U.S. homeowners have impressive 71% equity. But can buyers afford these values?

Housing market health alert! The economics team at National Association of Homebuilders (NAHB) recently shared some interesting data on U.S. home values. Between the third and fourth quarter of last year, Fed data show values of U.S. owner occupied homes fell for first time since 2012. That’s the headline NAHB used, and they noted the decline has to do with home prices beginning to decrease from pandemic highs.

But I wanted to point out another noteworthy item in this data.

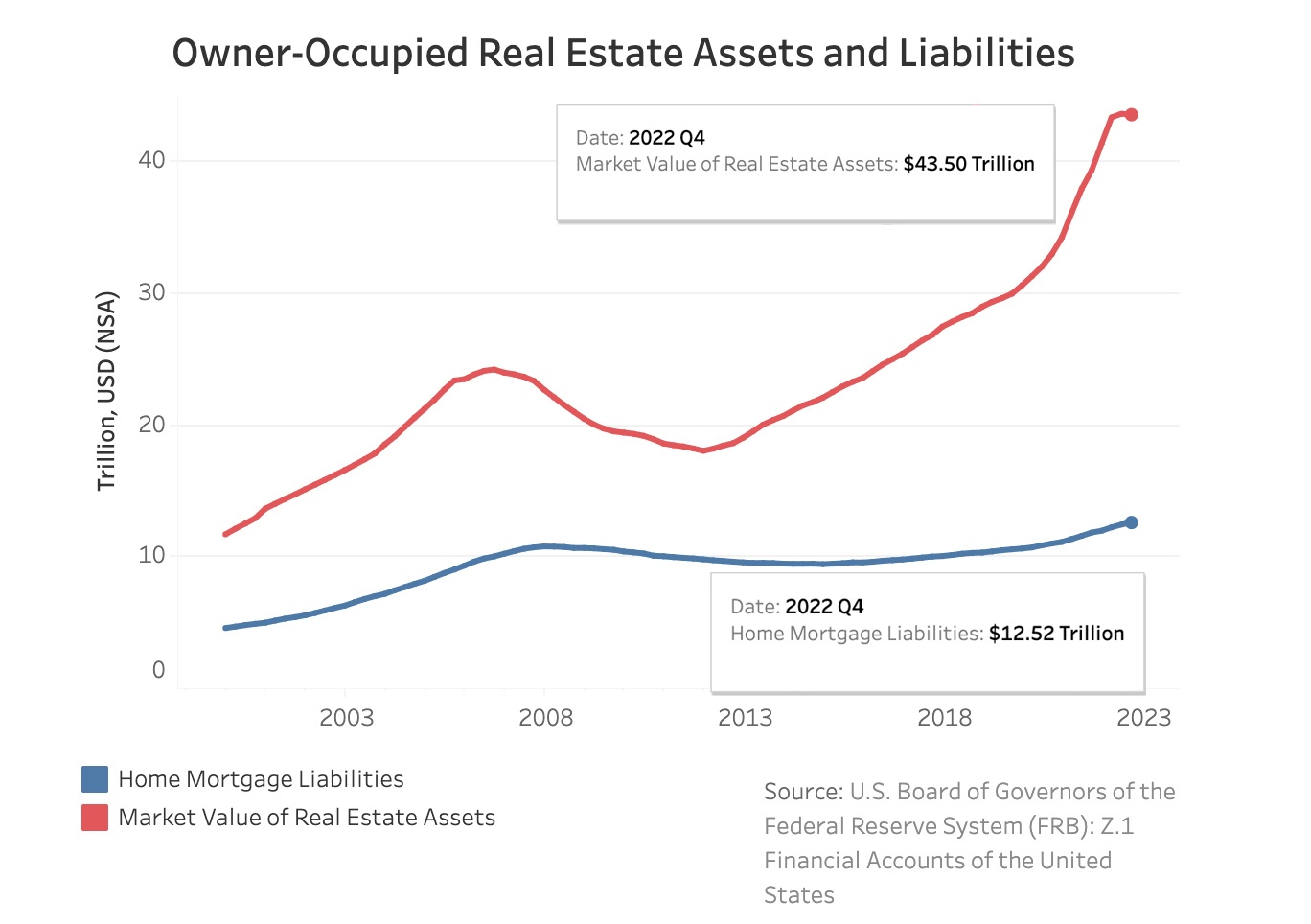

U.S. housing market looks healthy with homeowners having 71.22% equity in homes collectively.

We calculate this by dividing total mortgages outstanding of $12.52 trillion by the $43.50 trillion in total value of U.S. homes.

This means total mortgages outstanding are 28.78% of the total value of U.S. homes. And people own the remaining 71.22% of their homes.

To put this in perspective:

When making mortgages to people, government-backed housing orgs like Fannie Mae, Freddie Mac, and Ginnie Mae allow lenders to lend up to 97% of a home’s value.

Comparing what’s allowed to the actual low percent of loans to values makes the housing market look pretty healthy.

It’s worth noting total outstanding mortgages increased 6.55% from 4Q21 to 4Q22 — from $11.75 trillion to $12.52 — so it’s always important to watch these trends.

But for now, the high percentage of equity in U.S. homes looks like a sign of health.

The key reason for this ‘health’ is higher home prices.

Which leads to this critical question: can people afford homes at these values?

Check out the link below which covers today’s home affordability math.

___

Reference:

– Newly built home prices now $438,200. Can you afford this? (TheBasisPoint)

– Home Values Fall 1st Time Since 2012 (NAHB)