1Q 2023 bank earnings dates & signals – including Fed lending to banks in March

1Q 2023 bank earnings will start tomorrow, and below are two reference items. First, Fisher Investments closed out March with a useful signal of bank strain during that rough month. Second, WSJ has compiled good stats on bank performance as well as earnings dates. Previews of both are below.

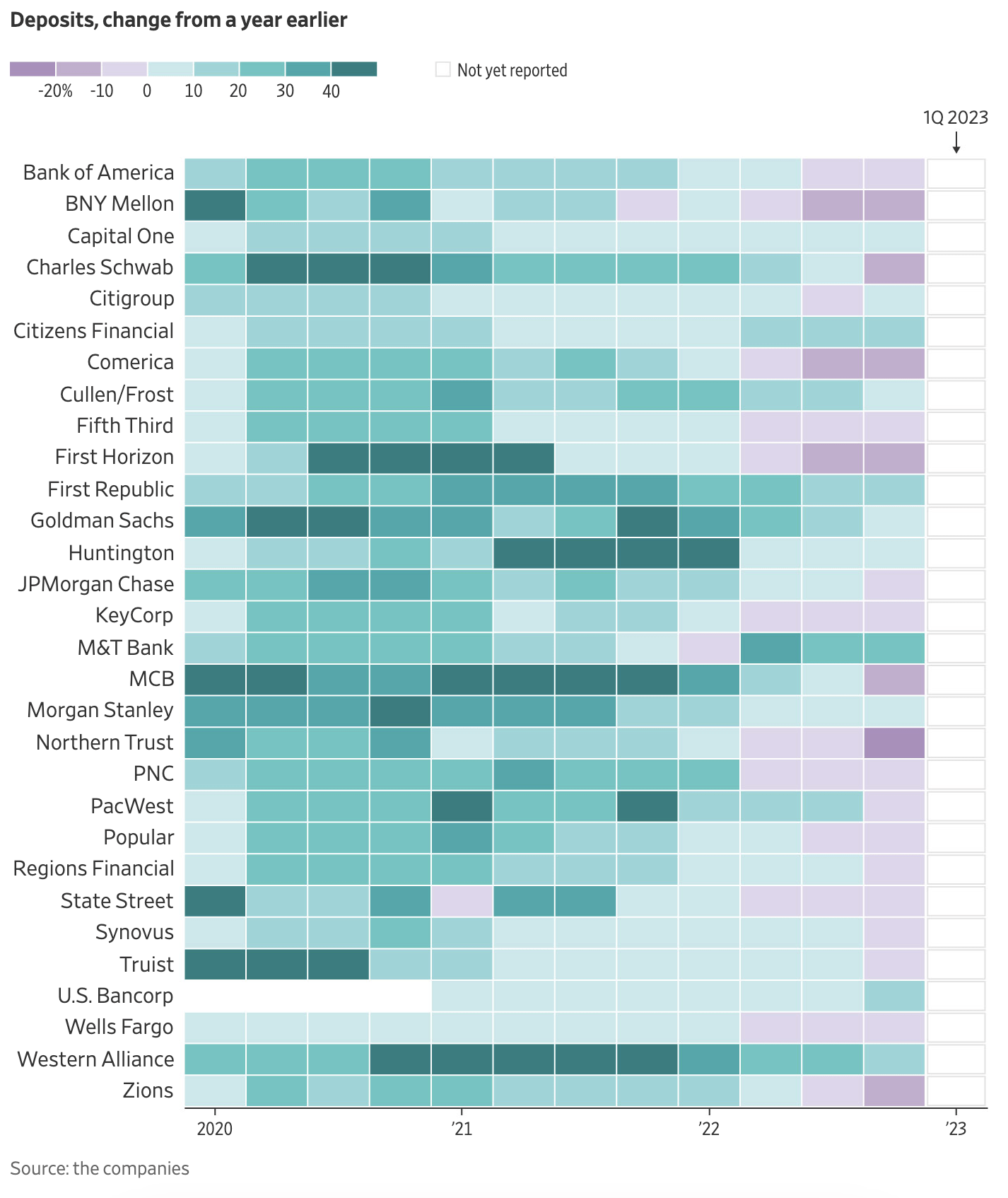

While the Fed doesn’t say which banks borrowed, the Fisher chart above shows where all bank borrowing was concentrated:

The Fed discloses data on the size of borrowing weekly, but it doesn’t tell you who the borrowers were. Loads of people see those actions in aggregate and presume the roughly $350 billion in increased Fed branch assets indicates a rush in borrowing, arguing it means broad trouble exists. With borrowers’ names and specific actions undisclosed, it feeds the “who is next” murmuring.

But when a bank borrows directly from the Fed, it does so via its regional Fed branch—and the data show the change in assets on the regional banks’ balance sheets. So although Fed data don’t disclose borrowers until well after the loans are drawn, one can form some rough conclusions about how widespread problems are by looking at the weekly change in Fed branch assets. Exhibit 1 does that, showing the three weeks’ data since the two regional US banks failed.

The Fisher team also provides a good explanation of Fed lending facilities, including the new Bank Term Funding Program (BTFP) created in response to this crisis:

The discount window is perhaps the Federal Reserve’s oldest tool, created to help it serve its original function—acting as the lender of last resort. Through it, solvent banks experiencing liquidity issues can borrow directly from the Fed by posting collateral — loans, corporate bonds or Treasurys, etc. — in exchange for short-term cash. Currently, the discount rate is 5.00%, and a bank can carry the loan for up to 90 days.

The BTFP, by contrast, was created by the Powell Fed earlier this month. It similarly lets banks with eligible collateral borrow—but these loans can extend up to one year at fixed rates. In the first two weeks after the two banks failed, increases in Fed lending to banks have been mainly through the discount window, with the BTFP trailing it by some distance. That reversed in the week ended 3/29, as discount window borrowing fell while BTFP borrowing rose. Regardless, banks tapped the two facilities a lot less in this most recent week than in the prior two.

Beyond these two facilities, the Fed extended another big slug of credit to the FDIC to help it resolve the two failed institutions. That also cooled dramatically in the week ended Wednesday.

===

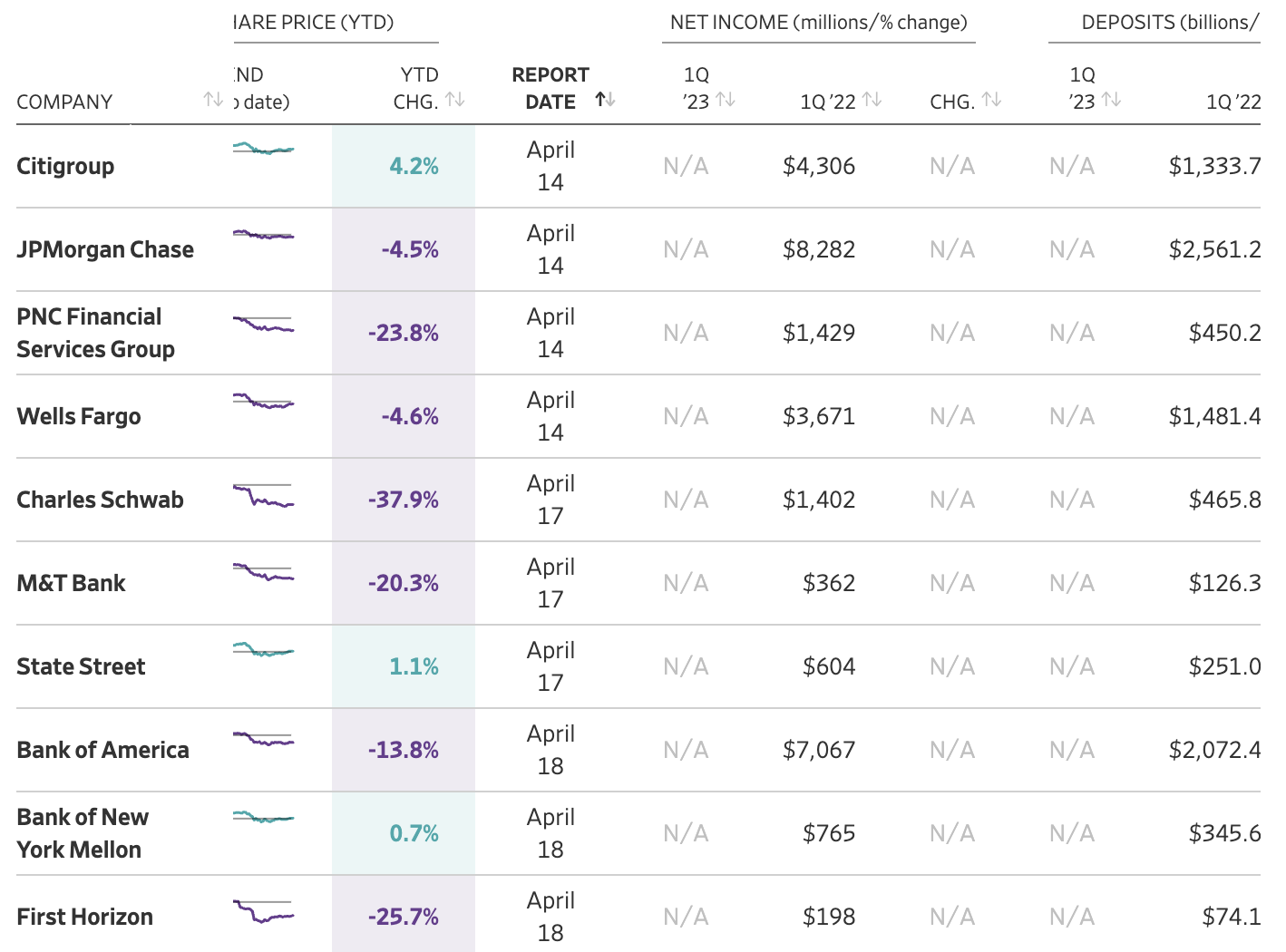

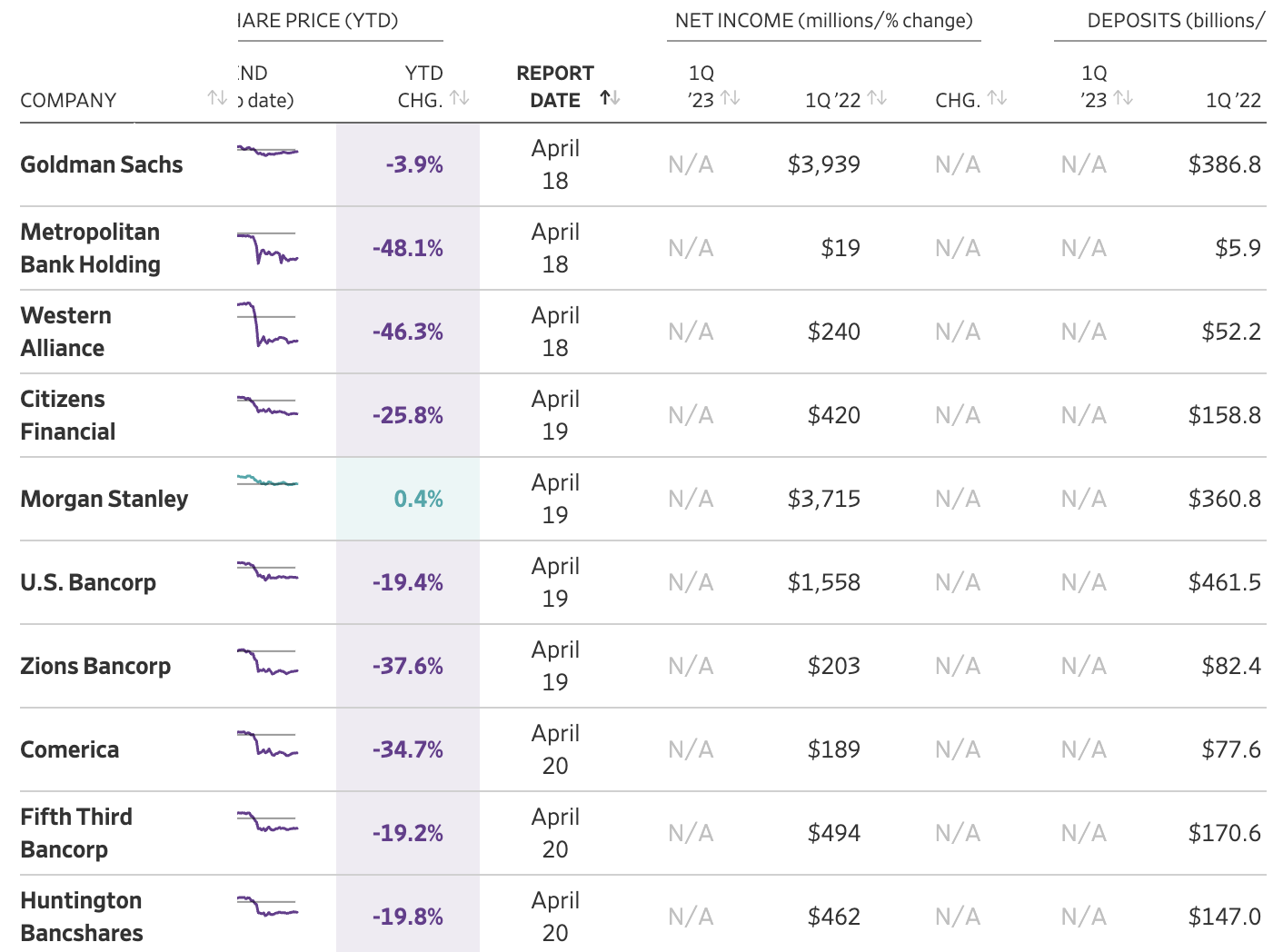

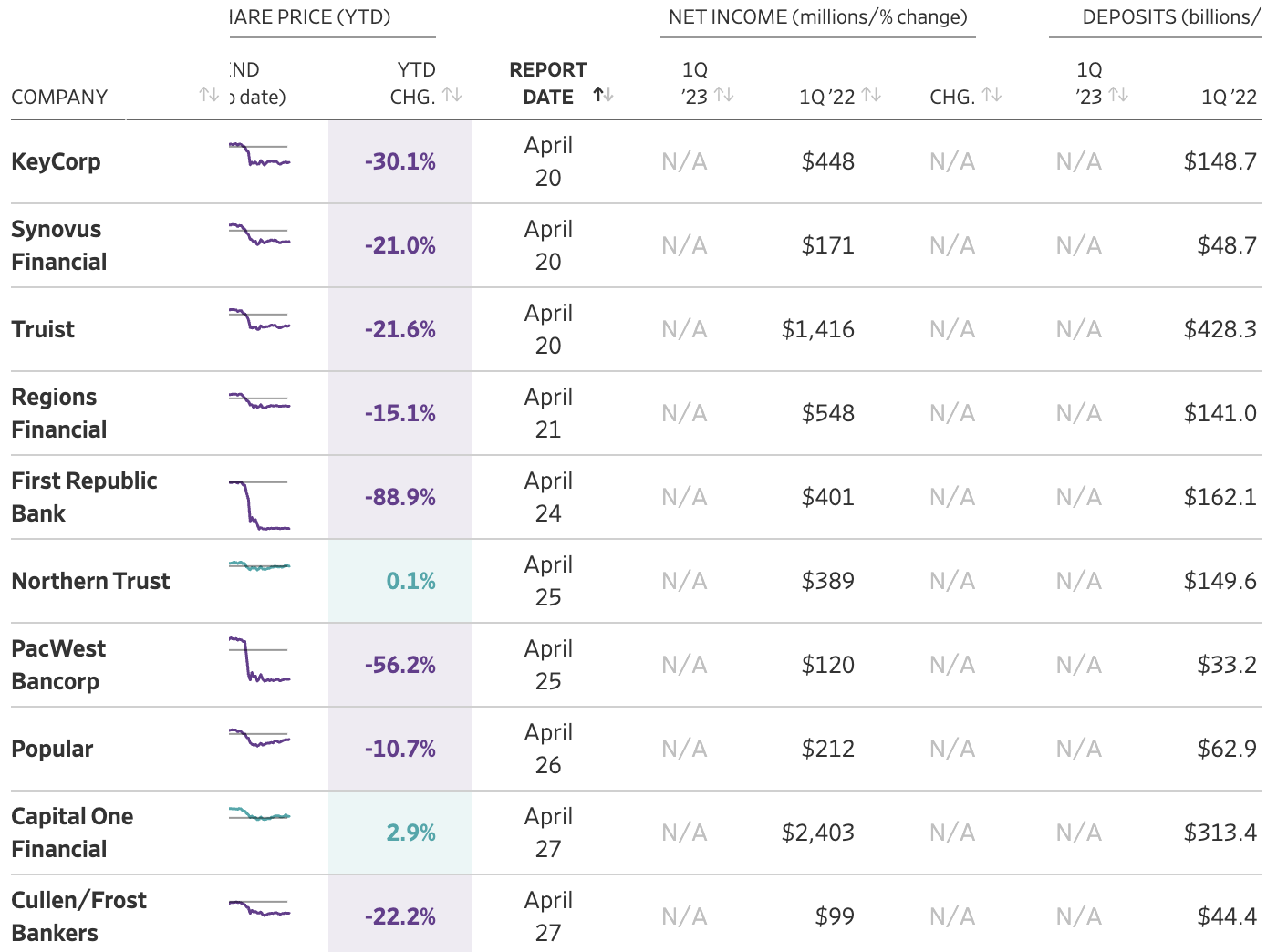

Separately, here’s a rundown of bank earnings dates and 1Q23 deposit trend stats from the Wall Street Journal team. The link has details for these tables shown that include all the bank stats.

Also below are links to the Fisher post, and another link to an S&P preview of First Republic and other 1Q 2023 bank earnings.

___

Reference:

– CHART: Regional Distribution of Fed Lending to Banks (Fisher)

– First Republic reports 1Q 2023 earnings April 24. Here’s a preview. (TBP)

– 1Q 2023 Bank Earnings Dates & Stats (WSJ)