for new bank partners.

The startup community is split between migrating to big banks and startup banks (aka fintech brands backed by banks).

Everyone is nervous about FDIC-insured limits, and ironically the smaller startup banks have higher FDIC insurance thresholds.

More on that soon.

___

Reference:

– First Republic, Western Alliance seek to calm contagion worries from SVB meltdown

– UPDATE 3/12: First Republic financial stability disclosure 3/12/23

– First Republic stability disclosure March 10, 2023

– First Republic deck on financial condition as of 12/31/22 (obv before today’s crisis)

– First Republic Bank Hit By Silicon Valley Bank Failure (WSJ)