Is first investigation from ‘news hedge fund’ Hunterbrook just a big short on top U.S. mortgage lender UWM?

News hedge fund Hunterbrook launched with a piece alleging fraud at United Wholesale Mortgage while shorting the stock. Is this the future of media?

A new media firm, Hunterbrook Media, launched this week with an investigation into America’s top mortgage lender United Wholesale Mortgage (UWM), which funded $107.9 billion in mortgages last year. Hunterbrook Media is affiliated with Hunterbrook Capital, a hedge fund which concurrently shorted UWM stock.

Is this the future of media?

The founders Nathaniel Horwitz (CEO) and Sam Koppelman (publisher), who met at Harvard, seem to think so. They’re in their late-20s and not deep media nor hedge fund veterans (yet), but the Financial Times reports they both have media pedigree:

Horwitz is the son of Pulitzer Prize- winning journalist Tony Horwitz and novelist Geraldine Brooks, also a Pulitzer winner, while Koppelman is the son of Billions co-creator Brian Koppelman and novelist Amy Koppelman.

Billions is about rich and powerful people’s pathological urge to f**k with each other, and the Showtime series definitely had storylines where hedge fund antihero Bobby Axelrod used media to make his trades work out.

As a Billions fan, I fully enjoyed Axelrod’s antihero antics, but I’m not sure Sam Koppelman’s strategy here plays in real life.

Or is he just way ahead of everyone like Axelrod, and I haven’t caught up yet?

The Hunterbrook Media value proposition to users is deep investigative journalism with no ads and no paywall.

Cool, cool. But if you follow Hunterbrook Media incentives like a journalist or investor, they lead to Hunterbrook Capital.

