Home Price Gains Outpace Wage Growth In 72% Of U.S. Cities – but that doesn’t derail you as a homebuyer

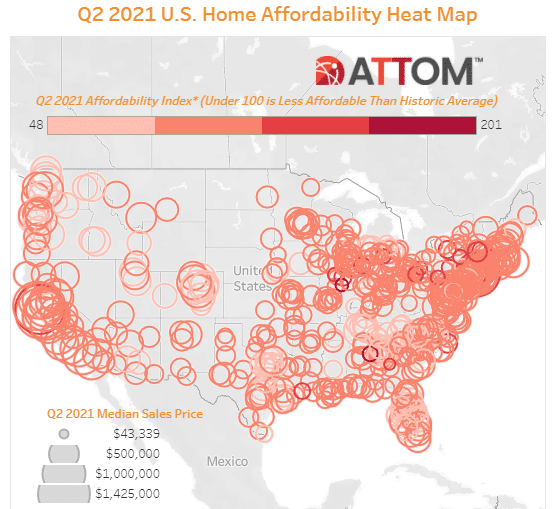

A new ATTOM Research report on 2Q 2021 home affordability says that home price gains have outpaced wage growth in 72% of U.S. cities. But this doesn’t derail you as a homebuyer. It’s based on averages as follows.

They calculate affordability similarly to how lenders do, which is dividing monthly payment obligations by income. So to make the example easy, if your total monthly housing payments (principal, interest, taxes, insurance) are $2,300, and your total houshold income is $100k per year, your monthly income is $,8333. So you divide $2,300 by $8,333 to get a “debt-to-income ratio” (also called DTI by lenders) of 28%. This is considered affordable, and 28% is the DTI that ATTOM uses for its affordability metrics.

They assume 20% down on a median home price on the debt site and use average weekly income data from the Bureau of Labor Statistics on the income side.

With this math (median home prices, average income, and a 28% DTI), they come up with home prices outpacing wage growth gains in 72% of U.S. markets.

This math makes for clickable panic headlines, but it’s based on national averages when all real estate is hyper-local. And your loan approval is also hyper-custom to your profile.

Lenders actually allow your DTI to go up into the 40% range, sometimes higher if you have other factors like money left over in the bank after you close on a home.

Anyway, the point is when the calculations are done to approve you for a home, you’d be surprised what you can afford.

You can ping me with questions on specific calculations, which go much deeper than this.

And for geeks who like to dive into the data, this report from ATTOM does contain some interesting findings, including:

Here's a rundown of what's in ATTOM's latest home affordability report for 2Q 2021:

- A majority of markets still require less than 28 percent of wages to buy a home

- Home prices up at least 10 percent in almost two-thirds of country

- Price gains outpace wage growth in almost three-quarters of markets

- Annual wages needed to afford median-priced home exceed $75,000 in less than 20 percent of markets

- Homeownership less affordable than historic averages in almost two-thirds of counties

- Roughly 40 percent of markets are more affordable than historic averages

___

Check It Out: