Live Blog From Top U.S. Mortgage Conference – MBA Annual 2021

The mortgage industry’s top conference is this week in San Diego, and I’ll be live blogging it for The Basis Point’s readers. The Mortgage Bankers Association’s MBA Annual 2021 brings together 3000+ top banking, lending, trading, fintech, and regulatory players. This year is especially exciting as pandemic risks ease and we can all meet to improve the business of serving America’s housing consumers. And it’s very big business.

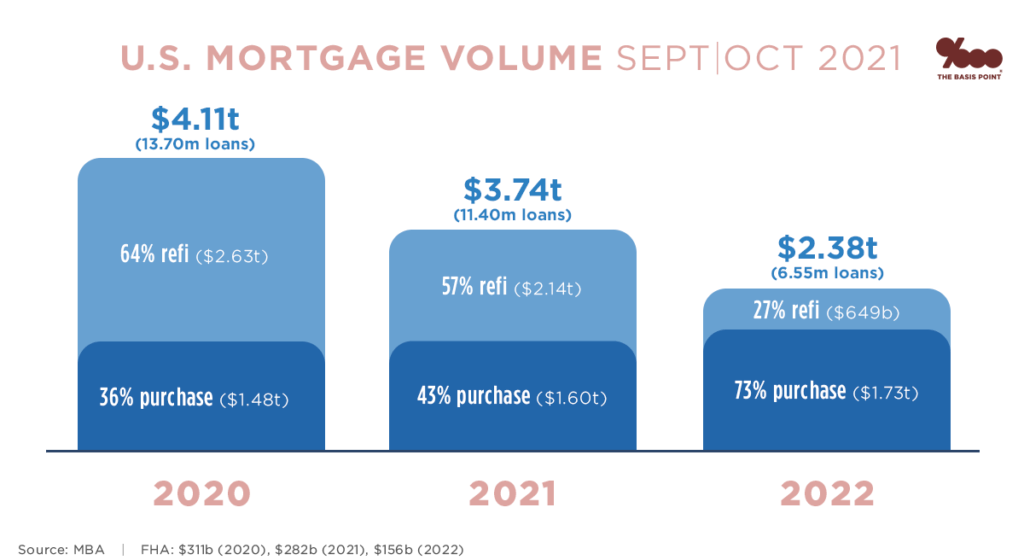

Below is the size of the U.S. mortgage market by volume right now.

You can see banks and lenders funded $4.11 trillion in new mortgages last year.

They’ll fund $3.74 trillion in new mortgages this year, and $2.38 trillion next year.

Next year is a more normal volume year for the mortgage industry, and this will be a hot topic at MBA Annual 2021.

Notice how refinance mortgages drop sharply from $2.14 trillion this year to $649 billion next year.

This transition to a purchase market will be another hot topic for MBA Annual 2021.

Total new and existing home sales will go from an estimated 6.88 million this year to 7.48 million next year.

But the MBA estimates only 4.83 million of those home sales will be financed this year. And 4.74 million home sales will be financed next year.

Still, “only” $649 billion in refinances and “only” 4.74 million home purchase loans for $1.73 trillion in purchase volume is very big indeed.

And this is just the annual activity!

