America Is Home Rich & Car Poor

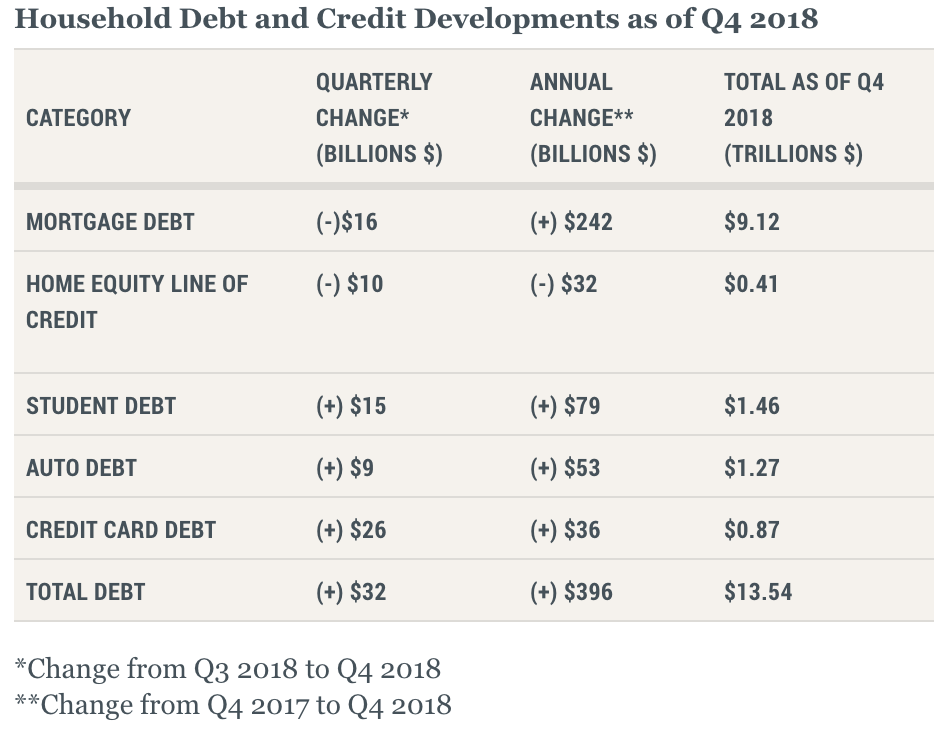

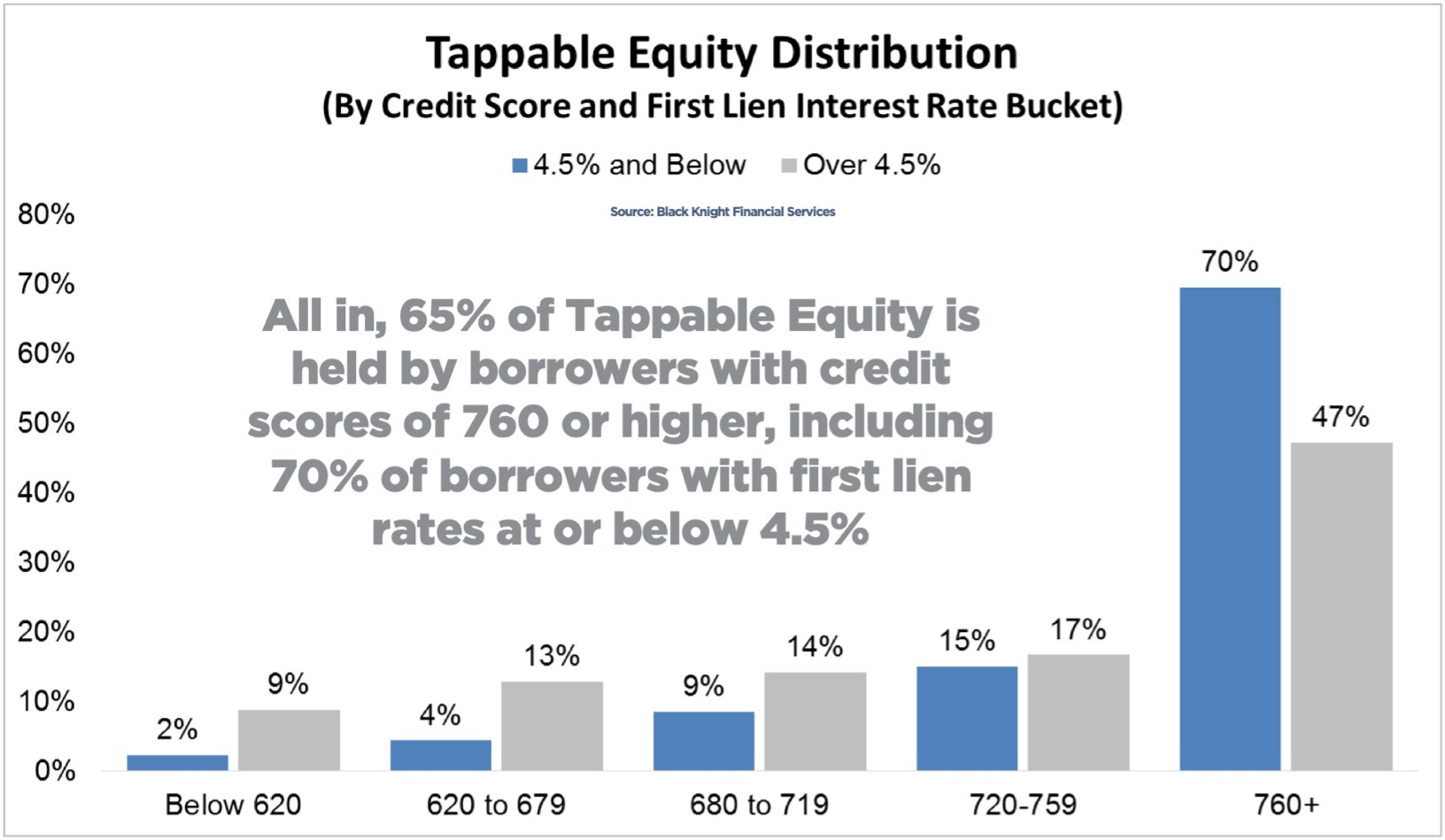

Every three months, the Fed releases data about how much debt we’re all in, and the latest underlines core themes we’ve been covering: Americans are home rich and car poor.

It’s a classic haves and have nots story.

On the one hand, a record 7 million of us are 90 days or more behind on car loans. This is crazy: more people are behind on their car payments than before the 2008 crash. And the biggest share of people way behind?

You guessed it: millennials.

