Homes at $363k affordable even with what Fed is doing to rates

USA Today has a good round up of charts and comments from good sources on the current state or mortgage rates and housing.

Here’s a couple quotes from Jeff Taylor who’s an MBA board member and Mphasis Digital Risk managing director.

The takeaway here is that median home prices on 87% of homes that sell (existing homes) is $363,000 right now.

Even with what the Fed is doing to rates, this is within the affordable range. See Jeff’s comments below, and I did a post yesterday on showing some math on whether $363k home prices are affordable.

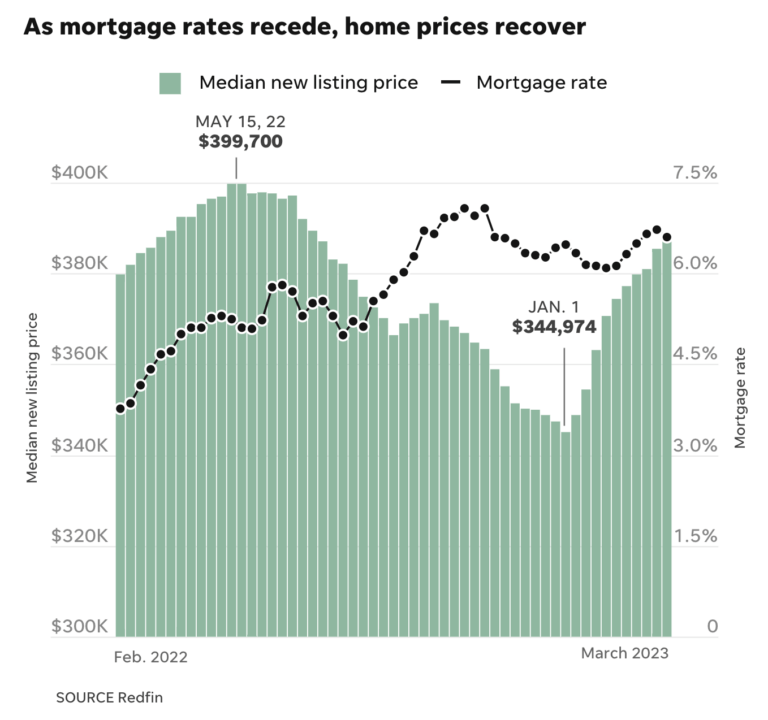

When it comes to median prices of existing homes, it’s most relevant for home buyers to look at price trends versus the previous month and relative to the pandemic peak. February existing home prices of $363,000 were up $4,000 from January, but down $50,800 from the pandemic era peak of $413,800 in June 2022.

Fed hikes cause lots of headline noise, but mortgage rates are lower than they have been for quite some time, more than 1% from their 7.375% peak on October 20, 2022.

It is the daily trading of mortgage bonds – not Fed actions – that move mortgage rates. As bond investors get bullish seeing the Fed do its job to moderate inflation, mortgage rates will drop as lower future inflation makes bonds more valuable.

And that is actually good news for homeowners, and as the Fed progresses on its inflation fight, mortgage rates are likely to drop more.

Prices dipped from the peak as higher rates resulting from the Fed inflation fight slowed home sales. Prices rose slightly in February as rates dipped to near 6% in January.

USA Today has a good series of charts and experts commenting on Fed actions and their impact on home buying and selling.

___

Check It Out:

– Housing market is 'overly sensitive' to Fed rate hikes. Experts weigh in on what's next.