ICE Experience 2025 – State of Mortgage Fintech LIVE BLOG

Intercontinental Exchange (ICE), the same $97 billion market cap company that owns the New York Stock Exchange, is also the biggest mortgage technology company in America — see notes on this below.

This week, they’re hosting ICE Experience 2025 in Las Vegas, which is both a client conference and an industrywide conference.

Most major mortgage lenders, servicers, and other fintechs that are part of the ecosystem powering lenders and servicers are here.

Also here are regulators, Fannie Mae, Freddie Mac, private investors (aka buyers of mortgages from lenders), mortgage insurers, and other major players in the space.

The Basis Point will be live blogging the show to capture all things mortgage markets and fintech.

We hope you check it out.

This is truly real-time so if you see anything that needs adjusting — or if you have questions — please reach out.

ICE Experience 2025 Table Of Contents

- Good Morning from ICE Experience 2025 at Wynn Las Vegas

- View of The Sphere & Wynn from ICE Experience 2025

- How NYSE Owner ICE Also Became Largest Mortgage Software Player In America

- History of ICE 2020-2023 & 3 Major Business Units, Including Mortgage

- ICE Made $2.02 Billion In 2024 Mortgage Tech Revenue

- Wow the ICE conference is huge: PHOTO

- ICE Mortgage Vision In One Image

- Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 1

- Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 2

- Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 3

- Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 4

- Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 5

- Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 6

- Mick Ebeling, Not Impossible Labs, With A Formula For Helping Those In Need

- McLaren Alert!

- Economist Super Session – ICE Experience 2025, part 1

- Economist Super Session – ICE Experience 2025, part 2

- Economist Super Session – ICE Experience 2025, part 3

- Economist Super Session – ICE Experience 2025, part 4

- Economist Super Session – ICE Experience 2025, part 5

- Good Night From ICE Experience 2025 Party at XS

- Good morning Day 2 ICE Experience 2025

- Keynote: Marine Veteran Jake Wood on VUCA, part 1

- Keynote: Marine Veteran Jake Wood on VUCA, part 2

- Keynote: Marine Veteran Jake Wood on VUCA, part 3

- Tennis Legends Andre Agassi & Steffi Graf, part 1

- Tennis Legends Andre Agassi & Steffi Graf, part 2

- Tennis Legends Andre Agassi & Steffi Graf, part 3

- AI and its projection into the lending industry, part 1

- AI and its projection into the lending industry, part 2

- AI and its projection into the lending industry, part 3

- AI and its projection into the lending industry, part 4

- Navigating New World of Real Estate Agent Partnerships, part 1

- Navigating New World of Real Estate Agent Partnerships, part 2

- Navigating New World of Real Estate Agent Partnerships, part 3

- Navigating New World of Real Estate Agent Partnerships, part 4

- Navigating New World of Real Estate Agent Partnerships, part 5

- ICE’s Role In Powering $2 Trillion/Year Originations & $14 Trillion Servicing Sectors

- Special Thanks To ICE SVP Jonas Moe & Team

- Leaving Wide-Eyed From ICE Experience 2025

Good Morning from ICE Experience 2025 at Wynn Las Vegas

Getting ready to start the mortgage markets and fintech day.

Very grateful for these views from my room before I head down to the show…

View of The Sphere & Wynn from ICE Experience 2025

Another great morning pic of The Sphere and Wynn from the show…

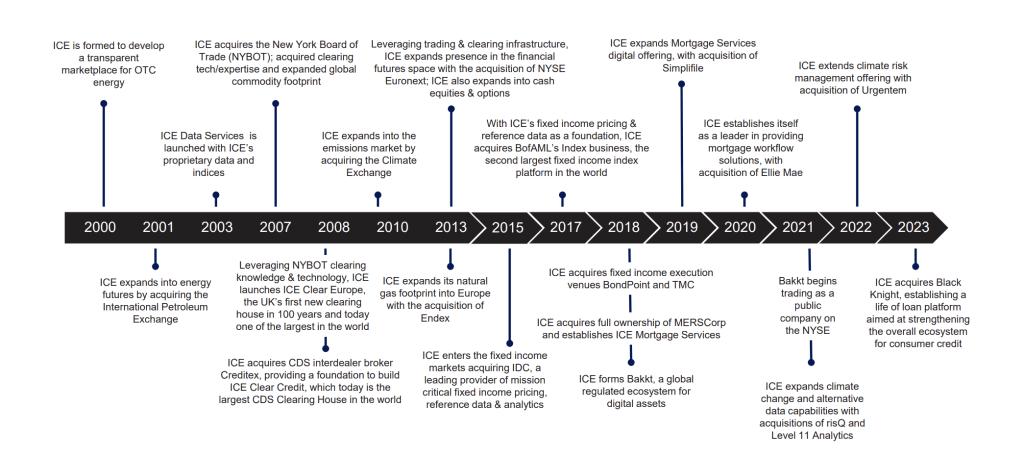

How NYSE Owner ICE Also Became Largest Mortgage Software Player In America

Above I noted how ICE is the biggest mortgage technology in America. Here are some notes about how it happened.

In September 2020, ICE paid $11 billion for Ellie Mae, America’s largest mortgage originations software firm.

In September 2023, ICE paid $12 billion for Black Knight, America’s largest mortgage servicing software and mortgage data firm.

By the end of 2025, the Mortgage Bankers Association estimates lenders will originate $2 trillion in new mortgages and will be servicing $14.7 trillion in outstanding mortgages.

After spending $23 billion on the originations and servicing software that powers a huge part of these enormous markets, ICE Mortgage Technology is truly an ecosystem company.

ICE also owns 4 other key mortgage infrastructure components:

1. Between 2016 and 2018, ICE acquired the Mortgage Electronic Registration Systems (MERS) database (price not disclosed), which records and tracks changes, servicing rights, and beneficial ownership interests in U.S. mortgage loans.

2. In June 2019, ICE acquired Simplifile for $335 million, which enables lenders to electronically record deeds, mortgages, liens, releases and other documents online, over the nation’s largest network.

