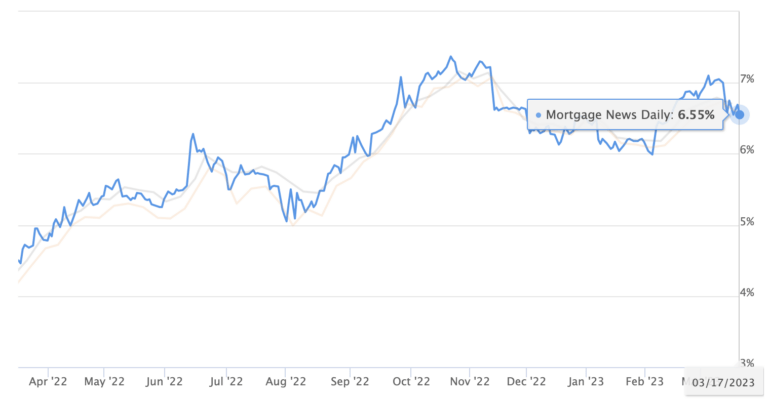

Mortgage rates end bank crisis week at 6.5%. Will they go lower after March 22 Fed?

Matt Graham at Mortgage News Daily has seen a few crises, so he’s always measured. But he does hint that this week’s drop to 6.5% mortgage rates could drop further.

After next week’s March 22 FOMC meeting, the Fed could announce a rate hike around 25 basis points because they still need to fight inflation.

CPI inflation is still at 6% overall and 5.5% if you exclude volatile food and energy prices, both of which are still way above the Fed’s 2% target rate.

Or the Fed — who knows WAY more than any of us about bank system plumbing right now — could pause or even cut overnight bank-to-bank lending rates. Because one year’s worth of hikes totaling 4.5% has wreaked havoc on the era’s bank business model.

That bank model has been that, with short rates so low since the last crisis, deposits are basically free money. So the loans banks make have paid them comfortably more interest than they have to pay out on deposits. Net interest margin success.

But the Fed’s aggressive rate hike cycle, especially after a long period of record low rates for loans being made, has inverted this.

So if the Fed thinks banks are hurting, they’ll pause. If banks continue hurting and/or this gets worse, the Fed will cut.

Both scenarios would be good for mortgage rates. That’s the medium-term assessment.

For the today recap and next week outlook, check out Matt’s post. He’s all over it as usual.

Mortgage rate ace Matt Graham at Mortgage News Daily suggests 6.5% rates may fall more next week, but read his caveats.

___

Check It Out:

– The Fed Will Still Raise Rates in March, And That’s Why Rates May Keep Falling