17 Stats Homebuyers, Realtors & Lenders Must Know About Each Other As 2019 Kicks Off

Below I walk through some some critical stats that define the current state of relationships between homebuyers, realtors, and lenders. This is from client work I was doing last couple months of 2018, and I’ll continue to share more of this analysis as 2019 goes on. I comment above each image.

+++

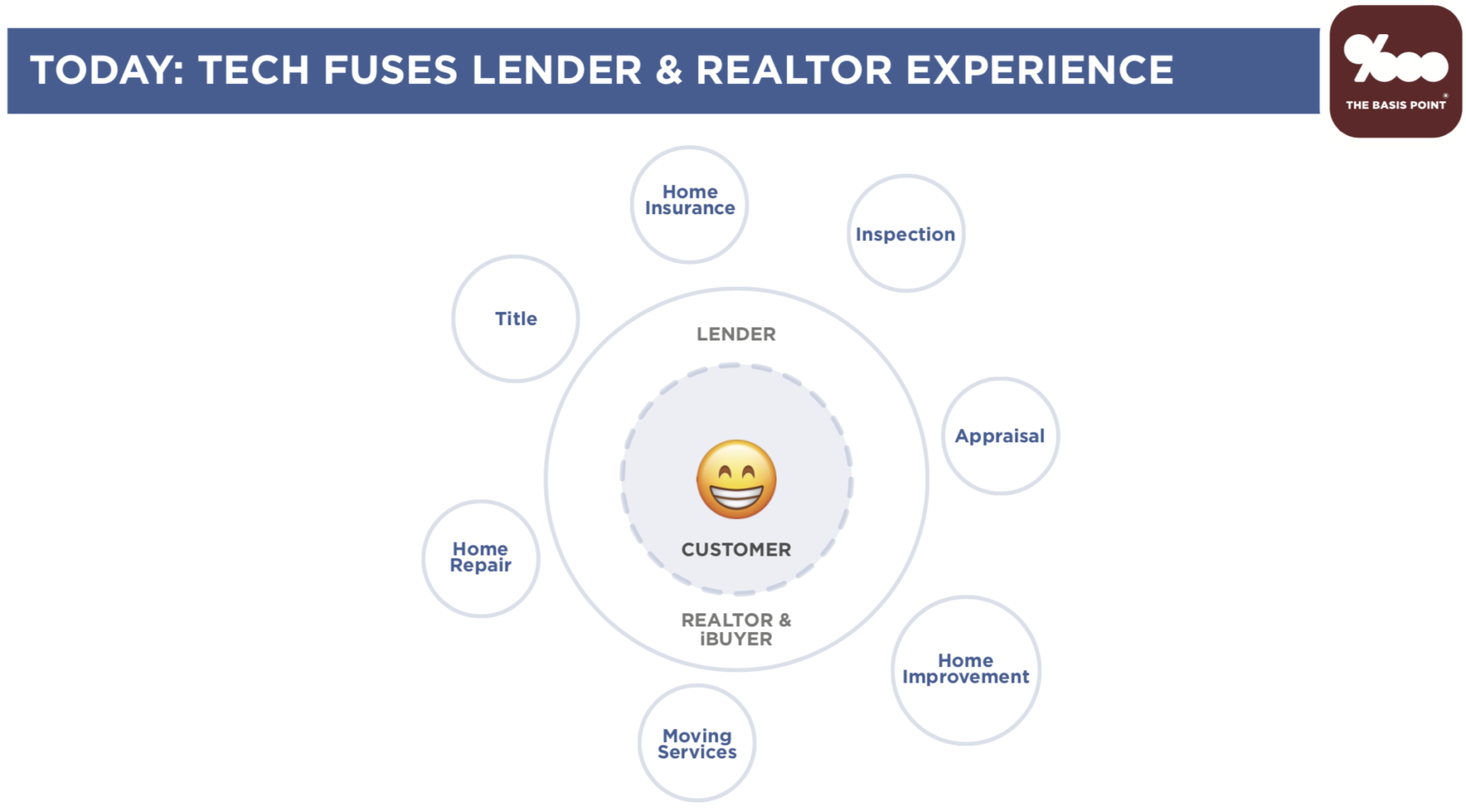

As a homebuyer, there are at least 9 providers you have to deal with, and while technology is starting to help bring this together, your general mood looks like this after you finally overcome fear of buying and actually enter the homebuying process.

+++

There were 6.12 million homes sold in 2017 (5.51m existing & 613k new), and this number should come in similar (but slightly lower) for 2018. Each home sale typically has 2 realtors, 1 repping seller side and 1 repping buyer side. That’s about 12 million “sides” to share between 2 million licensed realtors, which averages to about 6 deals per realtor per year. With average realtor volume this low, lenders can’t expect realtors to come to the same technology lenders offer you. The technology must also come to realtors, so you’re all involved in the transaction—and the future relationship—together in one place.

+++

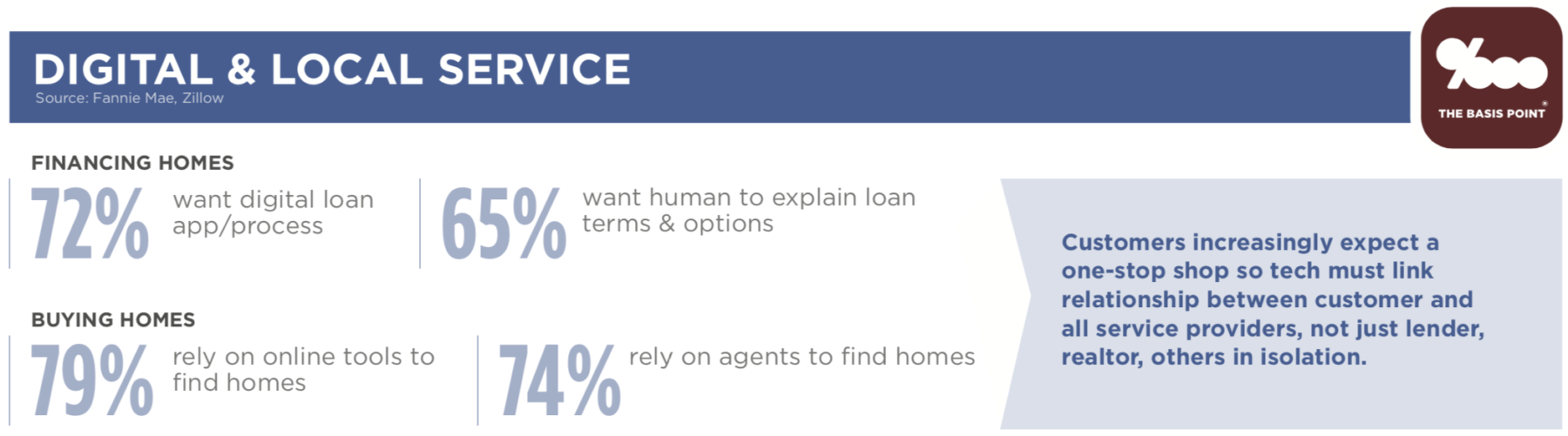

The technology must link you, lender, and realtor for two reasons: (1) lender and real estate agent must be tight to get your deal done fast/right, and together they also quarterback all the other providers for you, (2) you demand both digital AND local service from lender and real estate agent, as these late-2018 stats show.