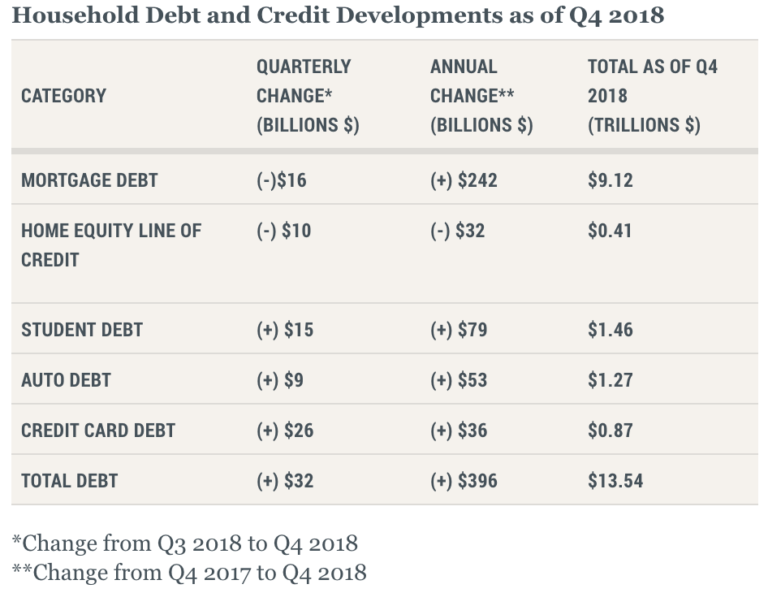

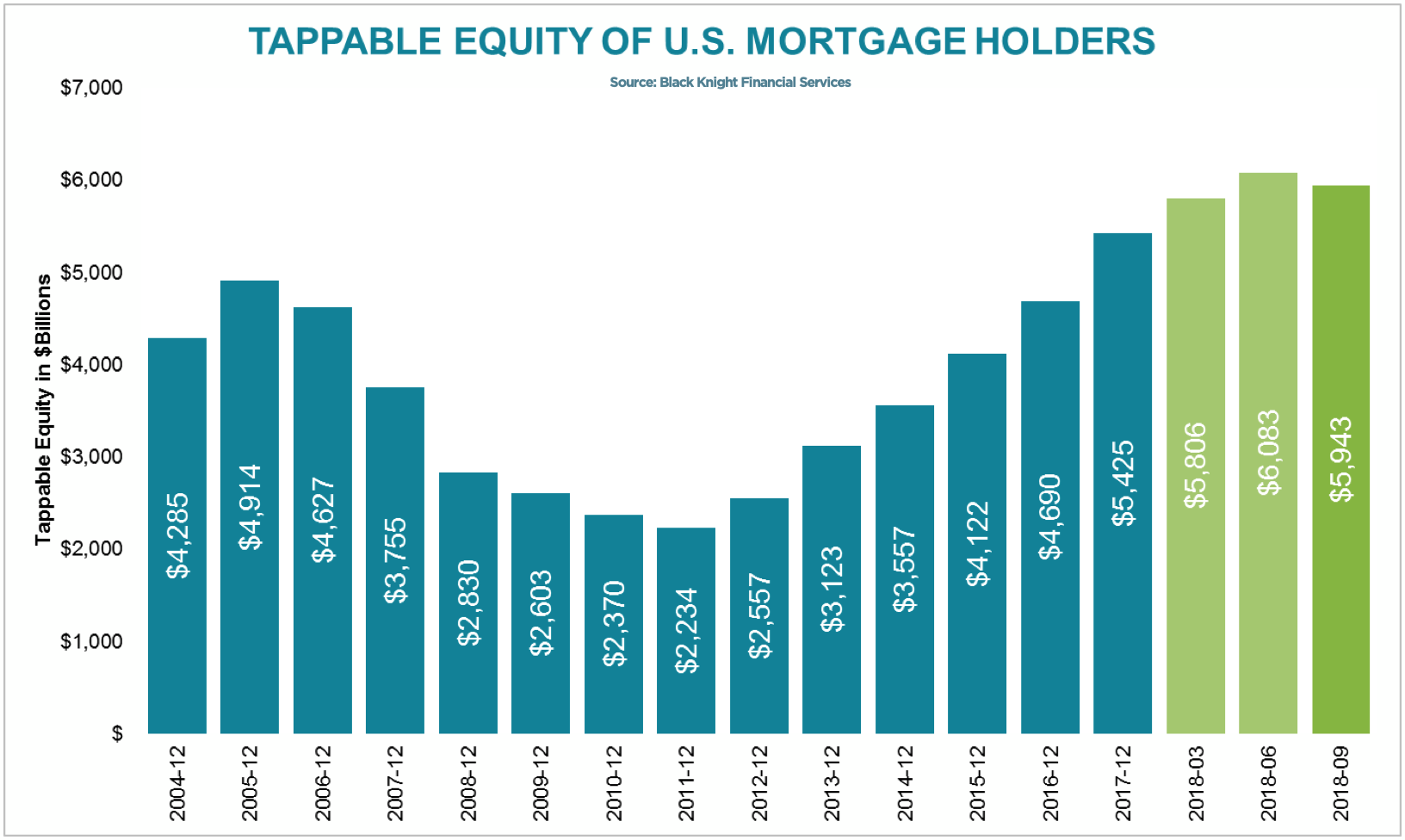

On the other hand, homeowners have become home rich from home prices rising sharply (while paying down their mortgages) since the 2008 crisis, but aren’t tapping into their equity. And their financial situations look quite stable compared to the car crowd noted above. As you can see in the charts below, of the $5.9 trillion in tappable* equity, 65% is held by those of you with nearly perfect credit.

So here’s where we are: millions of cash-strapped car owners could drag on the economy as we move into 2020, but equity rich homeowners could offset that.

That’s why some pros say auto debt is an early warning sign of an economic downturn because if those behind on car payments lost their cars, they could lose jobs, which could ripple from there.

It’s important now because when the economy’s been strong for years like it has recently, market pros look for these early warning signs to see if/when things might turn.

If you’re getting 2008 flashbacks, don’t panic.

Auto debt isn’t as big a systemic issue as housing since the numbers are smaller. There are more cars out there now as auto sales have grown during economic recovery, but percentage of late payments isn’t as high as last cycle.

Even if we have a recession like many pros call for in 2020, it’ll be from cycle maturing more so than from a toxic housing and financial system.

Translation: a 2020 recession wouldn’t be as severe as 2008.

But with one caveat: if homeowners with all this equity stop showing restraint and start treating homes like ATMs again.

The good news is we also have restraint in the system we didn’t have last time. New home loan rules prevent people from going too crazy tapping equity.

There’s a balance somewhere between auto and (especially credit card) debt being too high right now and home equity debt (which is cheaper and sometimes tax deductible) being too low.

We’ll keep an eye on it and keep you updated.

And below are all key debt stats to impress or “Actually…” your friends with. Enjoy.

___

Reference:

– Quarterly Report on Household Debt and Credit (NY Fed)

– *Tappable means your total outstanding home loans don’t exceed 80% of your home’s value.