15m six figure income earners live paycheck to paycheck. Can they afford homes?

CNBC and Momentive released a survey showing 70% of people are stressed about money. No surprises. This stress afflicts even the rich kids on Succession. Seriously though, who do you know at any age NOT stressed about money in some way? What’s more surprising is 32% making a six figure income say they live paycheck to paycheck.

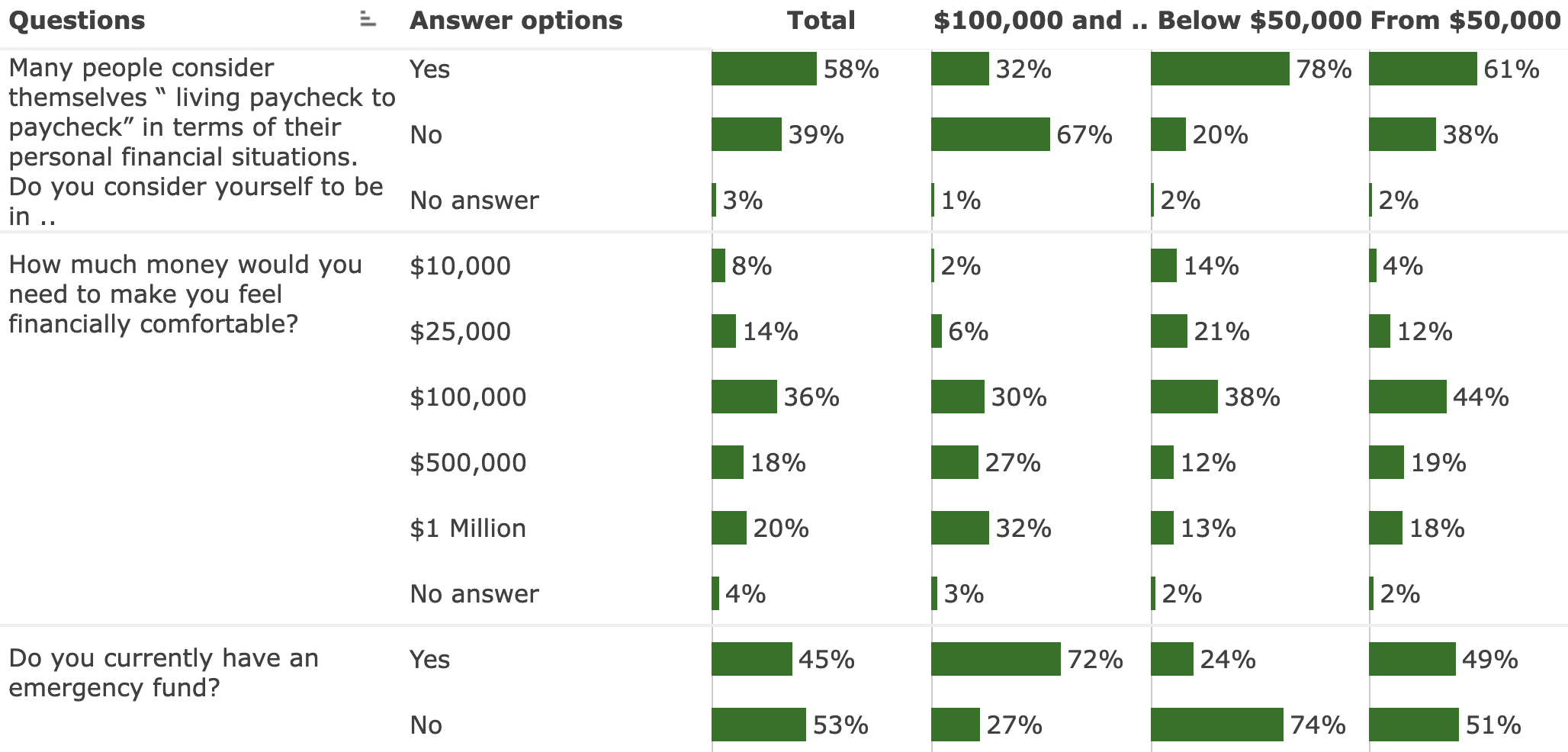

Here’s a clip of the survey showing this. The question cuts off but here’s what it says:

“Many people consider themselves ‘living paycheck to paycheck’ in terms of their personal financial situations. Do you consider yourself to be in that category?”

SIX FIGURE INCOME PAYCHECK TO PAYCHECK. REALLY?

The 2021 Census shows, that of 131.2 million households, 46.97 million households make $100,000 or more.

If 32% of 46.97 million households making $100k+ live paycheck to paycheck, that’s 15 million households.

So, if 15 million households making $100k+ feel they’re paycheck to paycheck, can they afford homes?

