Mortgage Rates Low 3% To End February 2020. Lock Rates Now?

It’s time again to update the 2020 outlook for mortgage rates, home prices, and home sales. Thanks to our friends at the MBA for compiling all the data that matters. We’ll look at the 2020 quarterly numbers, then the multi-year numbers.

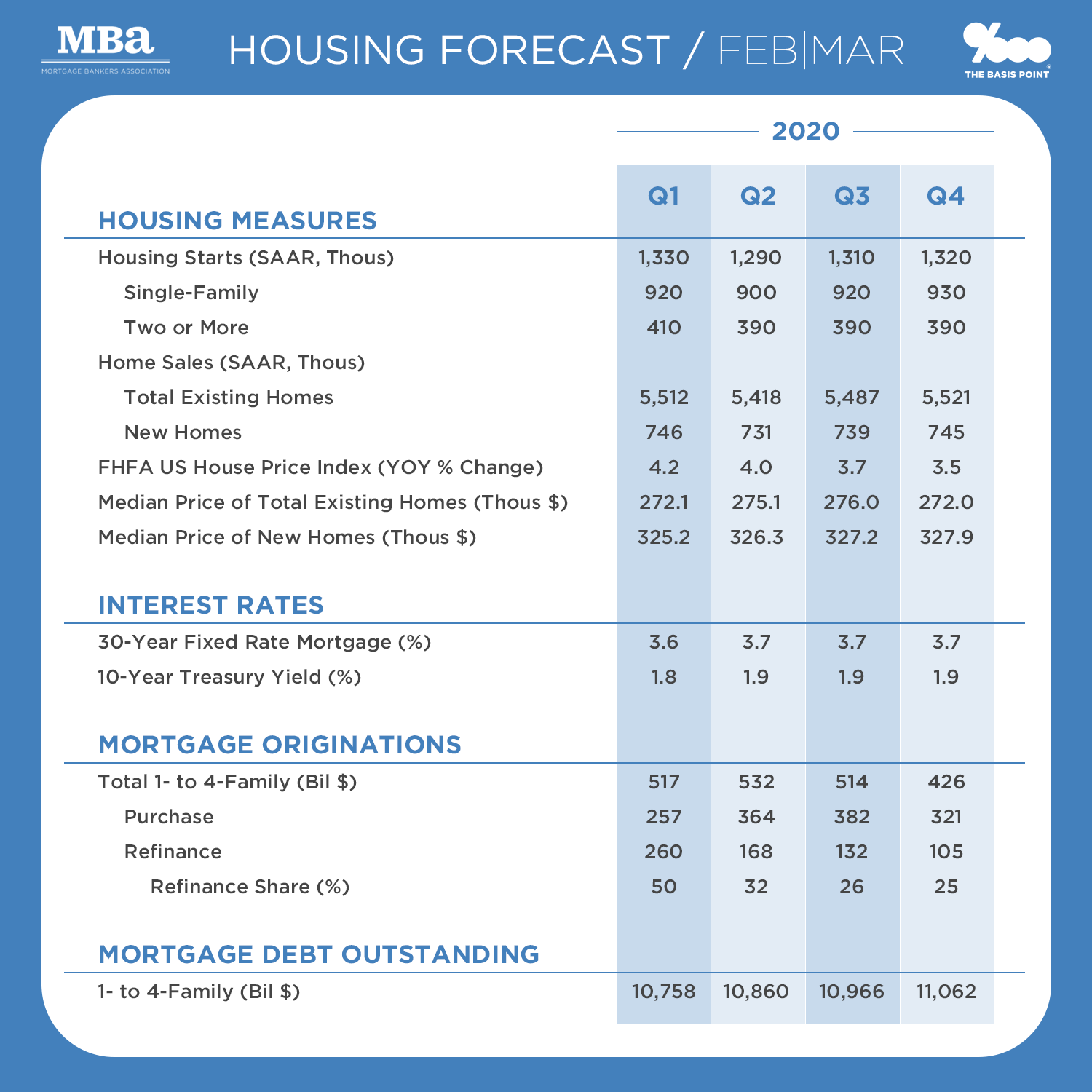

Below is a table of how key 2020 stats may play out by quarter. This outlook was built knowing about coronavirus, but before the severity hit markets this week. So read my comments below the table to get current data on rates, monthly payments, refi cost savings, and whether to lock rates now.

LOCK RATES AT THESE LOWS?

Mortgage rates dropped significantly as this has played out, so this outlook already looks dated.

It shows 30-year rates being about 3.6% in Q1 2020, but today’s rates are more like 3.375%.

The rest of the year shows rates at 3.7%, and it’s hard to guess how quarter by quarter rates will play out when we’re in a volatile segment like this.

Rates will drop more if coronavirus spreads more, but rise if the virus shows containment.

Also as we get closer to the election, rates volatility will increase based on candidates.

The question when rates are this low is always:

Do I hold for lower rates?

The answer is usually no.

Why? Because rates are now likely in a range where they can go down OR UP by about .25%.

If you don’t have the stomach for them to go up again, then take the gains.

If you have a 4% rate on a $300,000 loan and you can get 3.375%, that’s $156 monthly interest cost savings per month.

If you waited and rates rose .25% from here, your monthly interest cost savings would be cut to $94.

MONTHLY PAYMENT ON NEW & EXISTING HOMES

– Median New and Existing home prices may stay steady at around $326k and $275k respectively.

– At these prices a 10% down home new or existing purchase would cost $1872/month or $1579/month, respectively.

– This is all-in cost including principal, interest, taxes, insurance, and mortgage insurance.

– It also uses rates close to 4% instead of 3.375% to account for premiums on a lower down payment.

– But there’s not a .625% premium for this, so these are padded a bit.

– But if rates stay low, this may push up prices more.

HOW MANY REFI & PURCHASE LOANS IN 2020?

– For now, the market is expected to do about $2 trillion new mortgages in 2020, 67% purchase loans and 33% refi loans.

– You can see refis start the year strong then wane in future quarters.

– I expect next month’s revision (which I’ll post here) will show more aggressive Q2 refi numbers.

1.3 MILLION NEW HOMES IN 2020

– New building is another important stat.

– Construction will begin on about 1.3 million homes in 2020, as represented by Housing Starts.

– New construction and remodeling of single family and multifamily homes is about 3-5% of GDP.

– But it has broad ripple effects in the economy as builders purchase materials and hire workers, and buyers spend a lot to buy, move into, and furnish homes.

RATE & HOME PRICE OUTLOOK 2019-2022

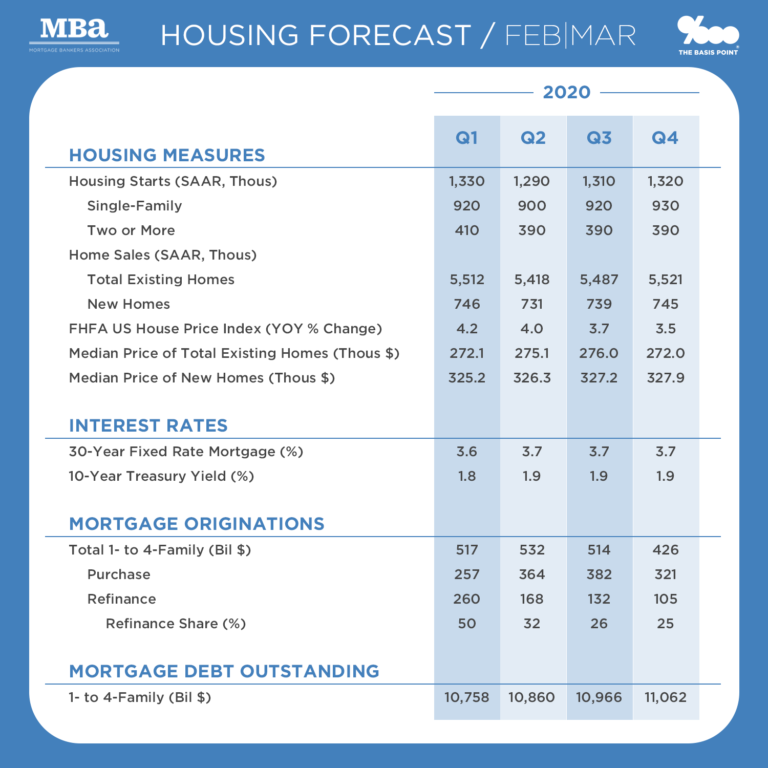

Below is a table with all the same data as the table above but looking out a few years.

Generally, the housing market looks to remain healthy with:

– Rates generally below 4%.

– Building starting on about 1.3 million new homes per year

– About 6 million new and existing home sales per year.

– Almost $2 trillion per year in new mortgages made.