3. In May 2024, ICE launched a product and pricing engine (PPE) lenders use to price loans and manage gain on sale — the lifeblood of lender P&L strategy. For those following closely, this was after they divested the Optimal Blue PPE when closing the Black Knight deal. The Basis Point hosted the ICE PPE (along with 3 other PPEs: Optimal Blue, LenderPrice, and Polly) in a special MBA Secondary 2024 PPE demo showcase last May.

4. And because all of these other functions and a large customer base gives them so much data, ICE’s vast data and analytics suite is another big piece of the puzzle, which generated $259 million in 2024 revenue.

All of this adds up to full-lifecycle mortgage loan closing, servicing, and tracking across securitization markets.

More below on how this mortgage strategy fits with ICE more broadly, and how big it is financially. Spoiler alert: the $259 million in data revenue is just 12.8% of the total.

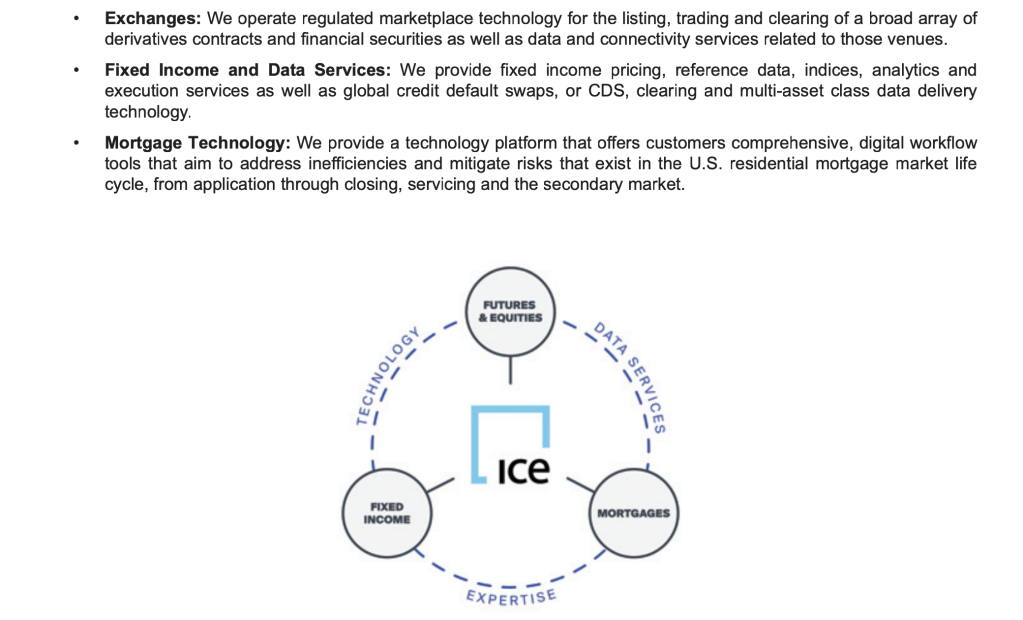

History of ICE 2020-2023 & 3 Major Business Units, Including Mortgage

Here are some good images from ICE’s SEC filings about their business model and history.

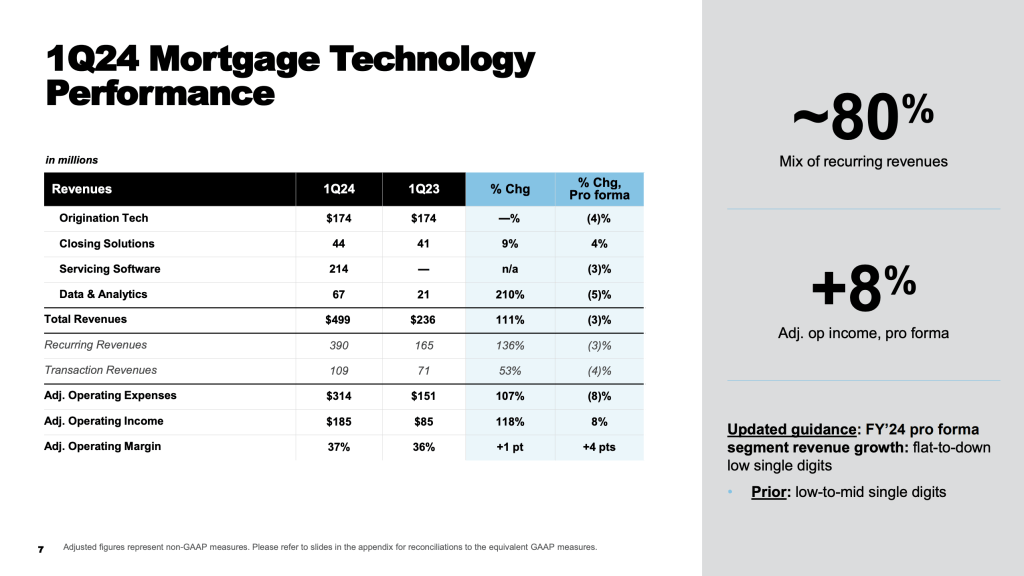

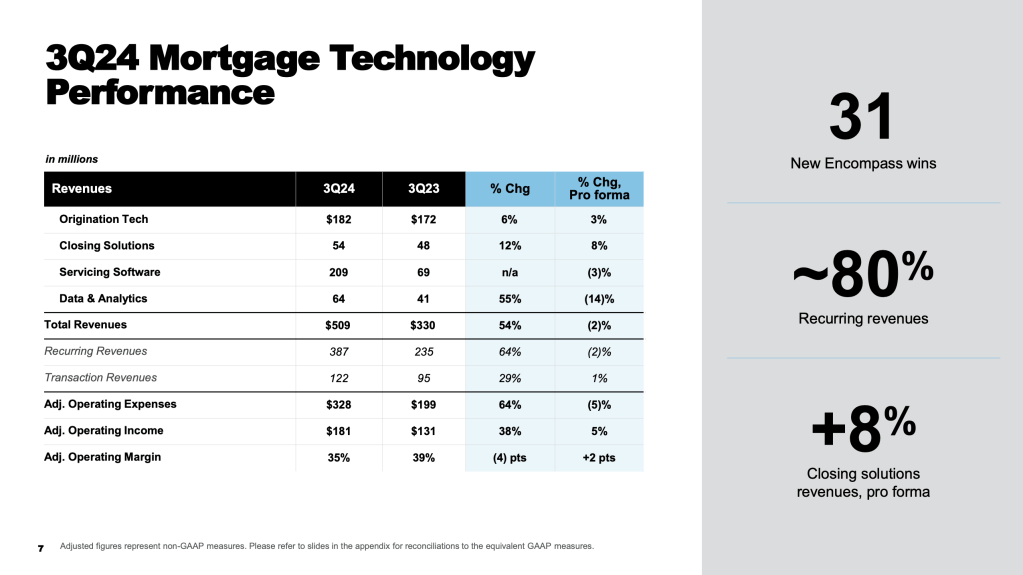

ICE Made $2.02 Billion In 2024 Mortgage Tech Revenue

Mortgage is one of 3 major business units of the $97 billion market cap ICE operation.

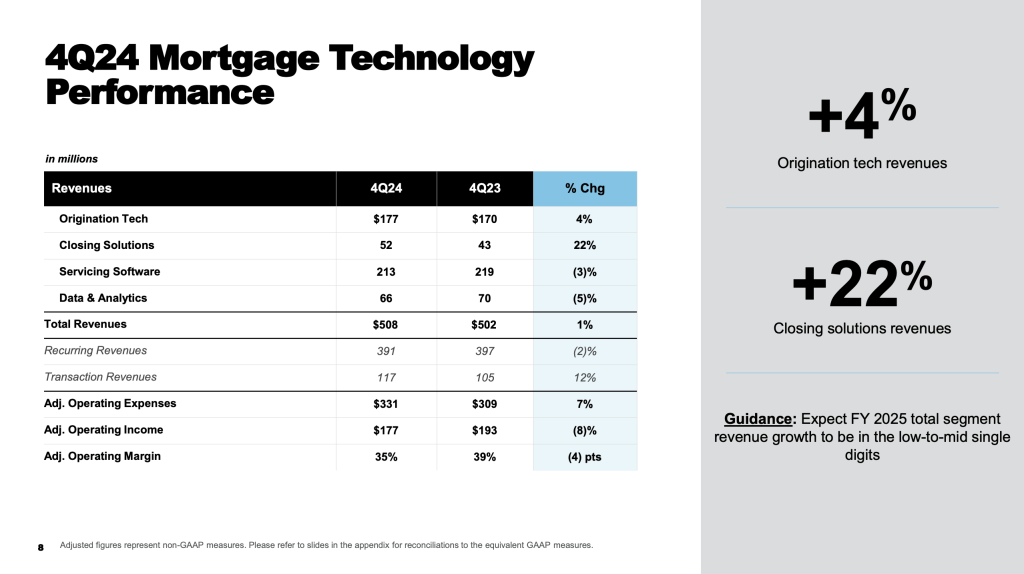

ICE’s mortgage revenues for the past 4 quarters break down as follows:

1Q24: $499 million

2Q24: $506 million

3Q24: $509 million

4Q24: $508 million

Total 2024 ICE Mortgage Technology Revenue: $2.02 billion

Below are the 4 quarters of ICE Mortgage Technology stats from quarterly reports.

===

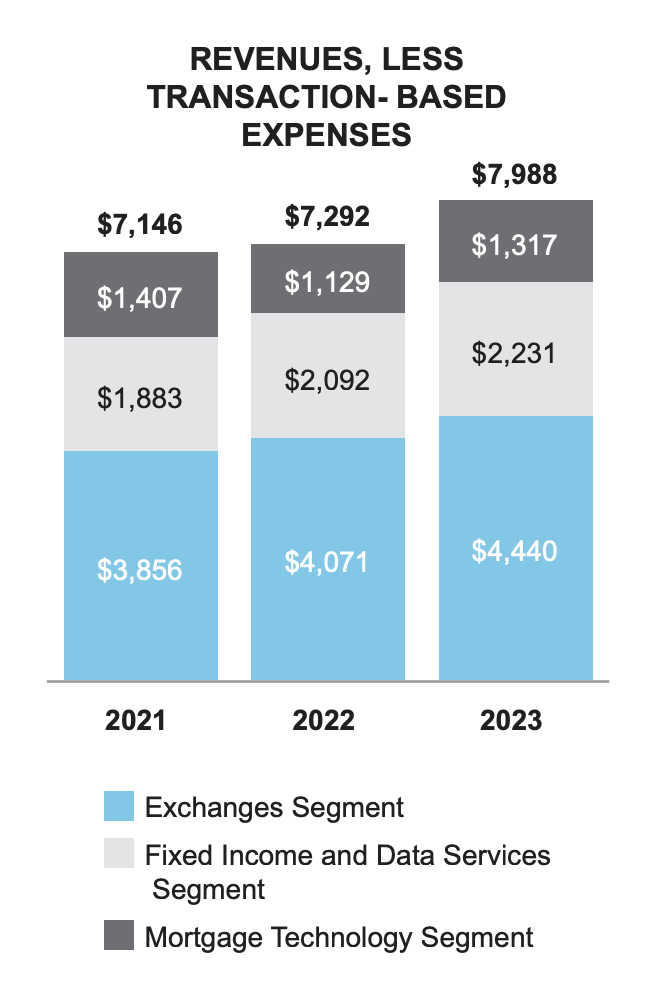

Also, it’s worth noting where the $2.02 billion of mortgage revenue sits in the broader ICE revenue machine.

They haven’t published 2024 final figures yet, but here’s a revenue breakdown of ICE’s 3 main business units for 2023:

Wow the ICE conference is huge: PHOTO

ICE Mortgage Vision In One Image

This is an image that sums up the full originations, serving, and capital markets lifecycle in one image.

Thanks to Eric Kujala on the ICE product team for sharing this vision he and the team created.

Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 1

Michael said the market volatility is from Trump administration agenda even conflicting former Trump policies.

He also noted the historical players in Washington (see slide below) who are influencing Trump policies.

Deportations are partially inflationary from labor shock.

Also tariffs are inflationary.

This is not what voters wanted when they voted for Trump who ran in Biden inflation theme.

The idea is to outgrow this, and build more infrastructure to bring inflation down.

Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 2

Michael said most people in the administration spent their careers arguing for some form of free trade.

He said it would be very hard to give advice to this administration at this time.

Canada tariffs with a major ally make no sense.

More drugs flow North to Canada than South to America, and they’re an ally.

As for deportations, Michael gave an example:

Eisenhower deported 1 million people initially then reduced that to 80,000.

A lot can change in 18 months.

Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 3

As for energy transition to green energy, it’s expensive.

It’s been keeping Producer Price Index high.

As for AI and its need for energy, DeepSeek is a good example of AI using less energy.

Michael doesn’t believe nuclear energy is cheaper, especially in the infrastructure building phase.

As for AI impact on worker productivity.

He use JPMorgan as an example, saying the jury is still out on whether AI can cut 20%-ish of workers.

He said AI spending is way better than metaverse spending, which he likened to a back yard bird feeder project.

Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 4

As for housing, why aren’t we hearing more about zoning issues.

This is the main culprit of low supply.

Only 7% of new homes are starter homes 1400 square feet or less.

Grants and loans aren’t the solution for first time buyer affordability.

This creates more demand and drives up prices.

The issue we need to solve is supply.

You can’t solve a supply shortage issue by stoking demand.

You need opportunity zones and other zoning related regs to help supply.

If this administration expanded eminent domain rules can help create more buildable areas.

EDITOR NOTE: Eminent domain in the hands of overzealous political leaders is a slippery slope because it can displace existing property owners. The eminent domain comment was fast and he didn’t expand, but it was a definitive statement.

Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 5

Next topic: mortgage rate outlook.

This is the only Fed cut cycle where rates went up and stayed up after the Fed cut.

This is because of inflationary Trump policies.

We can expect administration to pressure Fed for cuts, but Fed will hold higher when inflation is a threat.

One scenario is a recession that takes the 10-year note to 3.5%, which would help mortgage rates come into low-6% or even the 5s.

This would create refis for homeowners.

But this means job loss and other issues which would strain homebuyers.

And Michael didn’t address stagflation, where you have a recession AND inflation.

Market Outlook – JPMorgan Strategist Michael Cembalest & ICE MT President Tim Bowler, part 6

As for China relations, we need to take down the tension.

For now, it seems Trump is raising China tariffs so he can lower them at some forthcoming summit.

In closing, Michael reiterated that A LOT can change in 18 months.

So whatever is happening now is less likely to be similar by the midterms.

Mick Ebeling, Not Impossible Labs, With A Formula For Helping Those In Need

Mick was an interesting inventor and humanitarian who founded Not Impossible Labs after helping create an eye writer for an artist who’d lost his ability to move or speak.

The EyeWriter became a humanitarian phenomenon, and led to Not Impossible and its approach.

The humanitarian approach is Help One, Help Many. Then tell stories.

It’s not about solving hunger. It’s about feeding one hungry person, knowing their story, telling their story, and letting the bigger effort grow from that.

Lots of moving stories. And a highly accessible way to help in a world where it seems like helping can sometimes feel like it’s not moving the needle.

Here’s more information on Mick and Not Impossible Labs.

He talked about how “impossible” is a fallacy.

Everything we know today was once “impossible.”

Then someone solved it.

This means what when we face difficulties, we can say it’s difficult.

But we CANNOT say it’s impossible.

Once you accept this mindset shift, you realize how temporary “impossible” is.

McLaren Alert!

We interrupt this Live Blog for an obligatory McLaren Las Vegas shot…

Economist Super Session – ICE Experience 2025, part 1

Next up is a super panel with these 5 top housing finance and policy analysts below.

This will go very fast so I’ll break it into parts.

Chris Flanagan, Bank of America Securities

Fixed Income Strategist and Head of US Mortgage and Structured Finance Research

Laurie Goodman, Urban Institute

Fellow, Housing Policy Center

Mark Palim, Fannie Mae

Chief Economist

Edward Pinto, AEI Housing Policy Center

Senior Fellow, Co-Director

Andy Walden, ICE

VP, Research & Analysis

—

First question was whether Fed will be over or under 2.5% by year end. Here are the results.

Chris Flanagan said the Fed will have low odds of getting it right because we have both inflation and recession risks.

Even before stock selloff this week, volatility was on high because of policy uncertainty.

Trump is trying to reengineer a global geopolitical system that has served us for the past 50-80 years.

Treasury chief Bessent is trying to get the 10yr Note yield down before 2026 midterm election.

Because of this, we should take the “don’t fight the Fed” phrase and rework it to say “don’t fight the administration.”

Chris/Bank of America projections:

2.5% GDP

4.4% unemployment

2.7% Core PCE

4.75% 10yr Note

2.75% Fed Funds

He caveated this with the fluid situation. And if you don’t fight the administration, rates could be this low:

10yr Note: 3.25%

30yr fixed rate: 5.5%

Andy noted there are 5 million loans over 6.5%.

EDITOR NOTE: If rates did in fact drop to 5.5%, giving 5 million borrowers up to 1% lower rates, that’s more than double the 2.1 million refis projected by MBA for 2025.

Economist Super Session – ICE Experience 2025, part 2

Mark Palim, Fannie Mae said consumer balance sheets are holding ok.

FHA loan delinquencies are rising but generally people are holding.

We think mortgage rates will stay above 6% this year.

Our February forecast:

2.2% GDP

4.2% unemployment

KEY: Don’t just read headlines.

You can go listen to hour-plus interviews with Treasury chief Bessent.

This is what you need to follow.

The administration has been very clear about reengineering trade and overall geopolitical policy.

Edward Pinto, also said follow what Bessent says.

Rates (10yr Note) could drop 75 basis points if they do what Bessent wants to do.

Mass deportations during Clinton and Obama are worth looking at for potential market impacts.

The market will maybe be more tempered than headlines.

Construction must continue regardless of headlines, especially in disaster recovery areas.

