3 Quick Reasons Apple Pay Later Will Eat BNPL Competitors

Apple finally announced they’re releasing Apple Pay Later … 2 years later. We’ve been covering Apple’s entry into the buy now pay later (BNPL) space as it has been slowly evolving since mid 2021 (timeline/links below). The question since day 1: will Apple gobble up BNPL competitors like Affirm, Afterpay, and Klarna? Our prediction is: basically yes.

Which leads to another question: how could Apple enter BNPL so late and still defeat incumbents?

I’ve got 3 initial theories.

1. It’s easy.

2. It’s Apple.

3. A core Apple ethos is that they don’t have to be first, they just have to be best.

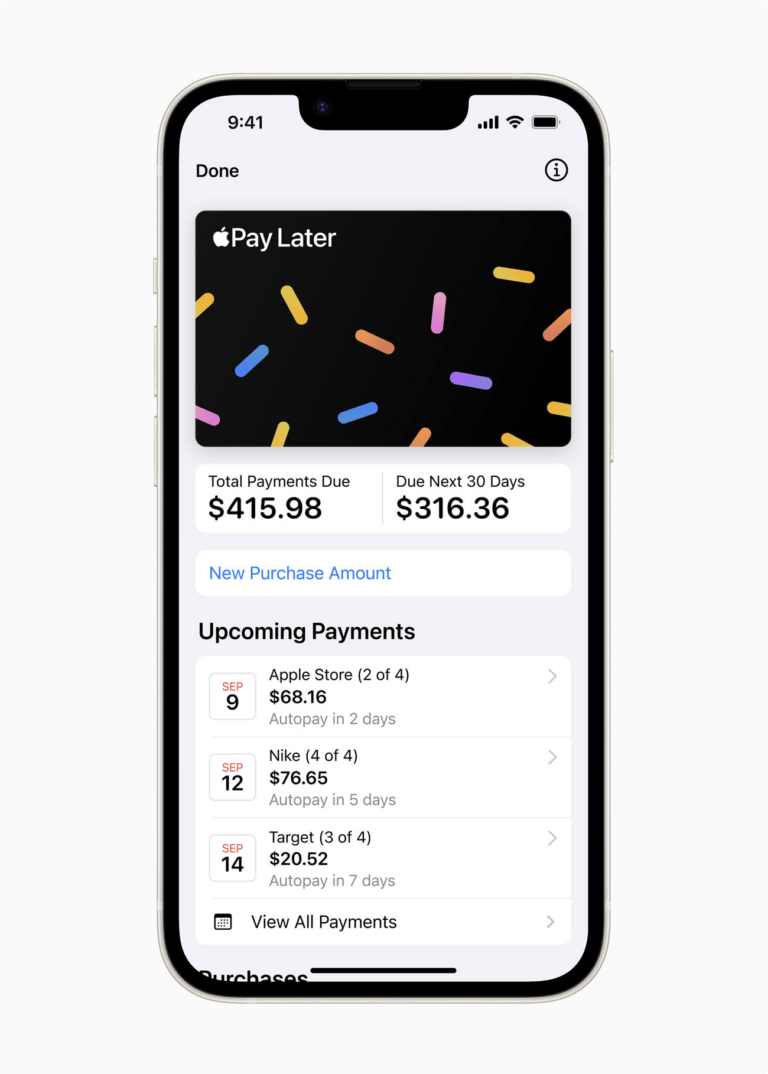

On theory 1, easy sells, and Apple Pay Later will be super easy. As Apple users, we’ll just have it. Anyone with an iPhone or iPad (everyone raise your hands) is already set up for the feature.

On theory 2, Apple users (again, raise your hands) are already a bit of a “sure thing.” Apple products are fun, sexy, and addictive. If you have an iPhone, you probably also have a Macbook and an Apple Watch, an iPad, and a couple sets of AirPods too.

When an Apple release drops, I’m interested before I even know anything about it (I’m already pre-registered for Apple Car in my mind!), and there are hundreds of millions like me.

So Apple has a BNPL advantage, even late out of the gate.

On theory 3, Apple Pay Later brings new things that’ll likely improve a reasonably mature BNPL market.

Most notably, they’ll help mainstream the reporting of credit on these layaway loans. BNPL providers were slow to this, only reporting derogatory credit in the early years. But if people can use Apple Pay Later to build credit using smaller dollar purchases. Here’s what they said about it:

Apple Financing plans to report Apple Pay Later loans to U.S. credit bureaus starting this fall,5 so they are reflected in users’ overall financial profiles and can help promote responsible lending for both the lender and the borrower. Apple Financing LLC may report past, current, or future Apple Pay Later loans.

And Apple Pay Later is allowing purchases as low as $50 (and up to $1000). This is different than the BNPL space overall, which emerged to help people with larger retail purchases like appliances, etc. It might get broader adoption with smaller purchases.

As for competitor impact, the Apple Pay Later launch is not all bad news for incumbents. Apple entering the BNPL sector validates the space.

Here are other key questions to unpack on this topic:

– How is BNPL not a credit card?

– Why would small-dollar Apple Pay Later users not just use debit or credit if they have to repay in 6 weeks anyway?

– Does this grow BNPL consumer risks that top finance regulator CFBP has raised?

Please comment below with your thoughts on these topics.

And please come back soon for updates, and subscribe to our newsletter!.

___

Reference:

– New Apple Pay Later allows consumers to pay for purchases over time (Apple)

– Feb 2023: What do regulators and BNPL competitors think of Apple’s imminent Pay Later launch?

– Feb 2023: How Apple’s new ‘buy now pay later’ fintech product works, and when it’ll launch

– June 2022: How Apple ‘buy now pay later’ fits with Goldman Sachs-powered Apple Card & its full fintech strategy

– June 2022: Apple entering Buy Now, Pay Later space shocks competitor stocks

– April 2022: Inside Apple’s fintech plans to compete with Square, PayPal, Google, and Klarna

– July 2021: Apple’s interest in the buy now, pay later space takes shape with Apple Pay Later

– July 2021: Apple & Goldman Sachs launching ‘Buy Now Pay Later’ (BNPL) service confirms what smart people in consumer fintech already knew: BNPL is a feature, not a product

– July 2021: Affirm, a hot fintech (founded by a PayPal co-founder) that lets you buy stuff with installment payments, might get eaten by Apple.