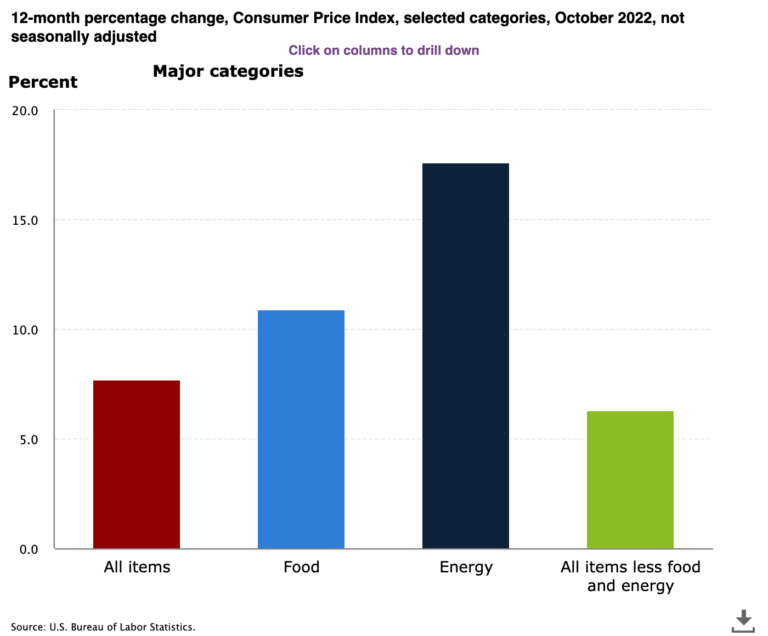

Mortgage rates plummet 0.5% after key Fed inflation measure drops to 6.3% in Oct from 6.6% Sept peak

Finally some decent trend direction for consumer inflation. September’s core inflation which excludes food and energy — and is what the Fed focuses on for policymaking — peaked at 6.6% and was a big reason mortgages tipped over 7%. Now that number for October is 6.3%, and since markets were expecting 6.5%, this has been great for rates today, and we’re now squarely under 7%.

It’s sparked a huge rally in the mortgage bonds that control rates (+192 basis points on UMBS 30yr 5% coupon for the geeks reading this). And since rates drop when bond prices rise on a rally, mortgage rates are down a whopping 0.5% today.

A rate drop this steep in one day may not hold in full, and because of this, not all lenders will adjust rates down a full 0.5% until they see if this rally holds. But it’s certainly a great day for the market.

Matt Graham from Mortgage News Daily watches rates in real-time, and here’s his rate update based on today’s mortgage bond action. And below that is a link from Diana Olick at CNBC who also has a good summary of today’s movement.

I’ll do more Monday after a couple more trading sessions to see how things are playing out.

This is not a misprint: mortgage rates are starting the day 0.50% lower than yesterday. This matches the biggest drop we've ever recorded in day-over-day terms (from March 2020, when it was arguably less "real" for a variety of reasons).

— Matt Graham (@MG_MBS) November 10, 2022

___

Reference:

– Mortgage rates fall sharply to under 7% after inflation eases (CNBC)