Details on how Biden team cut fees on low-down FHA mortgages, helping 850k borrowers save $678m in 2023

When you buy a home with a loan that finances more than 80% of the home’s value, you need mortgage insurance. This protects lenders from increased risk they’re taking, and protects the government who’s backing lenders on many of those loans. The good news is mortgage insurance fees just got cheaper.

Beginning March 20, HUD and FHA will cut annual mortgage insurance fees by 30 basis points on FHA mortgages — which allow for as little as 3.5% down.

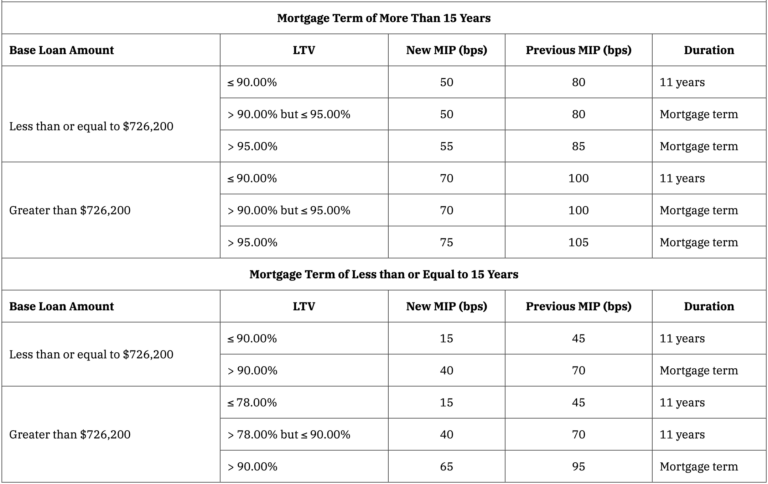

The table above is a bit wonky, and it’s what lenders use for reference. But here are some takeaways for you as a homebuyer:

– If your down payment on a 30-year or 15-year mortgage is between 10% and 19%, you’ll now pay 30 basis points (0.3%) less on annual mortgage insurance — a fee that’s added to your monthly payment. That fee will go away after you’ve made on-time payments for 11 years.

– If your down payment on a 30-year or 15-year mortgage is between less than 10%, you’ll now pay 30 basis points (0.3%) less on annual mortgage insurance — a fee that’s added to your monthly payment. That fee won’t go away unless you pay off the loan and/or refinance into another loan.

2023 FHA Mortgage Insurance Fee Cut Details

– The FHA mortgage insurance fee will be cut from 0.85% to 0.55% for most homebuyers seeking an FHA-insured mortgage, which could mean an estimated savings of $678 million for American families in aggregate by the end of 2023 alone.

– The reduction will benefit an estimated 850,000 borrowers over the coming year, saving these families an average of $800 annually.

– The average FHA borrower purchasing a one-unit single family home with a $265,000 mortgage will save approximately $800 this year as a result of FHA’s fee cut.

– For the same borrower with a mortgage of $467,700 – the national median home price as of December 2022 – FHA’s fee cut will save them more than $1,400 in the first year of their mortgage.

And of course, this should help more low-down people qualify for mortgages.

Why 2023 FHA Mortgage Insurance Was Cut

Also, it’s worth noting the reason HUD & FHA cut (or increase) mortgage insurance fees.

These FHA mortgage insurance fees are collected and put into an FHA fund to backstop the system if borrowers end up not being able to pay. Here’s how FHA words it:

“FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, we’ll pay a claim to the lender for the unpaid principal balance. Because lenders take on less risk, they are able to offer more mortgages to homebuyers.”

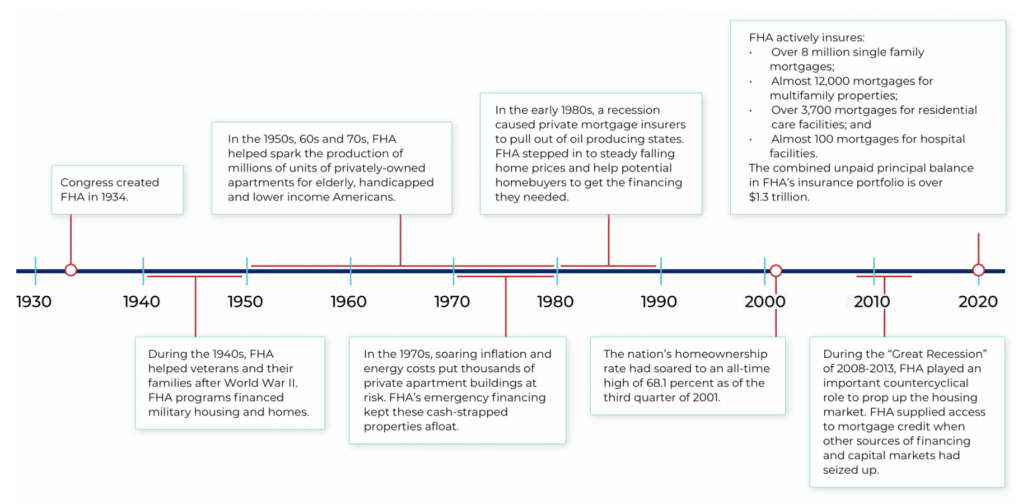

And here’s a timeline showing how FHA has grown and helped the system through key market inflection points.

And finally, here’s the link to FHA & HUD’s announcement about the FHA mortgage insurance cuts.

Here's how much FHA mortgage insurance fees were just cut, how much you can save, when you can cancel fees, and why they were cut.

___

Check It Out: