Housing Data-Charts: Home Prices and New Home Sales

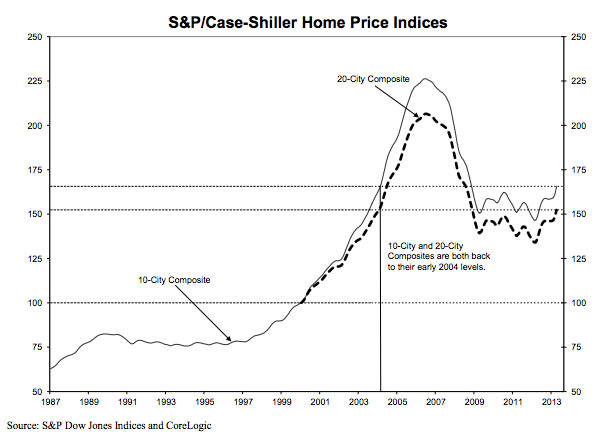

Three key housing reports today recapped below. Reminder that Case Shiller, the most widely followed home price report, is representative of what the market was like five to six months ago, and rates didn’t start rising sharply until about two months ago.

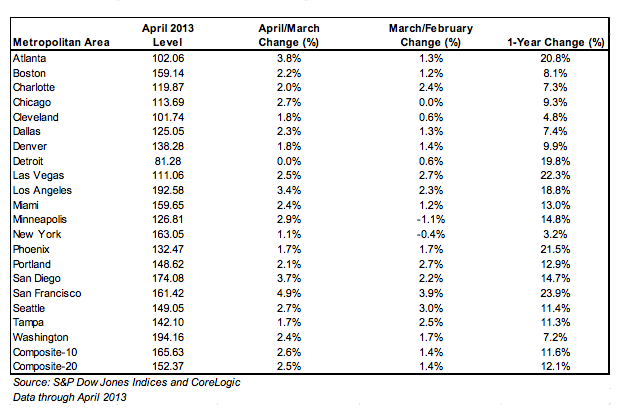

S&P Case-Shiller Home Price Index (April 2013)

– 20-city, Seasonally Adjusted Month/Month +1.7%

– 20-city, Not Seasonally Adjusted Month/Month +2.5%

– 20-city, Not Seasonally Adjusted Year/Year +12.1%

– Gains in Home Prices continue as demand exceeds supply

– Full report and charts below

– Also, here’s how to price a home locally

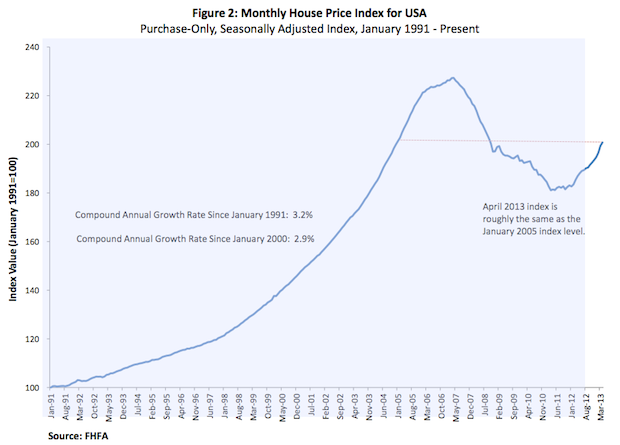

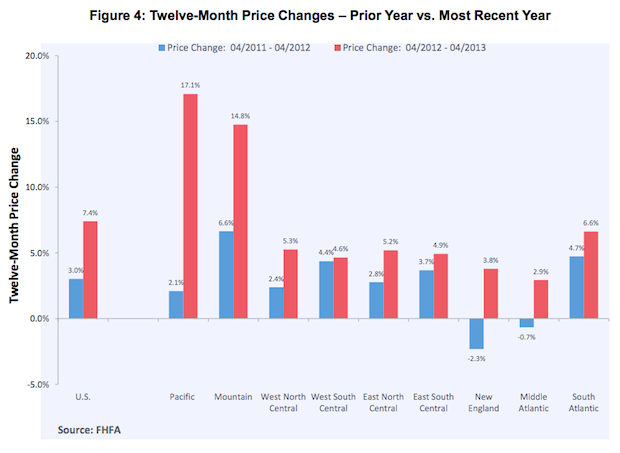

FHFA House Price Index

– Price Index Month/Month 0.7%. Previous was +1.5%

– Price Index Year/Year 7.4%. Previous was +7.5%

– These are sales financed with FNMA or FHLMC loans only

– Full report and charts below

New Home Sales (May 2013)

– New Home Sales Seasonally Adjusted, annualized 476,000

– Previous was revised up to 466,000

– Third straight month of gains and near a 5-year high

– A slow and steady gain in New Home Sales should continue

Durable Goods Orders (May 2013)

– New Orders Month/Month 3.6%. Previous revised to +3.6%

– New Orders Year/Year 7.6%. Previous revised to +2.6%

– Ex-transportation Month/Month 0.7%. Previous revised to +1.7%

– Ex-transportation Year/Year 2.8%. Previous revised to +1.3%.

ICSC-Goldman – Chain Store Sales (week ended 6/22/2013)

– Week/Week +1.1%. Previous was +0.3%.

– Year/Year +1.6%. Previous was +2.5%.

Redbook – Chain Store Sales (week ended 6/22/2013)

– Year/Year +2.8%. Previous was +2.9%.

– This is yet another week when the data tells us that Year/year sales are either increasing or decreasing. Thanks, guys.

– The Consumer Metrics Institute Daily Absolute Demand Index (this measure discretionary on-line spending) has been flat for the last week.