Rates up slightly after modest ADP gain, strong ISM Services

Rates are up slightly today as the key mortgage bond (aka MBS) coupons are trading lower: Benchmark Fannie Mae 30yr 3% and 3.5% coupons are down 16 and 23 basis points respectively. Lenders hike rates when MBS prices drop like this. Today’s MBS price decline isn’t extreme and rates are still near record lows, but with a sharp MBS up-trend in recent weeks that’s been driving rates to even lower records, consumers searching for the rate bottom shouldn’t get complacent.

Below is a rundown of today’s U.S. economic data: neutral jobs data, stronger mortgage applications, and strong read on the U.S. services sector.

ADP Private Jobs (September 2012)

– Private jobs were +162,000.

– Previous was +201,000 revised to +189,000.

This says that we think we have 150,000 (162,000 + 201,000 – 189,000) more jobs than we though we had in the last report. This is keeping only slightly ahead of what we need to keep pace with population growth. This data is market neutral partly because it is the BLS number which drives markets and the correlation between ADP and BLS has been weak lately.

Here are some additional thoughts from a Goldman research note this morning:

1. The ADP measure of private employment increased by 162k in September, slightly more than consensus expectations of 140k, while employment gains for July and August were revised down (by 17k and 12k, respectively). The report again showed gains in employment across all firm sizes and in each broad industry category in September. Goods-producing employment rose by 18k, with a 4k increase in manufacturing payrolls. Service-providing employment rose by 144k during the month.

2. Overall, the ADP report is modestly positive and roughly in line with consensus expectations of 115k for Friday’s nonfarm payrolls release (the ADP measure has exceeded total BLS nonfarm payrolls by an average of 33k per month this year). The report does suggest slight upside risk to our current forecast of 100k at this point.

– Full ADP September report w/charts

MBA Mortgage Applications (week ended 9/28/2012)

– Purchase Index, Week/Week 4.0%

– Refinance Index, Week/Week 20.0%

– Composite Index, Week/Week 16.6%

The refi and composite are strong because refinancing is driven by low rates and we have very low rates. The +4.0% in the Purchase Index is a nice gain but and supports the idea that the housing market is getting healthier but what we need is consistency. More precisely whay we need is home building and that will return to the natural level of 1,500,000 Housing Starts per year after the inventory of foreclosures is better cleared and unemployment falls.

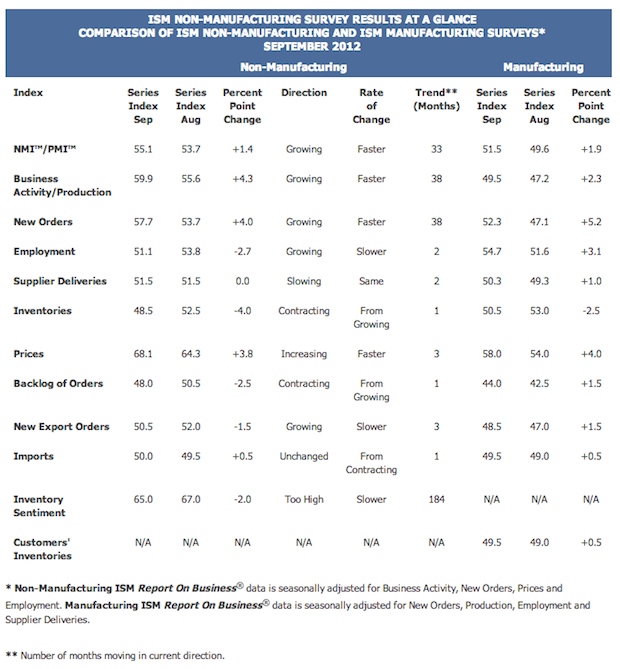

ISM Service Sector (September 2012)

– Composite Index is 55.1. Previous was 53.7.

This shows strength in recovery. With our economy being largely a service economy this is important.

Table summarizing data below, and here’s full report.