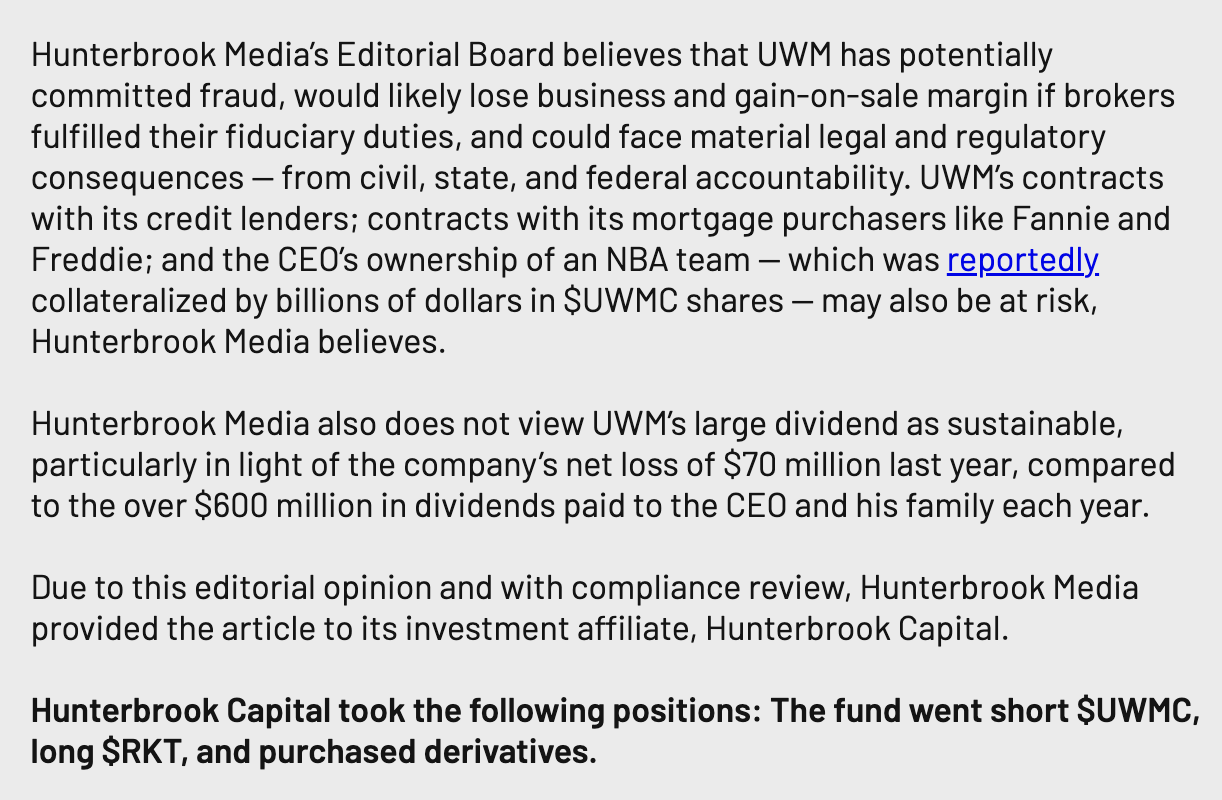

Which, again, shorted UWM stock along with this UWM story going live. How do I know? The Hunterbrook Media story on UWM says this right in the UWM story:

===

===

And speaking of incentives, Hunterbrook Media’s story alleges that UWM incentivizes and compels mortgage brokers to send all of their consumer customers to UWM.

The value proposition of mortgage brokers is supposed to be that they shop around and get you the best deal. Some in the mortgage industry have debated for years about whether UWM does in fact do what Hunterbrook Media is alleging.

They present well-researched information to make their UWM allegations.

But the Hunterbrook Media allegations against UWM lose credibility when their affiliated hedge fund, Hunterbrook Capital, is concurrently shorting UWM stock.

Here are Financial Times reporters Kate Duguid and Joshua Franklin on the Hunterbrook structure:

– A US hedge fund has raised $100mn to make trades based on articles by its affiliated newsroom.

– The business is an effort to pair the sort of investigative journalism typically done by newsrooms with a long-short hedge fund. The fund, Hunterbrook Capital, places trades based on scoops uncovered by reporters at the newsroom, Hunterbrook Media, which is separated by a layer of compliance. Those scoops would only be based on publicly available information.

The FT also reported that Horwitz didn’t disclose the identities of the limited partners who provided $100 million in funding for Hunterbrook Capital.

If experienced pros — and the Hunterbrook Media team members are definitely pros — are doing deep analysis and reporting with no ads and no paywall on their site, it raises some basic questions:

How do they get paid?

How does the operation get funded?

This excerpt from the FT story partly answers these questions:

Running the newsroom this year will cost about $5mn, Koppelman and Horwitz said, and $10mn in seed funding raised last year would support operations through the end of next year. The hedge fund arm will charge investors a traditional 2% management fee and 20% performance fee and will in effect pay Hunterbrook Media for its research, funding the venture.

So now, I’ll repeat my first question above:

Is Hunterbrook the future of media?

If so, it feels off at first glance.

All media has incentives (see 6 ways media makes money), the most obvious of which are advertising and subscriptions.

But is the claim of total openness with no ads and no paywalls disingenuous when your affiliated hedge fund is acting on your news?

On the surface, Yes.

But going deeper, how is this different from venture capital blogs, investment bank research, or buy side research? These information channels are not only deemed better than lots of financial journalism, they’re also the source material for most financial journalism.

So I think I understand Hunterbrook Media’s intent: Find a clever way to fund investigative journalism.

But like the Buddha said to young Siddhartha: Be on your guard against too much cleverness.

On that note, I’ve just begun meditating on this, so comment below or reach out to enlighten me.

___

Reference:

– The Lie That Helped Make UWM America’s Largest Mortgage Lender (Hunterbrook)

– News-powered hedge fun raises $100m to trade on reporters’ scoops (FT)

– A hedge fund that’s also a newspaper (Bloomberg)

– ESPN on mortgage billionaire rivalry Rocket & UWM brought to NBA