—-

Laurie Goodman, Urban Institute on Fannie Mae and Freddie Mac potential exit from conservatorship.

You basically have 2 years to let this play out.

There’s no real vision for what a more privatized market would look like.

If we cut back Fannie and Freddie, does this business just go to FHA?

Mortgage rates are higher than normal because there’s no natural buyer.

It’s not clear Trump administration is on board with recap and release.

They may want to raise Fannie and Freddie G-Fees and use them as a piggybank.

Economist Super Session – ICE Experience 2025, part 3

Laurie Goodman, Urban Institute

Rising delinquencies are an issue but we’re still well below historical averages.

Also making COVID homeowner hardship relief being made permanent means that 90 day delinquencies are no longer a good barometer of default.

It means people have more time to recover from hardships.

She estimates new regs improve default probability by 46%.

—-

Mortgage Origination Outlook

6.25% mortgages rates by August based on ICE futures projections.

Mark, Fannie Mae:

We think existing home sales bottom out by 4th quarter.

Newly built home market has 8mo of inventory so they need to move this product.

We have originations moving up 12% 2025 and 17% 2026.

This means little refi booms but still a tough market.

As for home purchases:

Debt to income ratios are up.

Loan to value ratios and credit scores are also up.

This means a smaller market but higher credit quality.

In some Sun Belt areas home prices are down because there are local borrower strains and/or more inventory.

Laurie, Urban Institute:

I don’t see lower rates even if there’s a recession because it’ll likely also come with inflation.

Our research shows almost no relationship between higher rates and homeownership.

Refinance share of market is extremely low.

She said one thing Trump can do is allow streamline refis with CFPB ability to repay rule (already risk on GSE books), it would be a lift and go along with a deregulatory narrative.

Chris, Bank of America:

The insurance cost spike is straining even borrowers with 3.x rates.

Some of the more recent mortgages are seeing this stress from a delinquency standpoint.

As for stagflation, he joked that he’s between a 70/30 and 50/50 probability.

EDITOR NOTE: This proves that even the best analysts at the most sophisticated orgs are still gauging Trump policy volatility.

Ed Pinto, AEI:

You can’t have a housing system without foreclosure.

But the regs (see notes on this above) bail out the hardship folks even when they have a lot of equity in their homes.

This is a form of privatizing gains and socializing losses.

Inventory is growing but still 30% below 2019.

Most metros have tight markets because of low supply, and because of higher debt to income ratios being allowed.

So we think home prices will rise 4.5% to 5% in 2025.

Economist Super Session – ICE Experience 2025, part 4

Andy Walden, ICE reminded everyone the ICE home price figure of 3.4% for 2024 was the lowest since 2011.

Mark Palim, Fannie Mae:

We think home price appreciation moderates in 2025.

Chris, Bank of America:

Home prices slightly below 3.4% for 2025.

Ed Pinto, AEI:

Florida has done a good job in fits and starts with insurance issues.

California restricted increases in premiums and is now under strain.

Houses built to post Hurricane Andrew standards have survived subsequent storms.

There are other similar building standards for fire.

Laurie Goodman, Urban Institute:

The most risky homes then go to public funds for relief.

We require replacement value for insurance as opposed to depreciated value or actual cash value.

This is a fraud risk and raises cost.

Flood insurance should be part of all homeowners insurance. If you’re not in a flood zone you’d not pay a huge premium.

Mark Palim, Fannie Mae:

He agrees that way too many people are under insured for flood.

The market for this isn’t working.

Economist Super Session – ICE Experience 2025, part 5

Mark Palim, Fannie Mae:

Our consumer sentiment survey shows people really get the current market.

They’re not waiting for rates to come down.

But buyers do know it’s a very tough market.

Laurie Goodman, Urban Institute:

Home prices and affordability will slowly realign.

This means people getting more comfortable with spending more on housing.

It also means wage growth is probable.

If Trump removes zoning restrictions, it can pave way for more inventory.

Example: allowing for ADUs to be build and making HOAs unable to oppose.

In California, this led to a ~20% increase in ADUs from 2018 to 2023 (she said the stats for each year but it was too fast for me to catch it).

These are acceptable to both political parties. If you could do this in all 50 states, it could be 5 million new units.

