Bill Gross On QE1, QE2 and What’s Next For Markets & Monetary Policy

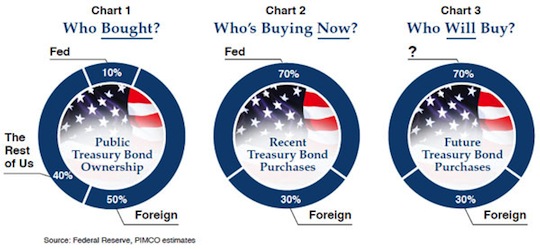

In his latest monthly Investment Outlook, bond king Bill Gross discusses what might happen when the Fed stops buying bonds to keep rates low and stimulate the economy. Below is a notable chart of who’s been buying U.S. Treasuries and who will. Interestingly, the chart calls his own reign as bond king into question. His PIMCO team had a very open strategy about buying mortgage and Treasury bonds before QE1 began in January 2009. “Shake hands with the government” was his term back in late-2008 to recommend that investors buy bonds before the government, and get out before they sell. Where does that strategy would leave the world’s biggest bond fund? That question remains to be answered … by talking heads now, but ultimately by market reality.

Here’s the answer to the mortgage bond part of that question. As for Treasuries, we’re still in the midst of QE2, which is a Treasury buying campaign. So until QE2 ends June 30, or is closer to ending, we don’t know. And for those who need a brush-up, here’s some Quantitative Easing 101 in simple language.