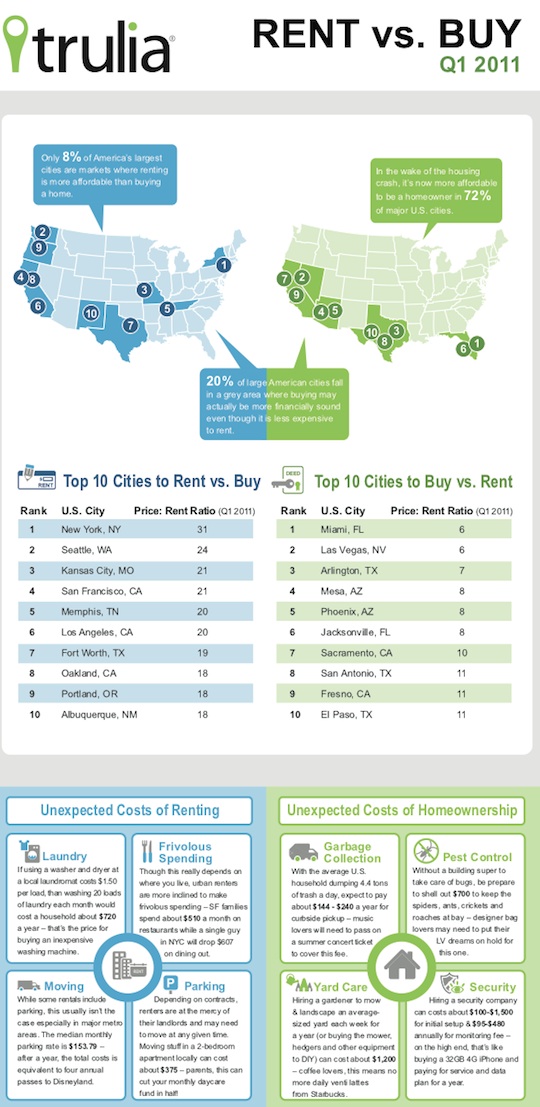

INFOGRAPHIC: Most Cities Cheaper To Buy Than Rent. Taxpayer Profit From Bank Bailouts?

Buying Cheaper Than Renting In 72% Of U.S. Cities

Recently Trulia compared the median list price with the median rent on two-bedroom apartments, condominiums, townhouses, lofts and co-ops listed on its website, and compared that to ownership costs including mortgage payments, property taxes and insurance. It determined that buying is cheaper than renting in 72% of the largest U.S. cities, led by Miami and Las Vegas. People have to live somewhere, right? And if your credit is shot… Trulia’s CEO stated, “Following the principles of supply and demand, renting has become relatively more expensive than buying in most markets.” RealtyTrac has reported that 2.87 million homes received notices of default, auction or repossession in 2010, while apartment vacancies are at a 2-year low. It is no surprise that the top 10 cities where buying is cheaper are all in Florida, Nevada, Texas, Arizona and California, as, except for Texas, those states were among the five with the highest foreclosure rates in 2010. Here’s a good interactive Rent vs. Buy analysis, and below is an infographic on the topic.

Taxpayer Profiting From Bank Bailouts?

Fifth Third Bancorp fully repaid its $3.4 billion in TARP funding yesterday, bringing total bank repayments to $243 billion, very close to the total disbursement figure of $245 billion. Remember TARP is the Troubled Asset Relief Program where Treasury just gave money to banks while the world was toppling in fall 2008. Treasury officials now estimate bank programs within TARP will eventually deliver a profit of $20 billion. Throw that onto the profit and spreads it’s made on buying $1.25 trillion of MBS’s, and now you’re talking real money.