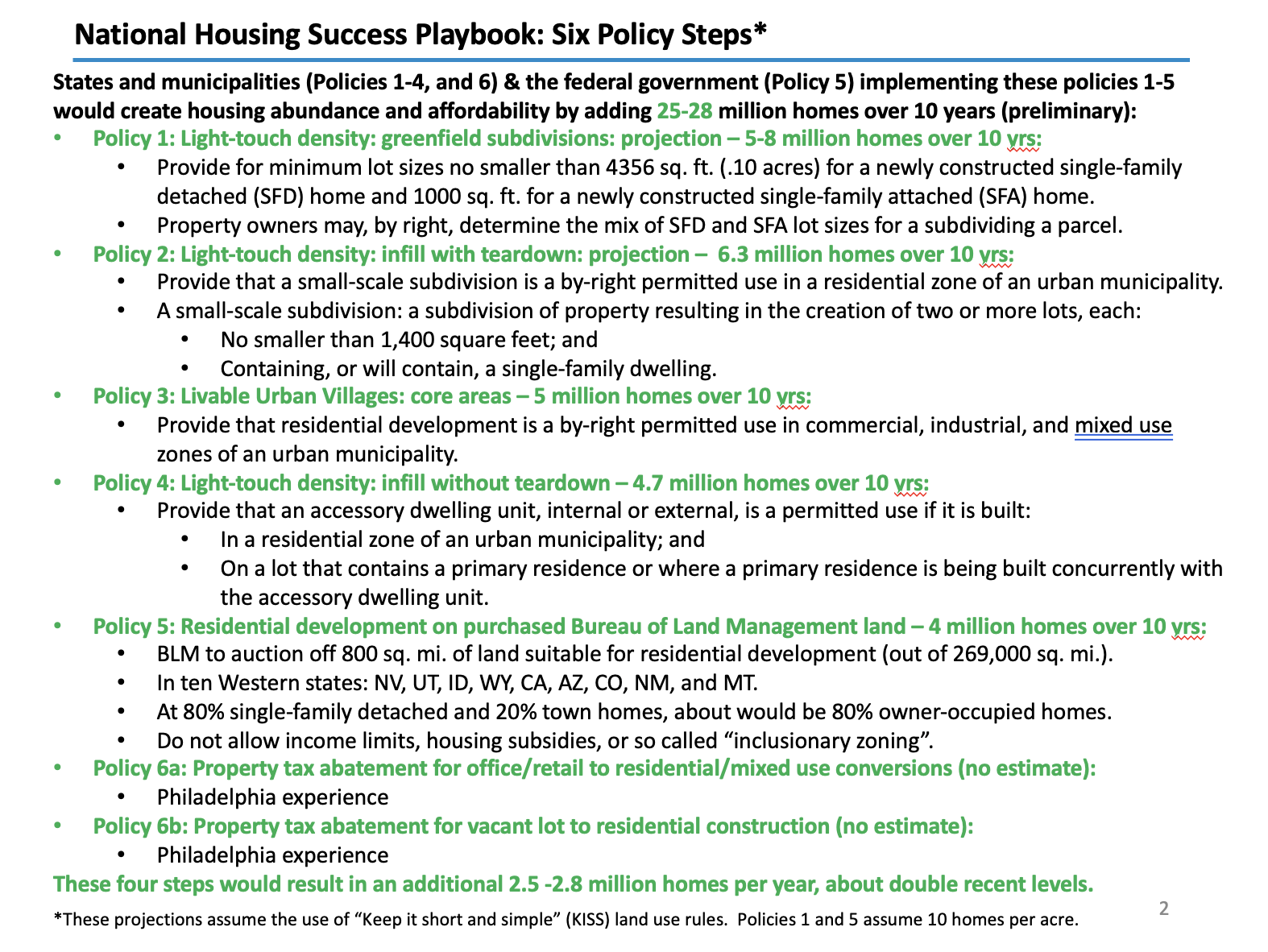

Ed Pinto, AEI

He laid out a 6 point plan for adding more housing inventory. See rundown below, and a quick summary here of how America could add up to 15-17 million new homes in next 10 years.

Good Night From ICE Experience 2025 Party at XS

ICE puts on quite the show, with every detail thought of. More on this tomorrow. For now, here are a few good night shots after day 1.

DJ at beginning of party before this dance floor was absolutely wall to wall.

Outside part of XS was also packed and fully branded.

View of Wynn sign from outside at XS party.

View of party from above, along with The Sphere night shot and Wynn.

Good night ICE Experience 2025.

See you again tomorrow.

Good morning Day 2 ICE Experience 2025

Good morning from day 2 at ICE Experience 2025.

The program starts a bit later today to give everyone some extra rest after the party last night.

Here are some killer shots of The Sphere waking up with Vegas.

Keynote: Marine Veteran Jake Wood on VUCA, part 1

Jake Wood of Team Rubicon is a Marine veteran and is doing a keynote on a military concept called VUCA, which stands for:

Volatility

Uncertainty

Complexity

Ambiguity

He was a college football player at University of Wisconsin.

Then did a tour in Afghanistan.

Then after volunteering for earthquake relief in Haiti, founded Team Rubicon to formalize deploying teams to people and places of need.

From there he observed that corporate philanthropy is broken and founded Groundswell as a software startup to a corporate philanthropy platform that turns donor-advised funds (DAFs) into an employee benefit.

Keynote: Marine Veteran Jake Wood on VUCA, part 2

VUCA rundown…

Volatility is change you can’t control.

Uncertainty are the factors you don’t know.

Example: Hard 16 vs. dealer face card so you assume they have 20. Only 2 cards, a 4 or 5, can help, and everything else hurts. You should hit because it’s slightly better than not hitting. Fear causes you to hesitate when you should press forward.

Complexity is when you have too many factors to evaluate fast enough.

Example: Chess has 288 billion possible moves. It paralyzes you as does a situation with a lot of factors. But you have to lean in.

Ambiguity is a situation that has no precedent.

The danger here is there’s no playbook for what to do.

Based on these VUCA parameters, the military developed a methodology for navigating VUCA.

Keynote: Marine Veteran Jake Wood on VUCA, part 3

There are 4 parts to deal with VUCA.

1. Vision

You need a clear, definitive statement people can relate to and wants to get behind.

2. Understanding.

This is shared consciousness. Orgs must abolish “information as currency” culture. This is the what’s in it for me culture.

Below is the formula for creating understanding.

3. Culture.

Culture is what guides good decisions in moments of chaos.

The vision leads to good people who are on board, and then you need strong values.

This isn’t best done in conference rooms. It’s part of it, but the real part is building processes, practices that support values.

Here’s a formula for getting good actions and outcomes from your values.

4. Alignment.

Alignment is driven by storytelling.

Your org is a story, and you need to master telling that story and all its chapters.

If you treat your people like unnamed characters it won’t work.

They must be the heroes of these stories.

This costs nothing. And it’ll fundamentally improved the quality of life for your team.

And when their quality of life and fulfillment is improved, it fundamentally changes your company.

===

Good session.

Jake’s social handle is @JakeWoodTR

Tennis Legends Andre Agassi & Steffi Graf, part 1

This panel is 2 of the biggest tennis legends ever, and a married couple.

Andre Agassi started by saying he hated tennis.

It was tough on his family and his psyche.

But he took it out on the game of tennis itself.

Steffi Graff said her story is the same.

Intense dad, supportive mom.

Start young, like 4-5 years old. It’s not about the kid’s passion at that age.

It’s about the parent recognizing the talent.

She became a pro at 13 years old.

She said it was hard to deal with at that age.

One of her key memories was beating Chris Evert at 15.

Agassi talked again about getting over his own demons was the bigger distraction than the opponents.

He said as he became favored in most matches, he was more about risk management than aggression.

He said his dad said winning at tennis was the fastest path to the American Dream for him.

He said when he wanted to quit at 27, it’s when he started finding his reason.

Even when he was winning he didn’t feel fulfilled.

But getting into philanthropy helped.