===

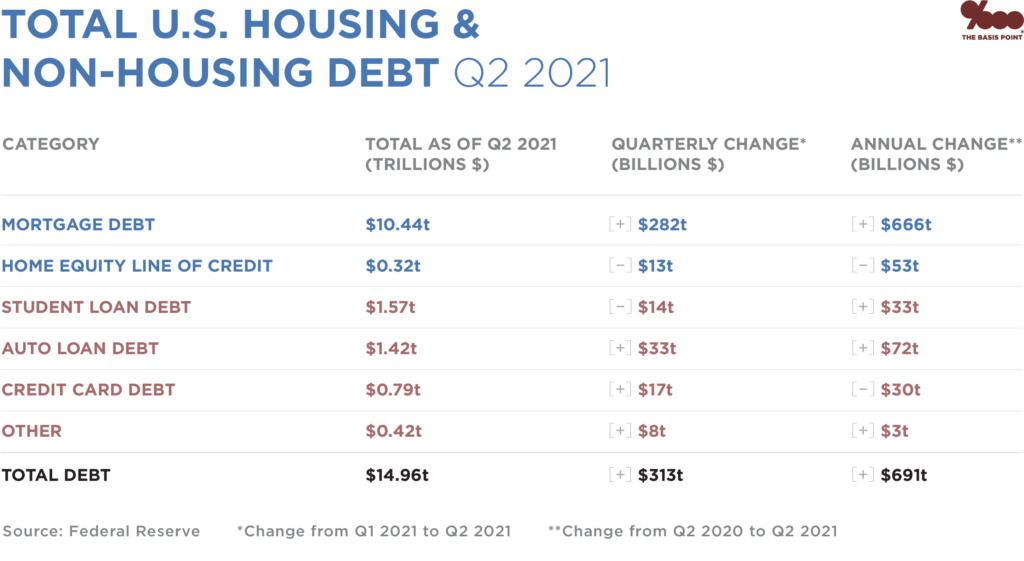

In the bigger picture, there are almost $12 trillion in total mortgage balances outstanding right now.

Servicing, retaining, caring for, and meeting other lending and banking needs of these long-term borrowers may end up as the hottest MBA Annual 2021 topic.

Below is New York Fed data showing $10.44 trillion in mortgage balances outstanding right now.

The MBA’s outstanding balance estimate is $11.5 trillion this year and $12.2 trillion next year.

And Inside Mortgage Finance estimates $12 trillion outstanding now.

You get the point: it’s absolutely giant.

AND MOST IMPORTANT: long-term financial plans of consumers are at the center of it.

That’s why I like to show this table because it shows the other outstanding debt people have right now.

===

One of the key market trends right now is that American homeowners have $9.15 trillion in tappable home equity, per mortgage data and software giant Black Knight.

Tappable equity is home equity that can be taken out and still leave 20% equity in the homes.

This is a key definition because it leaves room to breathe if home prices dropped.

Which is likely at some point after this long tear home prices have been on.

I also like connecting this tappable equity data point to the non-housing debt in the table above.

Why? Because housing debt is far cheaper than non-housing debt.

That’s better for consumers who are fortunate enough to own homes.

These stats set up a trend I see for next year of responsible cash out.

This is the tone of American housing at the moment.

And I will do my best to quickly document it over the next few days.

I’ll be running to lots of meetings, and hosting demo showcases of the hottest fintech firms out there.

But I’ll keep updating here too.

And yes: I did take this picture 🙂

Chime in below or hit me at @thebasispoint on twitter — or on LinkedIn — if you want to see anything here.

Everyone Is Competing With Everyone On Everything at MBA Annual 2021

I’m sharing this slide from the deck I’m using to kick off the MBA Annual 2021 tech demo showcase I’m hosting for the next 2 days.

The good AND bad news of the fintech era is that everyone is indeed competing with everyone on everything.

Lenders have always competed with each other. But it remains collaborative for two reasons:

(1) groups like the MBA bring us all together.

(2) The giant market stats shared above — $2-3 trillion in new originations per year and $12 trillion in loans to be serviced — means there’s plenty of business to go around.

But it’s getting harder for lenders to make tech decisions as the fintech firms that serve them grow and mature.

If a tech company wants to be worth more than $2 to 4 billion, they need to cover multiple areas of the lender origination and servicing spectrum.

There are ecosystem companies in the space that do that, like ICE Mortgage Technology and Black Knight, and each are worth more like $10-12 billion.

But there are new companies that are covering their originations and servicing core areas.

And there are tons of companies that specialize in different parts of originations, servicing, underwriting, marketing, valuation, compliance. The list goes on.

I believe the market is also big enough for a great many players.

And I also hope that all fintech companies serving the space continue to build in modern, open ways that enables lenders to build their own tech stack however they want.

I’ll come back and highlight which companies are in the demo packs.

But for now, I have to head over there and rehearse with all the demo participants.

More later…

Technical Difficulties Will Never Stop Mortgage Fintech

We had a packed house for the Fintech Showcase I hosted, and the tech went out during this session with Mark Stier of Sagent.

And it stayed out for subsequent sessions. But that didn’t — and will never — stop me or the MBA or our housing fintech community from crushing it.

I just moved into freestyle mode. Because with a crowd like this (which by the way was overflowing behind this into the main show floor), they came to learn and we came strong. More coming on companies highlighted.

What’s up with these Test posts, LOL?!

Here’s a second test post. While this conference is happening, The Basis Point team is also building some new tech. And this is a test from the iOS version of our Live Blog app. Stay tuned for more regularly scheduled MBA Annual 2021 posts shortly.

