Home Prices & Sales, Rates, Size Of U.S. Mortgage Market – September 2020

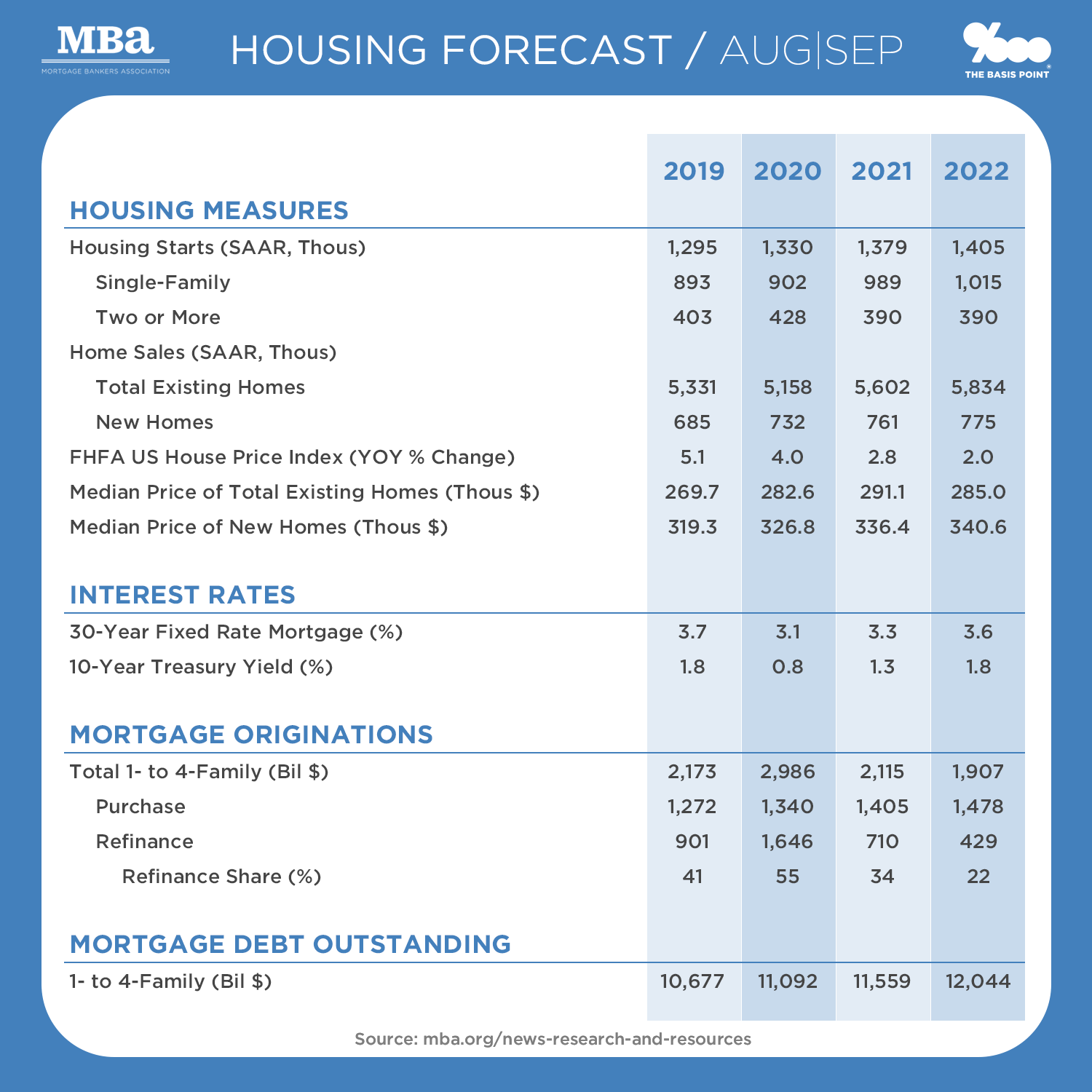

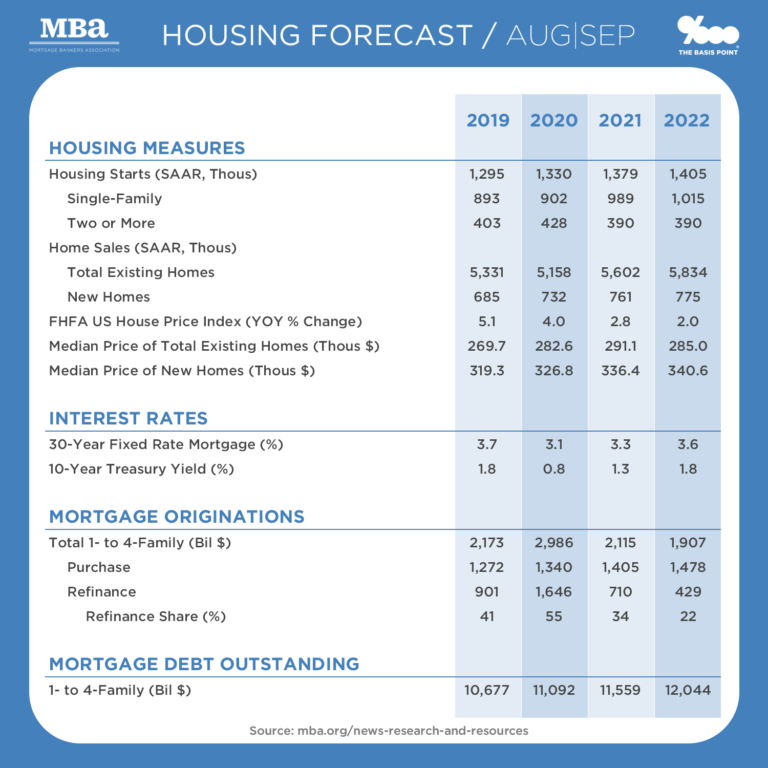

Lets look at mortgage rates, home prices, home sales, and size of U.S. mortgage market as of September 2020. Below I review 2020 by quarter, then the outlook through 2022. This MBA outlook incorporates (very volatile) probabilities about the election and path of the pandemic. So read my comments below the table to get current data on rates, monthly payments, refi cost savings, and whether to lock rates now.

LOCK TODAY’S MORTGAGE RATE LOWS BELOW 3%?

This outlook predicts 30-year fixed rates at 3% in Q3 and 3.1% in Q4 2020.

Today’s 30-year fixed mortgage rates are just below 3% with zero points.

A rate of 2.875% on a $250,000 loan gives you a payment of $1037.

Wow! This is why the size of the U.S. mortgage market will be $3 trillion this year alone. More on this in next section below.

When rates drop and the economy is under strain, the question is always:

Do I hold for lower rates?

The first part of the answer is based on the outlook, and there are two near-term factors: progress on a coronavirus vaccine, and outcome of the election.

Rates will rise as a vaccine becomes more probably, and rates will likely remain steady despite election outcome because markets perceive both candidates as market friendly.

The second part of the answer depends on your timeline.

If you’re refinancing and waiting for lower, you better have the stomach for rates to rise — and if you look at the 2020 to 2022 outlook at the bottom of this post, you’ll see rates are projected to rise as the economy gets back on its feet.

If you’re buying a home, it won’t matter what rates do because you’ll need to lock a rate as soon as you’re in contract to buy a home so you can get your loan closed and meet the terms of your purchase contract. So you’ll be subject to whatever rates are available at that time, and the great news is rates are insanely low right now.

MONTHLY PAYMENT ON NEW & EXISTING HOMES

– Median New and Existing home prices may stay steady at around $327,000 and $286,000 respectively.

– At these prices, total monthly cost with 10% down on a new or existing purchase would be $1722/month or $1518/month, respectively.

– This is all-in cost including principal, interest, taxes, insurance, and mortgage insurance.