Coincidentally, it takes about $100k to qualify to buy a home right now if you have minimal savings and about $600/mo in car, credit card, and/or student loan payments.

Each month, The Basis Point calculates how much you need to make to buy median priced homes that are existing or newly built.

We do these calculations the way lenders do when approving loans using Federally regulated guidelines.

Assuming a 5% down payment, here’s how the math breaks down right now.

AFFORDABILITY OF EXISTING HOMES

As of March 21, the median priced existing home is $363,000.

Monthly all-in cost on a $363,000 home purchase with 5% down and today’s rates of 6.5% rate would be $2881 (mortgage payment, insurance, taxes, mortgage insurance).

If you had no other monthly debt, you’d need to make $80k* per year to qualify for this.

If you had $600 in credit card, auto, and other monthly debt, you’d need to make $97k* per year to qualify.

AFFORDABILITY OF NEWLY BUILT HOMES

As of March 24, the median priced newly built home is $438,200.

Monthly all-in cost on a $438,200 home purchase with 5% down and today’s rates of 6.5% would be $3456 (mortgage payment, insurance, taxes, mortgage insurance).

If you had no other monthly debt, you’d need to make $96k* per year to qualify for this.

If you had $600 in credit card, auto, and other monthly debt, you’d need to make $113k* per year to qualify.

HOW MANY OF YOU CAN AFFORD TO BUY A HOME IN 2023?

47 million households make the income shown above that’s needed need to qualify to buy a home right now.

Using 2021 Census data referenced above, it breaks down like this:

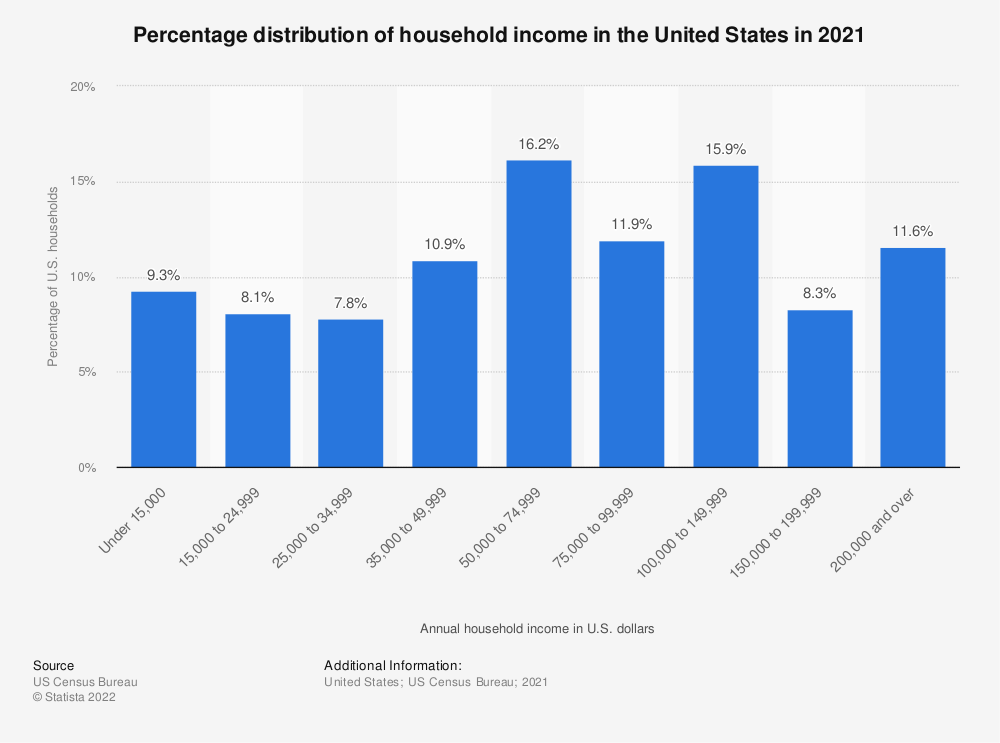

– Of 131.2m households, 46.97m households (35.8%) make $100,000 or more per year.

– 20.86m households (15.9%) make $100-149k, 10.89m (8.3%) make $150-199k, and 15.22m (11.6%) make $200k+.

– Here’s a chart summarizing the breakdown in the previous bullet:

We’ll recalculate these home affordability figures on April 20 and 25.

That’s when the latest median existing and new home prices are updated by NAR and Census/HUD.

Please stop by again and subscribe to our newsletter 🙂

And please reach out or comment with your thoughts.

___

Reference:

– CNBC & Momentive Survey Results On Consumer Financial Stress

– Are existing homes affordable at $363k?

– Are newly built homes affordable at $438k?

– Statista: income levels using Census: 2021 U.S. income report

* To arrive at these qualifying income numbers, we use a 43% deb-to-income ratio that Federal regs allow for all mortgages of this size in America.