+++

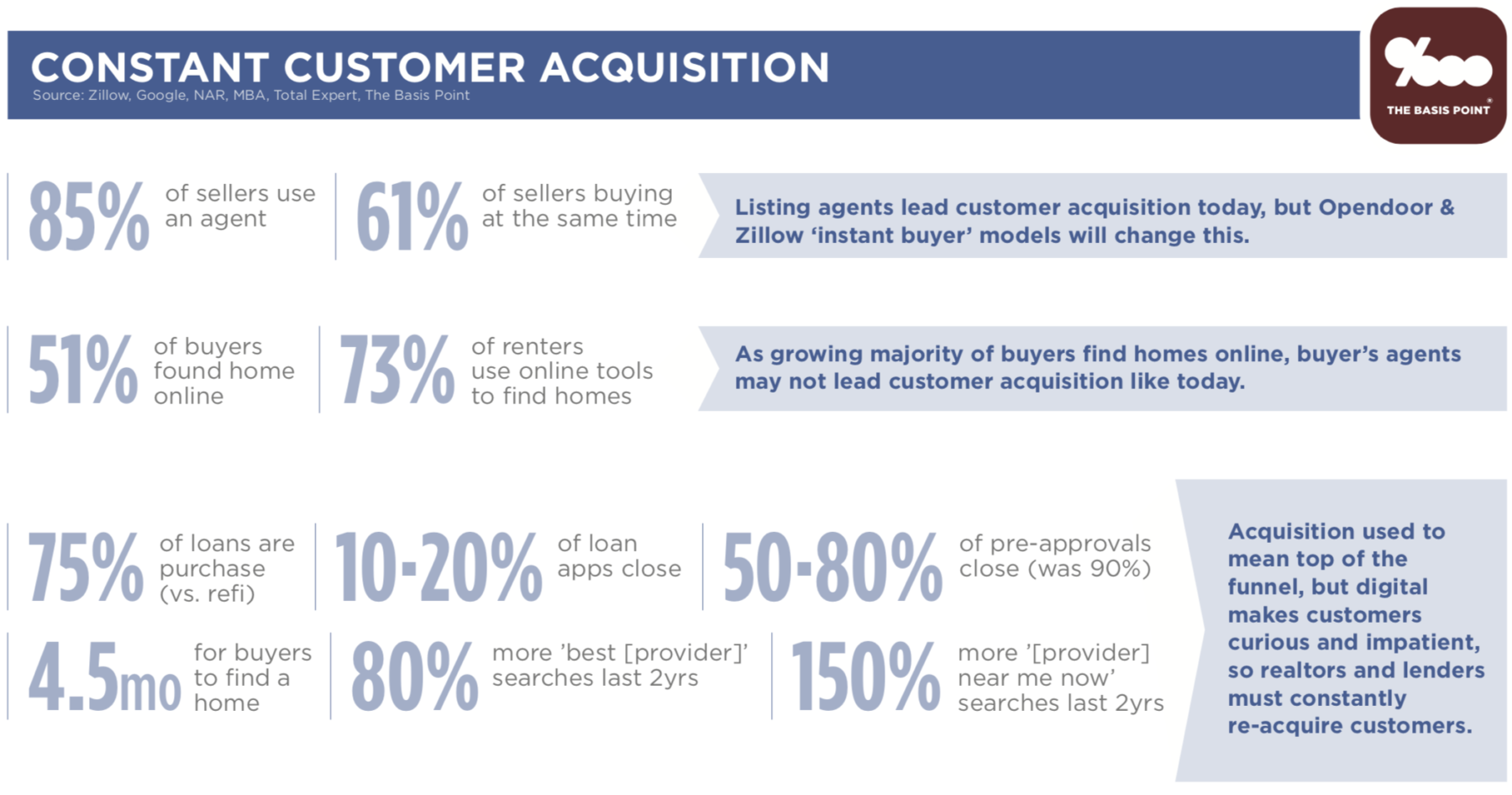

At what point do you find and commit your lender and realtor? If you’re selling a home, 85% of you use a realtor and 61% of you are buying at the same time, so the realtor repping you as a seller gets to you first as a buyer.

If you’re buying, 51% of you found the home you bought online (vs. 30% of you found that your home using a realtor), and that early majority may grow since 73% of you who rent use online tools to find homes, so you’re online-trained way before ever becoming homebuyers.

You’re also getting harder for lenders and realtors to keep even after you’ve “committed” to them. About 75% of the $1.6 trillion in U.S. mortgage loans made in 2018 were for home purchases (the rest were refis), and the percentages of lender’s loan-applications and pre-approvals that actually close are low and dropping.

Why? Because it takes you 4.5 months to find a home and you get picked off by those listing agents when you shop for homes. They can then refer new lenders. Also easy online access makes you more curious and impatient about lenders and realtors. Google says that your searches for “best [provider]” and “[provider] near me now” have increased 80% and 150% respectively in last 2 years.

+++

But you’d admit it’s exhausting to change providers too many times, especially lenders and realtors who team up and bring together all the other providers. Today, some fairly sophisticated lenders are able to bridge the relationship by offering realtors the same technology they provide you as noted above. This way you’re all in it together, and it’s pretty seamless for you.

+++

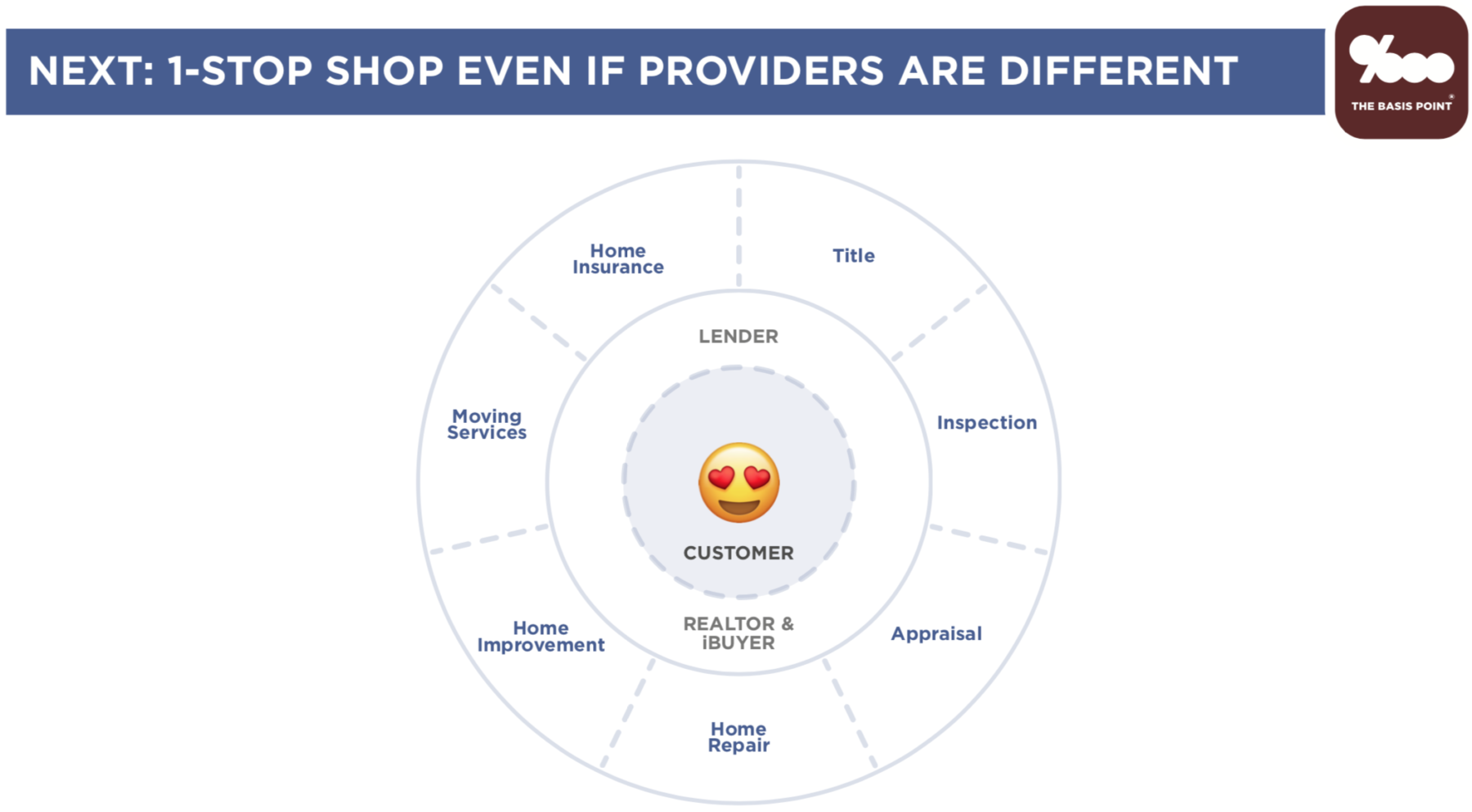

As we move deeper into 2019, your homebuying experience will start to be more of a one-stop shop, either from highly sophisticated firms are starting to do all of this under one roof, or by a more advanced version of the model above which keeps all services as separate entities but uses technology to link everything for you. The latter is more likely because consumer protection laws make it extremely difficult to have it all under one roof.

+++

Stay tuned as we dive deeper all year. Follow us using buttons below.