– It also uses rates 3.25% instead of 2.875% on a 30-year fixed to account for premiums on a lower down payment.

-Compare those all-in monthly obligations to rents for a comparable property. This will make buying more attractive than renting in lots of cities.

SIZE OF U.S. MORTGAGE MARKET 2020

– The U.S. mortgage market is expected to fund almost $3 trillion in new mortgages in 2020, 45% purchase loans and 55% refinance loans.

– In the quarterly breakdowns above, you can see refis being a majority share in Q1, Q2, and Q3, then drop to 49% of all mortgages in Q4.

– In the annual breakdown below, you can see refis dropping sharply from 55% to 34% of the market between 2020 and 2021, then drop to 21% of the market in 2022.

– More comments on what this means for homebuyers and lenders in the last section below.

1.33 MILLION NEW HOMES IN 2020

– New home building is an important stat because of its contribution to the economy.

– Construction will begin on about 1.3 million homes in 2020, as represented by Housing Starts.

– New construction and remodeling of single family and multifamily homes is about 3-5% of GDP.

– But it has broad ripple effects in the economy as builders purchase materials and hire workers, and buyers spend a lot to buy, move into, and furnish homes.

– This is especially important as the pandemic has kept jobless claims above 1 million for 22 of last 23 weeks.

2020 NEW & EXISTING HOME SALES STEADY DESPITE PANDEMIC

– We’re slated to have 5.98 million new and existing home sales in 2020, comprised of 732,000 new home sales and 5,158,000 existing home sales.

– This is a highly resilient number considering pandemic economic disruptions.

– By comparison, a strong 2019 housing year posted 6.02 million new and existing home sales in 2020, comprised of 685,000 new home sales and 5,331,000 existing home sales.

RATE, HOME PRICE, SIZE OF U.S. MORTGAGE MARKET 2020-2022

Below is a table with all the same data as the table above but looking out a few years.

The housing market looks like it’ll remain healthy with:

– 30-year fixed rates in the mid-3% range.

– New home construction starts growing slowly to about 1.4 million new homes per year by 2022

– New and existing home sales growing to 6.36 million in 2021 and 6.61 million in 2022.

– New and existing home prices growing to $340,000 and $285,000, respectively, by 2022.

– Total mortgage originations leveling off to a very high $2 trillion per year in new loans made.

___

Reference: