In a First Republic sale scenario, I hope this valuable bank brand would stay

First Republic stock rebounded today, helping calm weeks of bank-failure market panic, but the story isn’t over. A First Republic sale is still among options the bank is exploring.

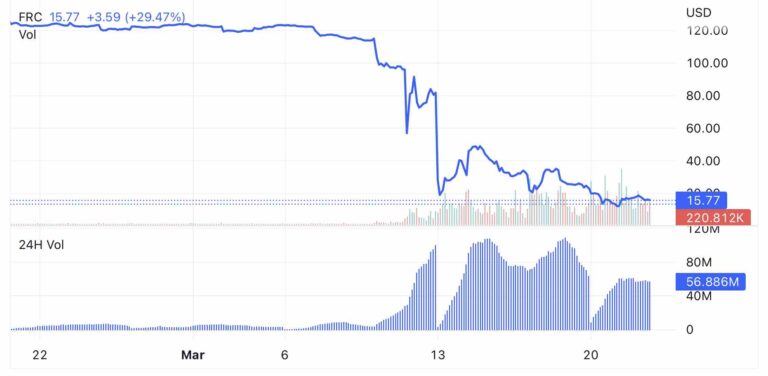

At today’s closing price of $15.77, First Republic stock is still down 86% since March 8, which was 2 days before Silicon Valley Bank (SVB) was seized by the FDIC on March 10.

And WSJ reports First Republic customers have withdrawn $70 billion since March 10. This is 40% of the $176 billion in deposits First Republic reported at year-end 2022.

First Republic is the envy of the banking community because its customers love it, and its typically got a steady and profitable business.

I discussed some First Republic key strengths when this first began.

I also noted how First Republic has sold before.

They sold to Merrill Lynch for $1.8 billion in a deal that closed September 2007 as the last financial crisis was heating up.

Then Merrill Lynch was sold to Bank of America for $50 billion in September 2008.

In October 2009, First Republic management bought itself out from Bank of America for about $1 billion.

That private deal closed July 2010, and First Republic’s second IPO was December 2010 at $280.5 million, with shares opening at $27.25.

Fast forward to today.

The stock closed at $15.77, and WSJ reports the following:

[First Republic] tapped Lazard Ltd. to help with a review of strategic options that could include a sale, a capital infusion or asset trimming. It also hired consulting firm McKinsey & Co. to help map out a postcrisis structure for the bank.

Lazard and McKinsey have been brought in alongside JPMorgan Chase, which had already been hired by First Republic to advise on moves the bank could make to regain its footing after the failure of two other lenders caused its depositors to flee.

Even in a First Republic sale scenario, I hope a buyer would retain the First Republic brand and operations separately.

So far, this looks more like a crisis-induced liquidity issue than mismanagement.

It’s a beloved brand in a sector that’s not typically loved.

This is rare and special.

And it’s part of the reason First Republic is so important in this bank crisis.

First Republic is representative of how important local and regional banking is to people.

I was also glad to see Treasury Secretary Janet Yellen acknowledge that explicitly today.

___

Reference:

– First Republic Taps Lazard & McKinsey To Review Strategic Options (WSJ-paywall)

– First Republic has sold before. Here’s the history.

– 4 key First Republic strengths despite this crisis

– Yellen quote on the importance of local and regional banks