Tennis Legends Andre Agassi & Steffi Graf, part 2

Agassi said his choice for focusing on education in philanthropy was because he didn’t focus a lot on education — he was only focused on tennis.

But he realized that unlike him with tennis being the path to the American Dream, education is that path for most people.

He took out a $40 million mortgage to open a charter school.

The biggest issue isn’t the programming — you can get funding for that.

It’s the space. The school facility itself.

So you get those set up. Then you enable those charter schools to refinance and take over the buildings.

Since 2011, they’ve helped raise $1.3b to build 130 schools.

Graf then covered her philanthropic focus.

She focuses on war torn areas like Uganda and Cape Town, and provide therapy for children.

Germany is one of the biggest refugee areas in Europe.

They also provide therapy for those refugees coming into Germany.

This is about giving hope for the future, and acclimating to a new environment when they’ve been displaced.

Tennis Legends Andre Agassi & Steffi Graf, part 3

Fun fact:

Graf and Agassi have both picked up pickleball.

Graf said it’s easier to pick up pickleball than tennis.

She also said it’s really fun socially, especially when it’s 2 on 2.

She said tennis is definitely more of an individual sport and pickleball is great for social.

Agassi said tennis is the Everest of racket sports.

But pickleball is fun, physically challenging, and it’s fun to see a growing sport.

Pickleball has urgency on the frontside because it’s closer proximity.

He said pickleball is more mentally challenging because it’s totally focused all the time and more intense.

He also said it’s really good socially, and has led to making new friends.

They’re trying to help grow the sport.

===

Most notable part of the session was Graf getting emotional talking about her philanthropic endeavors. It was very palpable.

Agassi closed the session with a great reminder to everyone:

It’s easy to dream while you’re asleep. But we need to dream while we’re awake.

AI and its projection into the lending industry, part 1

Neil:

AI isn’t software. It’s a high energy intern. It’ll do what you need done but you need to train it. There are 3 main components to AI:

1. It’s got machine learning.

2. It has ability to understand natural language.

3. It has ability to interact with you.

Anand:

Reasoning and learning buzzwords have been around for ages.

But generative AI makes this real.

It learns from data.

Rick:

AI is the Rick Hill employment act. LOL. Everyone wants to talk about it.

MISMO is trying to define AI in terms of mortgage.

Anand:

Data processing is a key use case.

ICE is processing 5 million pages a month.

We have Bloomberg like products where we can let customers search docs and find narratives for market analysis.

This includes news and sentiment analysis.

Here’s a good slide on:

Generative AI Trends & Top 16 Use Cases Revolutionizing Real Estate

AI and its projection into the lending industry, part 2

Next segment: AI use cases.

Neil said first wave is automation.

Another use case is providing realtime coaching to loan officers WHILE they’re doing a borrower consultation.

Michael made a great point about this:

AI, ironically, is trying to make us more human.

Rick delineated between decisioning AI like automated underwriting and generative AI.

We’ve been using decisioning AI for underwriting for decades.

But new generative AI like ICE All Regs makes loan production teams more productive by searching for the right guidelines for each borrower.

For now, lenders are a little hesitant on using AI directly with consumer.

Michael said the AI you’re using today is the worst it’ll ever be.

This means it’s time to use it for consumers and get it right.

Anand noted again that market analysis is a key use case.

Example: they look at news headlines to see if they correlate to stock tickers.

In mortgage servicing software, they’re using AI to determine what borrowers might do — refi, experience a hardship — by analyzing all call center info in realtime.

AI and its projection into the lending industry, part 3

Next segment: Where should lenders start with AI?

Neil said there’s no straight out of the box AI because you have to train it.

EDITOR NOTE: This is a great point. It’s a big shift going from a software buying mindset to AI. Software is built to do something set and specific. But AI must learn. It takes time for ROI. Where software and AI are similar is how you mist configure software for your purposes. Likewise you have to train AI for your purposes.

Neil notes that one key advantage of AI as you’re training it is that you can ask the AI how to beat use it for your purposes. You can tell AI the problem you’re trying to solve and it can help you figure it out.

KEY: On this note, Anand said you give your teams a playground for this type of problem solving.

At ICE, they build all the computing power and provide the models and APIs to teams. They also establish the ground rules (e.g., what do you do if AI can’t answer your questions). Then they deploy these resources to teams, and each team has subject matter experts who help lead new AI projects.

Rick talked about responsible AI guardrails.

He made it simple: we have bodies of laws we must follow. AI doesn’t mean you don’t have to follow those. So AI use compliance is therefore very similar.

CRITICAL: This same logic applies to lawmakers. AI doesn’t necessarily mean new regs are required. AI is just another tool that’s subject to all existing laws.

Thanks to MBA for helping lawmakers to understand this.

AI and its projection into the lending industry, part 4

On a progressive regulatory note, some proposed regs suggest using responsible AI to solve for things like fraud — which is proliferating because of irresponsible AI.

===

Forward looking AI vision…

As self-driving cars proliferate, will the value of homes with garages go down?

EDITOR NOTE: This sounds crazy today. But it is feasible, especially when I see increasingly more self-driving cars in my hometown of San Francisco.

Anand said when he first got self-driving Tesla, it was so bad it was to the point of true danger.

Three years later, he got a software update and he was blown away that it could drive as well as a human.

It can see when someone is parallel parking, stops, and eventually goes around when it’s safe.

As for our industry, AI will eliminate a lot of data dashboards.

Why? Because you can ask AI whatever you need to know and it’ll get it for you.

Rick noted language translation is a key use case that’ll bring families closer together. And also enable much more opportunities for lenders to better serve borrowers in their native languages.

Navigating New World of Real Estate Agent Partnerships, part 1

Dale Vermillion, Mortgage Champions founder is a legendary coach in the industry and he’s going to run down purchase market opportunities.

Starting segment is on mindset.

Markets do not dictate success.

Our beliefs and behaviors do.

And as managers, the only thing we can do is influence beliefs and behaviors of our teams.

So if you feel the market is negative because of inventory, rates, etc., you don’t even have to get all the way to positive. But you do need to get to neutral.

Because negativity is toxic.