What Amazon Can Teach Mortgage Industry About Managing Products & Teams

Felipe Million runs the Amazon Web Services product and he gave a keynote at MBA Annual 2021 on Amazon’s culture of innovation. Below are key notes from the session.

AWS is $59b, 13% of rev and 50% of profit of Amazon as a whole

Amazon mission: to be earth’s most customer centric company

We focus on the consumer

Some orgs are product focus, some are competitive focused, some are business model focused.

But we are customer oriented.

Customers are always beautifully, wonderfully disappointed

1.Culture

Look up Amazon leadership principles

-Bias for action: speed matters, we value calculated risk taking

-mental model for decision making: is it a one way door or a 1-way door?

-a one-way door decision was Whole Foods. This is something you have to be sure about.

-a 2 way door decision is Amazon recommendation decision

-you should make 2 way door decisions with 70% of info or else you’re moving too slow

-Insist on high standards

-Invent and simplify: leaders expect and require innovation from their teams.

CRITICAL: We accept that we may be misunderstood for a long time.

-be stubborn on the vision but flexible on the details

-AWS was misunderstood for a long time

===

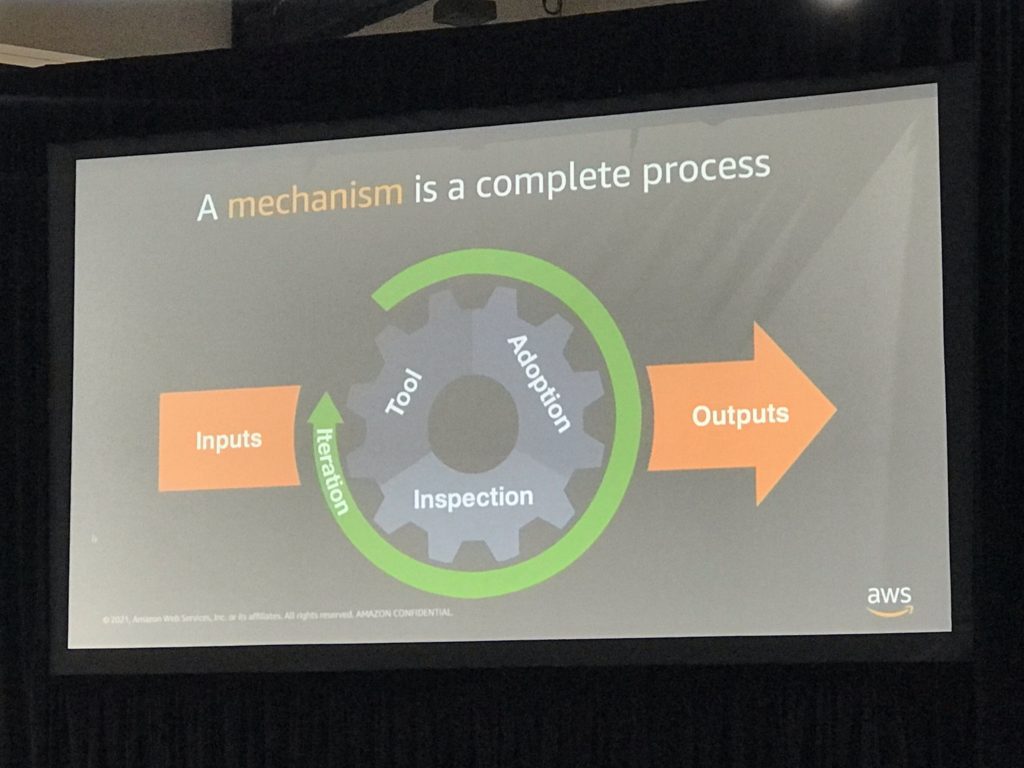

2.Mechanisms: encoded behaviors that facilitate innovative thinking

Good intentions don’t work but mechanisms do

We implemented the Toyota manufacturing line stoppage by anyone within products – we let Amazon employees pull something from the site

Working Backwards Process: write a press release about a product launch before a line of code is written. This ensures you’re speaking to customers.

You have to be very specific about client needs

Who’s the customer, what’s their need, what’s their experience

Amazon uses no slides for any internal meetings.

We write documents and print out documents that everyone reads first 15-20 min

There are 3 pieces of working backwards

-Press Release

-FAQ with internal and external questions

-Visuals

The fidelity of your visual should match the maturity of your idea – eg, a demo vs a sketch

===

3.Architecture

Technical structure and tools to support rapid growth and change

A shift to micro services

Business logic and data via APIs – leverage other parts of Amazon infrastructure to build new stuff

===

4.Organization

Small empowered teams that run with what they create

You need two-pizza teams

You should be able to feed your team with 2 pizza

The sweet spot is 5-8 person teams

Failure and invention are inseparable teams.

Fire Phone was $170m failure. Bezos said: if you thought that was big wait till you see what else we might fail at?

BUT… the people who failed at Fire Phone did Alexa

===

Felipe runs AWS housing business serving big banks and GSEs with computing infrastructure

===

IDEA I’m putting in here for The Basis Point team: we should write an Amazon press release using their approach described above to write our own release about our upcoming media products.

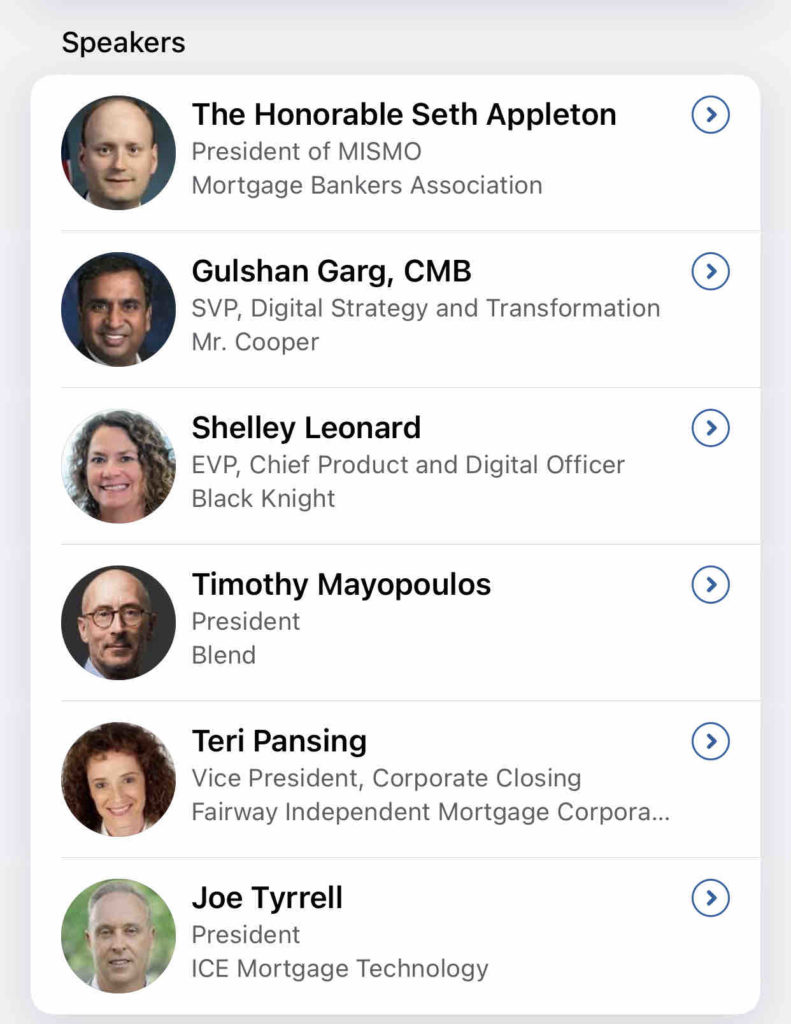

Mortgage Fintech Giants Panel: Blend, ICE Mortgage Technology, Black Knight

Three of the biggest — and publicly traded — mortgage fintech firms led this panel.

Blend is the market leader in software that powers consumer and loan officer experience, went public this year, and is worth about $3.5 billion.

ICE Mortgage Technology is the market leader in loan origination software. Plus they make consumer and loan experience software. They’re worth about $11 billion, and part of the ICE umbrella, which also owns NYSE.

Black Knight is the market leader in loan servicing software, and they also make loan origination software. They’re worth about $12 billion.

Here are notes on this panel.

===

Mortgage Fintech Giants Panel

This panel featured heads of three of the most powerful software firms in the mortgage industry and also Teri Pansing from mortgage giant Fairway Independent.

(Add up the market share)

TIM / BLEND: Pandemic accelerated tech so fast and I believe we can sustain this pace as an industry going forward.

TIM: we have 2 customers: lenders and consumers. We changed our pricing to pay as you go. This shows we’re giving lenders choice.

We also sped up digital and hybrid closings.

We helped lenders focus on loss mitigation even though we’re not in servicing. But our banks needed it and we got hardship apps down to 1:57!

This gave a lot of relief to people. We also responded to needs for PPP loans from customers. One customer processed 10k PPP apps in 1 hour.

We’re only in the 2nd inning of Fintech innovation.

Digital is the future but it’s all about meeting all customer needs including human contact.

SHELLY: moving form digital to in person is critical

Part of move to digital is making it easy to understand. Use non-mortgage words. Provide in context education about keywords like “escrow analysis” and how it impacts their payment.

SHELLY: it’s not just about the loan, it’s about the home.

TERI: Expectations about the loan experience is what Fairway expects to deliver to their customers and what they expect from their Fintech partners.

JOE: the whole digital experience is about convenience. The challenge is that mortgage isn’t something they do everyday.

On adoption, it’s about making sure the tech is super powering them.

Adoption isn’t a Revolution, it’s an evolution.

TERI: you need to understand the why and sell the why to everyone in every department.

TIM: we let perfect be the enemy of the good, and if we’re on an evolutionary path we have to keep pushing.

JOE: we’re up to 7% from 4% in 1 quarter on eNote registrations. Now at 55k e-notes per month. We’re on track to do 650k e-notes this year.

All firms have to get together on this. We have 2k lenders on our POS. But then we have partners like blend who can drive this.

All quantitative and qualitative data (conversations s lenders) show a move toward this

Adoption is more in refi because everyone has to be on board with this.

TIM: nobody will solve these big issues by themselves. And we’re all pushing to open up the architecture.

Shelly did nod despite the One stance for BK.

SHELLY: we need to take all digital concepts through servicing

How can we be more predictive about customers in servicing. Making sure it’s not just a customer contact when borrower is in trouble.

JOE: industry has been focused on the first 20 minutes of a lifetime process.

This is key and lifetime process is my words. He said “of a 45 day process”

How do we get 45 day process to 4.

This is still very originations focused.

TIM: how do we drive down cost? Title and insurance and loan and realtor fees. It’s a lot. The consumer pays for it.

We need convenience. But we also need to drive costs down.

Lots of lenders aren’t seeing ROI yet and it’s not just about adopting tech – we have to get LOs to make more money. Then it’s really moving the needle.

When I took over at Fannie in crisis era we didn’t know what was in millions of loans. The transparency digital brings is a game changer.

TIM: GSEs are a great force for tech innovation and should be given more leeway. MBA needs to push policymakers to help GSEs drive this.

Rundown of MBA Annual 2021 Fintech Demo Showcase – Hosted by The Basis Point’s Julian Hebron

The Basis Point and MBA have been partnering on fintech showcases for a few years, and it was nice to get back into the physical world this year.

These tech demos are lifeblood for the fintech firms showing lenders their latest products. So we do a hosted format where I preview and intro each company, they demo for 8 minutes, and I make real-time commentary on-stage.

This is good for the fintechs and the audience.

Below is a rundown of this year’s demo participants, and some notes of my own.

===

MONDAY PACK

-ICE Encompass Salesforce Connector (Marketing)

-Blend LO Toolkit (POS)

-Sagent (Servicing)

-LoanBeam (Underwriting)

-Total Expert (Marketing)

-Ocrolus (POS-Infrastructure)

TUESDAY PACK 1

-Azimuth GRC (RegTech)

-ClearCapital (Valuation/Underwriting)

TUESDAY PACK 2

-Tavant FinDecision (LOS/POS)

-HouseCanary (Marketing)

-BlackKnight SureFire (Marketing)

-SimpleNexus NexusPay (POS)

===

MBA Annual 2021 Demo Notes

MONDAY PACK

-ICE MORTGAGE TECHNOLOGY

-Presenters:

-Chris Backe – Partner Solutions Director

-Alex Popoff – Solutions Engineer

-Salesforce Connector

-Encompass for Salesforce Connector

-This is about a bridge between CRM and LOS

-Chris will do the intro about The Why

-Everyone has Salesforce, everyone has Encompass

-This connects them seamlessly

-JULIAN QUESTIONS ASKED

-What are the early cases lenders are most focused on?

-Where does the POS fit into this?

-Where does Velocify/Pulse come into this?

BLEND

-Presenters:

-Alyssa Mike, Product Manager, Verifications Team

-Sandy Chansamone, software engineer

-Their demo is LO Toolkit

-This shows borrower experience of Blend first

-Demo use case was getting home purchase borrowers pre-approved

-Then it cuts over to how the LO moves the file forward after borrower applies

-The loan officer can finish the file, do rates/pricing, fees

-LO can also see LTV and DTI which are critical for consulting with client

-They also get income and assets and credit

The most important part: LO can live here instead of LOS

-And they can co-pilot with same UX when borrower needs help

SAGENT

Presenter:

-Mark Stier, Head of Consumer Platforms

-Demo was CARE, a consumer platform for loan servicers

-This is consumer-first modernization

-It brings the same phone-based experience from originations to servicing

-Borrowers can manage loan payments, balances, taxes, escrows, etc.

-They can also manage hardship requests from request to resolution.

-Most important:

-They can see their home values and make loan requests and/or get offers

-This goes for home improvement and also new home searches

-They can also see credit scores, and all their financial profile

-So their servicer is really powering their financial wellness

-It’s like Zillow and Credit Karma within consumer experience a servicer provides

-Julian Questions:

-First: love seeing servicing modernization for the consumer

-How does a consumer act on something that would create a new origination? Is it tied to LOS?

-How does the servicer team help if a consumer needs help like on a hardship?

LOAN BEAM

Presenters:

-Roby Robertson, VP Marketing & Biz Dev (ran demo)

-Kirk Donaldson, Founder, President & Chief Strategy Officer (main presenter)

-Demo Absolute Wage product

-Tackling paper based problem on wage like we did with taxes

-Designed to read data from unstructured documents

-Best of the best OCR

-OCR is a commodity

-Making sense of data is special sauce

-Prism underpins Absolute Wage

-This lets you get full income analysis from paper wage docs in 5 minutes

-“Digital” solves 30% of wage problem in underwriting

-LoanBeam solves 70% of this

-How fast can you get income analysis done

-And what price of employee

-Up to speed in 2 weeks

-Julian Questions:

-How do your most adopted lenders use this in underwriting?

And with LOs?

TOTAL EXPERT

-Presenters:

-Matt Tippets & Joe Welu, CPO and CTO

-They showed how lenders easily build custom marketing journeys

-Future of lending is data

-And this drives outcomes across all products (not just mortgage)

-Design workflow for leads throughout your org

-Dial and click to call – 2 way sms

-Customer Intel built into journey creator

-Adding Action to “Data, Insights, Action” vision

-Prioritizing follow up for salesforces

-Bringing Consumer Direct efficiency to Retail mortgage operations

-But this serves all Org

-Julian Questions:

-What is best for adoption: centralized turning on of actions to hand LOs deals?

Or letting LOs do it?

-Where does TrueIntent real-time customer survey fit in?

OCROLUS

-Presenter

-Tim Dubes, VP Content Marketing

-POS-Infrastructure

-Super innovative middleware

-End users and customers (LOs) don’t see it

-“Awesome software, terrible demo”

-(but it turned out to be a great demo)

-This is a mortgage approval website demo

-“Rapid Mortgage” demo shows what users experience

-3-part screen: consumer, LO,

-They show which docs are being called by APIs

-Then they see what happens

-Main concept is machine-reading bank statements

-Removing manual tasks

-Firms can build proprietary w Ocrolus & they also power POS systems

-“Everything should be open and work with everything else”

-Sofi, Brex, cross river (4th biggest PPP lender), pay pal

-Sprout

-One of the biggest consumer direct lenders coming in 4Q

-Julian Questions:

-I’m a mortgage CIO: what are my 1-2 best use cases that other parts of my stack don’t cover

-In addition to big customers like ICE, Sofi, LendingClub, Brex, PayPal, Plaid is also a customer — this is intriguing – can you explain: are you powering Plaid?

-You just raised $80m. What is the primary priorities for this round?

TUESDAY PACK 1

AZIMUTH GRC

-Presenter:

-Rohin Tagra, founder & CEO

-Demo of GRC: Validator – Servicing/RegTech

-Tie controls to the right laws in the Rohit CFPB era

-Data, Content, Software

-Brings every law into the system

-Take a law, break it down into sub-section level

-Database elements within the system – totally granular

-Then shows business requirements for each subsection

-Lineage is workflow of tying subsections to law

-Track all updates to all laws in realtime

-Validator is testing rules for all the laws

-Written thousands of testing rules to provide full population testing

-What that means is banks and nonbanks go from manual to automated testing and audit of servicing books

-Can do 1m loans in 20 minutes!

-Can identify loan level compliance for 30-40 factors

-Azure based so it can live on its own

-Validator takes exports from MSP, LoanServ etc, and runs screens

-Then puts them back

-So it’s a simple setup

-Julian Questions:

-Let’s talk a little about how this works with systems of record: BK MSP, Sagent LoanServ, etc

-How long is the setup for someone teams who want 2-way communication w systems of record

-How fast can you keep up with real time regs?

-NOTE: they got all of CARES loaded in days, not weeks!

CLEAR CAPITAL

-Presenters:

-Kenon Chen, head of strategy (former head of product)

-Ashley Bierwolf, senior product manager

-Will demo ClearCapital: ClearCollateral Review – Valuation

-Problem 1: Higher cost, expensive underwriters

-Problem 2: Higher valuations – bias detection

-Problem 3: Todays UW desktop is PDFs w minimal data

-It puts all this data in front of them and automates rest

-Lenders are blowing their customer and LO experience with double reviews because of high values and bias

-1 in 8 appraisals are coming in low – Core Logic

-Julian Questions:

-High values and bias

-What does this solve? LO, Customer Experience? Eliminates double reviews?

-What about rebuttals?

TUESDAY PACK 2

TAVANT

-Presenterd:

-Puneet Jain

-Chayan Jagsukh

-Tavant is where you go when you want proprietary tech you don’t build yourself

-Demo of FinDecision for broker LOs (FinDec is 1 of 5)

-Fully self-serve broker LO ecosystem is demo

-Enables brokers to completely run loans in super easy interface

-And keep them out of the LOS

-Side-by-side DU/LP comparison

-5 key features, 1 min each

-Adoption stats and total volume so far

-1 in 4 loans go through Tavant

-Tavant is empowering brand (aka white label)

-CRITICAL: multi-channel experiences and data for large firms

-FinConnect is data hub – flagship product across industry

-Julian Questions:

-How does this work across channels?

-Can this be customized to the LO level? Or is it controlled at the enterprise level?

-Can this stand alone with the rest of my stack or does it need to be part of other Tavant options like FinConnect?

HOUSECANARY

-Presenters

-Ryan Kaiser, CRO

-Amir Friedman, VP of strategic sales

-Ryan and Amir demo of ComeHome

-ComeHome is a white-label, Zillow-quality portal for lenders to give to borrowers

-Homeowners can see values in real-time, and values are drastically more accurate than Zillow

-They can see how much equity in real-time

-This means they can request or receive loan offers

-They can model out home improvements and the request loans

-Homebuyers can search and save homes from any device

-All consumer activity is given to lenders so they can engage in real-time

-Live an available to 40m customers so far

-Chase and Wells are both customers

-Julian Hebron Questions:

-What’s are top Homebuyer and Owner successes for lenders?

-How does the intent come to LOs and salesforces?

Is it via CH or marketing systems?

-On the valuations, how big is the property database and how accurate and actionable are the values?

BLACK KNIGHT – BK’s SUREFIRE

-Presenters:

-Ryan Minard, Sales Engineer

-Nick Belenky, Chief Revenue Officer

-Demo of 2 marketing playbooks for purchase market transition

-1. Doing your own prospecting – capture leads and bring into SureFire

-Omnichannel marketing: video, text, email

-How does LO orchestrate

-2. Realtor

-Julian Hebron Questions:

-Realtor sites are the way to run a book for them

-What happens after contacts go into SureFire?

SIMPLENEXUS

-Presenter:

-Tracy Farber, Director of Sales Engineering

-Tracy will demo NexusPay

-Ability to pay for credit and appraisal fees within app

-This cuts days off the process

-Most important: single user experience for consumer and loan officer

-Can collect first payment within the app

-Eliminates the confusion of paper/mail transfers

-Tracy will cover how the money gets routed

-GlobalPayments are the rails that power this

-This product was launched at MBA

-Julian Hebron Questions:

-How does the first payment work?

-What happens if the lender sold the servicing?

-Where does that payment go and how does the borrower know they’re good?