Is a housing crash inevitable to beat inflation? Here’s the Fed’s answer.

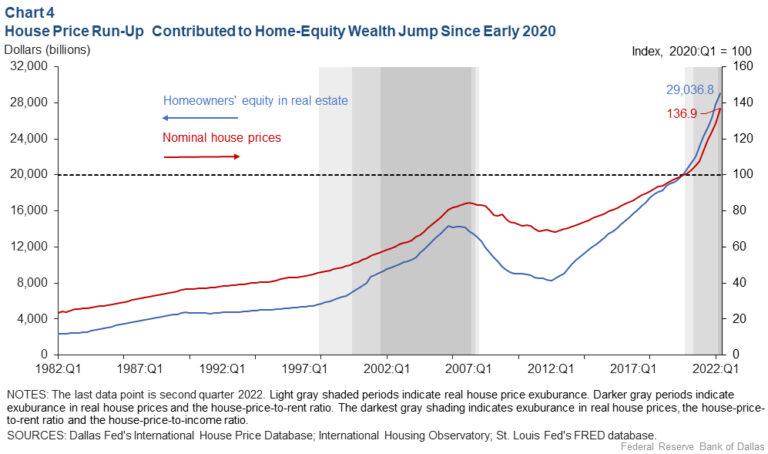

Home prices spiked 60.8% from 1Q13 to 2Q22, even when adjusting for inflation, and 40% of this appreciation happened during the 1Q20 to 2Q22 pandemic period. So naturally, countless headlines call for a housing crash.

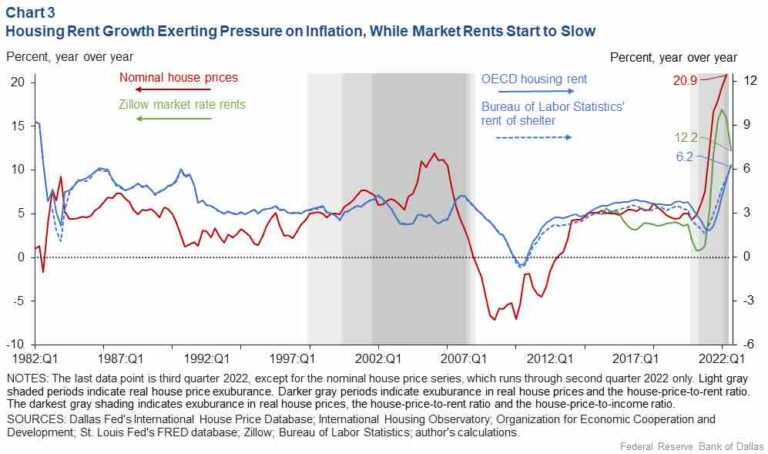

Now the Fed has slowed housing drastically with rate hikes that added almost 4% to mortgage rates during 2022.

Is a home price crash coming?

Dallas Fed economist Enrique Martínez-García doesn’t think so, but lays out the intricate work that’s required to give some price relief to buyers without causing owners to lose their equity or go underwater.

Here’s the link. Please let me know your thoughts — and your definition of a housing crash.

___

Reference:

– Skimming U.S. Housing Froth a Delicate, Daunting Task