He gave the example of Bill Buckner a Red Sox baseball player with 11 Golden Gloves. But his legacy is missing a ground ball to lose the World Series to the Mets.

Navigating New World of Real Estate Agent Partnerships, part 2

Here are the demographics creating housing demand for the next couple decades.

Housing demand is historic.

Home sales are on the rise.

We’re at 800,000 units in inventory.

That’s a growing inventory environment.

This is the opposite of headlines.

We do need 1.2m to 1.3m units to be normal inventory.

BUT… there are 70% fewer loan officers than normal inventory markets.

So there are bigger opportunities for the loan officers who are left.

Also, listings are increasing and list prices are dropping.

Consumer confidence volatile but people will respond well to good advice on housing.

The key is eliminating consumer fears.

Navigating New World of Real Estate Agent Partnerships, part 3

Today’s Homebuyer Needs

They’re more informed.

But they’re also confused. They need advice with both high tech and high touch.

They’re under incredible competitive pressure. They’re getting deluged by rate offers and caught in buyer bidding wars.

They still see mortgage as really complex, and the best way to simplify is focus on payment.

They define affordability by the payment, not the home price. But it’s up to loan officers to help borrowers not get intimidated by home prices by educating them on payment.

To serve these folks, you need to get your process to 12-17 days.

83% of customer loyalty is driven by process. See image below.

Navigating New World of Real Estate Agent Partnerships, part 4

Today’s Real Estate Partner Needs

Here’s what they need.

The third to last bullet on the needs slide above is that you have to give to get.

You have to give them referrals.

Dale also said that the top loan officers have one thing in common:

They do lunch and learn sessions for borrowers with realtor partners.

The last bullet on slide above is showing realtors you know how they get paid — and how to get them paid.

Affordability Strategy

The punchline here is that it’s better to pay down debt to qualify.

Addressing The Housing Inventory Problem

Loan officers need to diversify and expand their network.

Dale said most loan officers say they work with 4 to 12 realtors.

But most of those realtors are not productive.

The top producing loan officers doing $50m to $100m in production per year, they are wrong with 50 to 100 realtors.

TAKEAWAY: Their network is creating more inventory.

KEY SOCIAL MEDIA ADVICE:

Loan officers should only spend 20 minutes a day on social media.

You’re not going to be an influencer.

Get out and find realtors.

Navigating New World of Real Estate Agent Partnerships, part 5

The EXPERT Approach To Build Realtor Network

Evaluate:

Figure out who to want to go after.

Expand:

Pick the 20 best realtors from your list, like all their social posts, reshare, and do this for 10 days. This will get their attention and you can offer to send them business.

Educate:

Realtors need education just as much as consumers. Teach them how to qualify borrowers.

EDITOR NOTE: Dale went fast on this one, so here’s the image with all of the EXPERT acronym definitions.

===

REASONS TO BUY NOW…

Stability and predictability of homeownership.

Benefits of buying vs. renting

Less buyer competition in today’s market

Rare bidding wars

Seller concessions common today

Fewer contingency waivers

Massive tax benefits

Buy today at today’s less competitive market, and refi when rates go down.

—-

All of this adds up to an amazing market.

People will buy no matter what rates are.

They just need to know how to afford it.

—-

Dale is killer. Such a dynamic presenter. 💪🏻

ICE’s Role In Powering $2 Trillion/Year Originations & $14 Trillion Servicing Sectors

ICE Experience 2025 is one of the larger shows in the mortgage industry.

And ICE’s flagship conference overall across all 3 of its Exchanges, Fixed Income, and Mortgage Technology business units.

Total attendees are above 3000, comprised of about:

– 80% banks, lenders, and mortgage servicers

– 20% fintech companies who also power the mortgage ecosystems

Common chatter in the industry is that ICE is a competitor to all the other fintech companies.

That’s not accurate when it comes to ICE or any other technology ecosystem company.

As noted above, ICE has invested $23 billion in mortgage technology that covers the the entire mortgage lifecycle.

This includes key systems of record in the $2 trillion per year mortgage originations sector and the $14 trillion-of-mortgage-loans-outstanding servicing sector.

As such, almost every other fintech in some way integrates into the ICE ecosystem.

So I think it’s naive to say ICE is a pure competitor to the rest of the fintech community.

All fintechs must work together for the success of lenders.

One key example I noticed at ICE Experience is in the product and pricing engine (PPE) and secondary market technology category.

As noted above, ICE divested PPE/Secondary leader OptimalBlue when closing their Black Knight acquisition.

Since then, ICE has made extremely fast progress on their own PPE/Secondary software that they first launched in May 2024.

When the ICE PPE launched, ICE president Ben Jackson said this:

In this context, you can see why some of the chatter focuses on competition.

But here’s the punchline:

On the exhibit floor at ICE Experience 2025, OptimalBlue had the biggest booth by far. And they were a platinum sponsor of the show.

This is a strong proof point that there’s enough room in our huge industry for everyone — and that all the fintechs are ultimately working together.

That’s exactly what was on display in the ICE Experience 2025 show floor.

Here’s a list of exhibitors and sponsors at the show.

It was great to see you all out there hustling and collaborating 💪🏻.

The show floor energy was palpable.

Special Thanks To ICE SVP Jonas Moe & Team

To Brad Kuhn, Meggan Midbo, Eric Kujala, Chris McEntee, and the entire ICE team, I want to say thanks for letting The Basis Point come live blog ICE Experience 2025.

And a special shout to my old friend Jonas Moe, who helms this absolutely giant show. Down to the last detail, Jonas and team truly get what it means to create an experience.

Bravo Jonas. Great to see you…

Leaving Wide-Eyed From ICE Experience 2025

I’m not alone leave wide-eyed from ICE Experience 2025.

And it’s not just from staring at The Sphere from my room.

It’s a big energy jolt to see how committed the mortgage industry is to the American Dream of homeownership even after these past couple challenging years.

Relief is coming, as America’s top housing analysts predicted.

Let’s all stay strong so we can keep the consumers we serve strong.

Hope you’ve enjoyed The Basis Point Live Blog.

Please reach out with any questions or comments.