Mortgage Industry Says Appraisal Rules Cost Consumers Billions

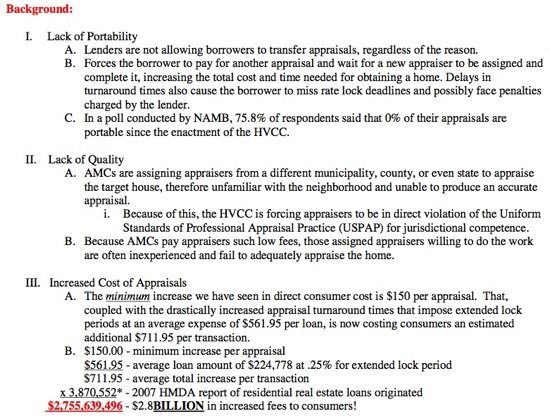

The National Association of Mortgage Brokers says new appraisal rules will cost consumers at least $2.8 billion in extra fees created by long delays (extended lock-in fees) and higher appraisal costs. New appraisal rules, called the Home Valuation Code of Conduct (HVCC), prevent loan originators from talking to appraisers. Here’s NAMB’s full memo on the topic and below are some key excerpts, including the tally of the $2.8b figure.

The memo has somewhat of a heated tone which may convey extreme bias, but these facts do speak for themselves, especially the background facts on how NY Attorney General Andrew Cuomo, the lead crusader for HVCC regulations, brought his original case (that led to HVCC) against a Federally chartered bank and an appraisal management company (AMC). AMCs are companies that banks hire to manage their appraisal process for them under HVCC, banks don’t have to do this, but most do because it’s a simple and fast way to become HVCC compliant. AMCs are utterly unregulated and the original source of Cuomo’s complaints about valuation bias/fraud, yet now AMCs are the solution to the regulations.