Mortgage refis were supposed to drop off in 2021, but so far tons of people are still able to get lower rates

We began 2021 with a lot of chatter about how refis would drop almost $1 trillion.

When the MBA’s 2021 predictions came out in December, they called for the 2021 mortgage market to be $2.75 trillion, with 43% of the market ($1.19 trillion) being refinances.

Those projections are now much higher, expecting $3.4 trillion in total volume with 51% ($1.74 trillion) in refis.

This is the result of rates staying low despite inflation threats. Rates are tied to trading in mortgage bonds, and inflation threats typically cause bond prices to drop, which causes rates to rise. But that’s not happening yet.

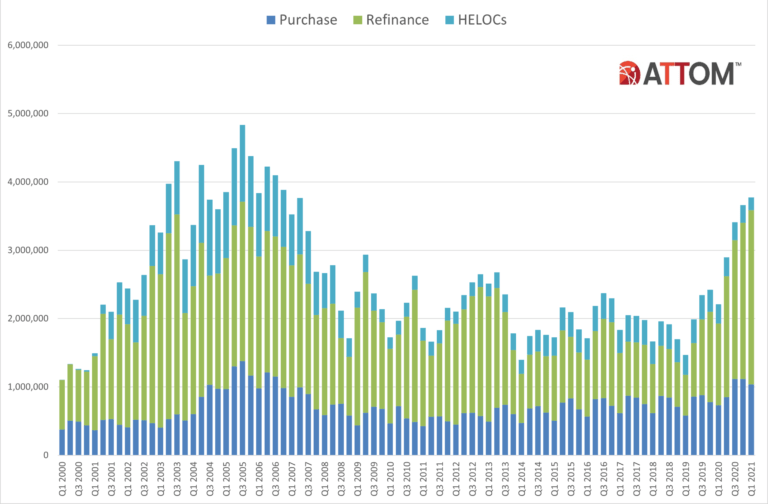

The ATTOM research team also looks at mortgage origination volume, and they’ve got some good refi stats here that also get at the same trend.

They get more local in their analysis. Here’s some quick stats, and the link below has more.

Comment below or hit me with any questions.

Lenders issued 2,549,126 residential refinance mortgages in the first quarter of 2021 – the most since the third quarter of 2003. The latest figure was up 11.6 percent from the fourth quarter of 2020 and 113.2 percent from the first quarter of last year. The dollar volume of refinance packages rose to $775.5 billion in the first quarter of 2021, up 13.6 percent from the previous quarter and 114.1 percent from a year ago.

Refinance mortgages accounted for at least three-quarters of all loans in 20 (9.5 percent) of the 211 metro areas with sufficient data.

Metro areas with a population of at least 1 million where refinance loans represented the largest portion of all mortgages in the first quarter of 2021 were Atlanta, GA (85.3 of all mortgages); Detroit, MI (76.3 percent); Boston, MA (75.6 percent); Buffalo, NY (75.6 percent) and Washington, DC (75.6 percent).

Lenders issued 2,549,126 residential refinance mortgages in the first quarter of 2021 – the most since the third quarter of 2003. The latest figure was up 11.6 percent from the fourth quarter of 2020 and 113.2 percent from the first quarter of last year. The dollar volume of refinance packages rose to $775.5 billion in the first quarter of 2021, up 13.6 percent from the previous quarter and 114.1 percent from a year ago.

Refinance mortgages accounted for at least three-quarters of all loans in 20 (9.5 percent) of the 211 metro areas with sufficient data.

Metro areas with a population of at least 1 million where refinance loans represented the largest portion of all mortgages in the first quarter of 2021 were Atlanta, GA (85.3 of all mortgages); Detroit, MI (76.3 percent); Boston, MA (75.6 percent); Buffalo, NY (75.6 percent) and Washington, DC (75.6 percent).

___

Check It Out: