Almost Everyone Is Wrong About New Federal Mortgage Fee Changes

I’ve mostly stayed quiet about mortgage fee changes required by new Federal rules as of this week. But after the Wall Street Journal editorial board published a blatant factual error about alarmingly high rate increases, I’ll share a few Points.

– The main Point: Lenders are the only credible source for borrowers on this topic.

– Almost everyone else is wrong about — or doesn’t fully get — how new Federal mortgage fee hikes hit borrowers.

– The top housing finance regulator — FHFA, which oversees Fannie Mae and Freddie Mac who back most of the U.S. mortgage market — is proposing higher fees for borrowers who have higher credit scores, and for borrowers whose debt-to-income ratio is above 40%.

– This is all over the media this month, as is misunderstanding of fees vs. rates.

– You should never act on financial advice you see in the media.

– Especially on a highly technical topic like how these fees hit individual borrowers based on extremely specific down payment, credit score, and income thresholds.

– When it comes to mortgage loans, your rate and fee will be specific to your down payment, credit score, employment history, income, assets, and debts.

– Only your lender can tell you accurate rates and fees for your profile.

– And they can only do this after they have a full profile on you.

– The rest is media chatter, and even the top financial media outlets are getting it wrong.

– The WSJ editorial board published this factual error about the new mortgage fee changes:

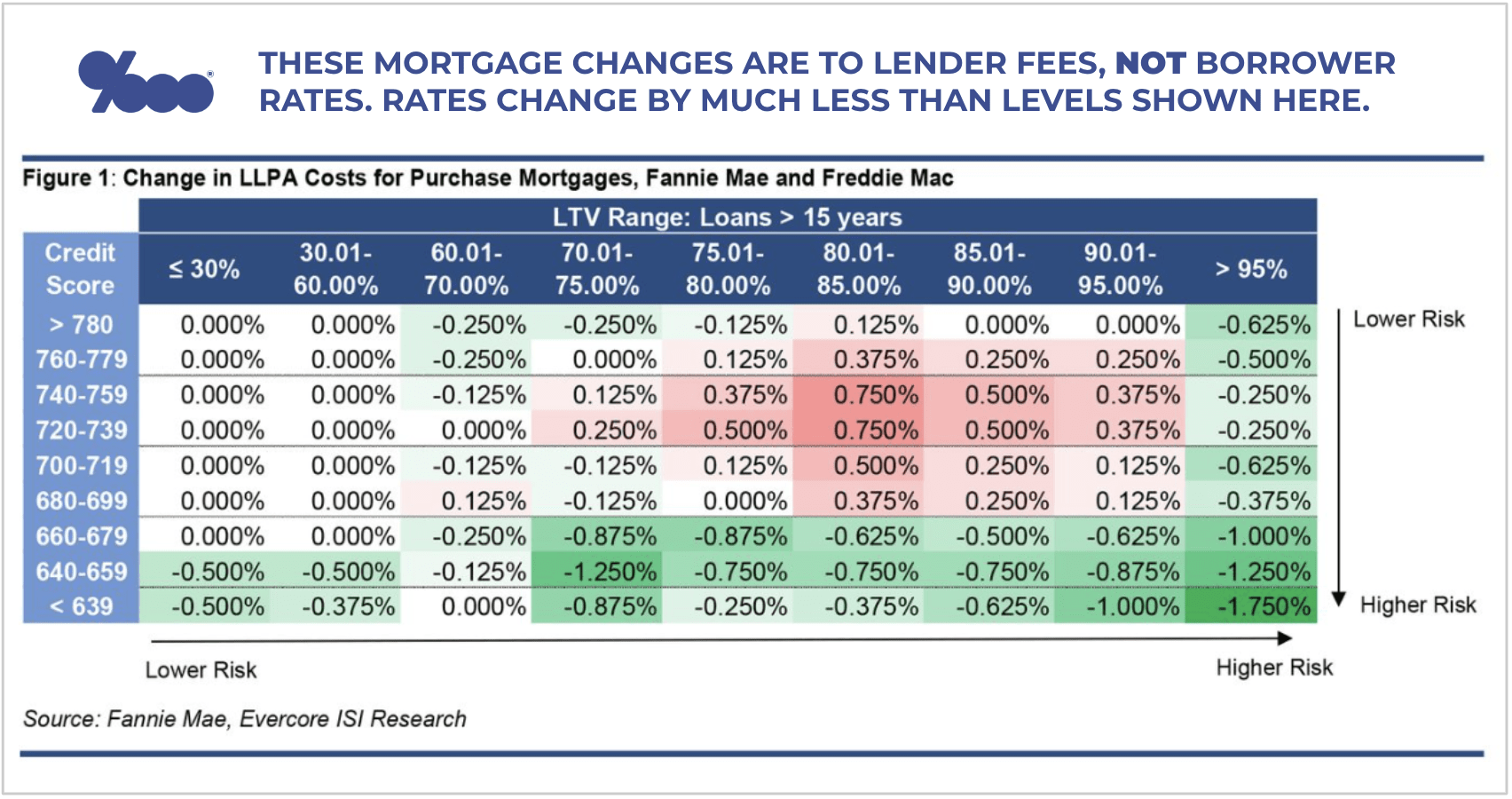

– “Buyers with strong credit scores between 720 and 739 who make 15%-20% down payments will see their rates increase by 0.750%.”

– This is dead wrong.

– WSJ was referring to the reddest part of the table at the bottom of this post.

– But they’re confusing rate and fee.

– Federal mortgage regulators have hiked fees, not rates by .75% for borrowers with 15-20% down and 720-759 credit scores.

– As a rule of thumb, a borrower rate would rise about .125% for every .375% in fee, so if fees rose .75% in the scenario above, the borrower rate would rise about .25%.

– So the mighty WSJ is telling millions of people rates for this profile rise .75% when rates would only rise .25%.

– Granted, the relationship of rates and fees is a tricky topic, but this a profound error.

– It’s also why I’ll say again: Lenders are the only credible source for borrowers on this topic.

– Do NOT let media chatter convince you that housing and mortgages are out of reach.

– In fact, to the FHFA’s credit, they’re trying to make mortgages more accessible to more people with these fee changes.

– Don’t spend your time worrying about this topic.

– Just talk to a lender, and they’ll make all this very simple by telling you how much you can afford.

– The rest is chatter, and mostly wrong.

– Below are notes about what you need to make to afford home prices right now.

– Also below is a link to one other clarification about a different aspect of these fee changes.

– Please comment or reach out with questions about mortgage rate/fee nuances.

___

Reference:

– How much you need to make to buy a new or existing home right now.

– Proposed mortgage approval rule wrongly penalizes consumer borrowers based on income

– WSJ editorial wrongly confusing mortgage fee changes with rate increases