ARM Rates 1% to 1.5% Lower Than Fixed Rates. Bank Failure Tally For 2011.

A survey of more than 100 lenders by Freddie Mac showed that adjustable rate mortgages (ARMs) are attracting applicants again, and that their market share may go from 3% in 2009 to almost 10% in 2011. Gone, for the most part, are two-year adjustables, option ARM’s, “pick-a-pay” ARMs, etc., and they’ve been replaced with the 3, 5, and 7 year ARMs. Rates on these loans are about 1% to 1.5% lower than 30yr fixed, so they’re a good option for some borrowers—on a %500k loan, a 1.5% lower rate means $439/month lower payment. If one expects rates to rise off record lows in 3, 5, or 7 years, then they either would have an upward ARM rate adjustment at that time, or they should plan be out of the loan. The latter strategy is safer, where a borrower knows they’ll only be in the loan for a certain number of years, so they take the lower ARM rate knowing they’ll sell the home or pay the loan down within that initial 3, 5, or 7 year fixed period of the ARM.

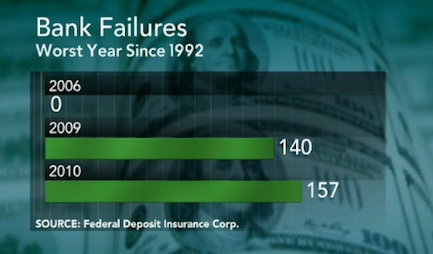

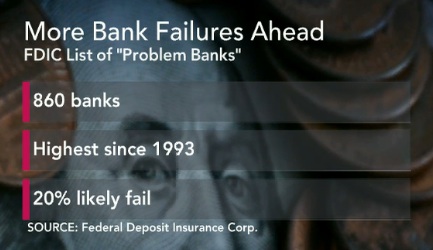

There have been eleven bank closures so far in 2011, with four on Friday. The First State Bank (OK) was sold to Bank 7 (OK), Evergreen State Bank (WI) was sold to McFarland State Bank (also of WI), FirstTier Bank (CO) was placed into the FDIC-created Deposit Insurance National bank of Louisville, which will remain open until Feb 28 to give depositors time to open accounts at other banks, and lastly First Community Bank (NM) was sold to US Bank (MN). Also Wells Fargo will cut temporary 145 employees from its wholesale mortgage lending division—wholesale is the division that serves mortgage brokers, and this shows a continuing trend of mortgage banks trimming broker divisions to focus on retail. Below is a summary of 2010 bank failures.