Home affordability better 4 straight months, but home prices still up 31.6% since February 2022

First American Chief Economist Mark Fleming shares key stats worth noting in his latest research note that uses data through February 2023.

– Affordability has improved 4 straight months, but remains down 32% since February 2022.

– Or, more specifically:

– Inflation-adjusted single family home prices rose 31.6% between February 2022 and February 2023.

– Single family home prices are down from peaks in 37 of the top 50 U.S. markets.

– The 5 states with highest February 2022 to February 2023 price gains are:

Maryland (+41.3%)

Nebraska (+40.0%)

Alabama (+39.7%)

Iowa (+39.6%)

Florida (+39.5%)

– The 5 cities with highest February 2022 to February 2023 price gains are:

Miami (50.0%)

Indianapolis (45.3%)

Jacksonville (42.5%)

Baltimore (40.1%)

Louisville (40.1%)

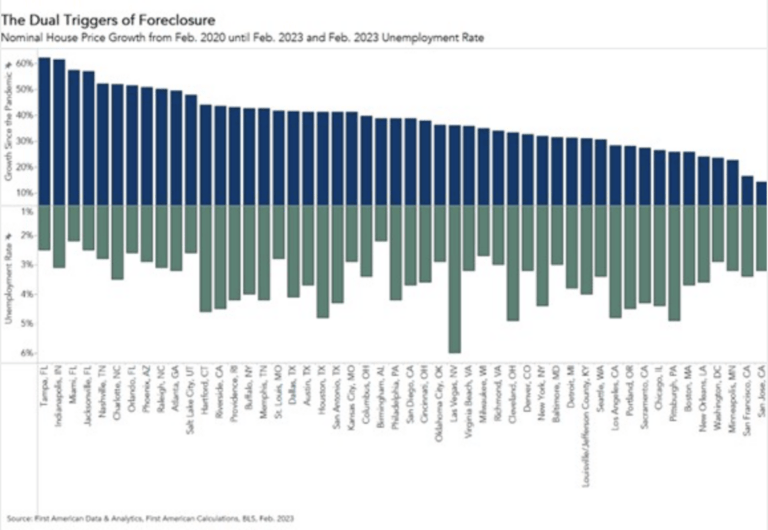

Mark also discusses whether price corrections from here will lead to a foreclosure wave.

He notes that even though home prices are down in 37 of top 50 markets, much of the equity gained during the pandemic remains.

Example: San Jose has had the sharpest home price declines, but still remains 14% above its pre-pandemic level.

Go check out Mark’s full post at the link below.

Here are a few key stats on home affordability, home prices today one year ago, and whether buyers can buy without sellers taking huge losses.

___

Check It Out:

– Why Declining House Prices and Softening Labor Market Will Not Trigger a Foreclosure Tsunami