Now’s the perfect time to buy a home, especially if you’ve already got it made

Getting into the “upper middle class” is basically winning the American Dream. You’re not quite living like a celebrity, but you have access to all the creature comforts you could want (and basically every movie and TV show is about you!).

But life’s getting harder for even those in the top 10 percent, since kinda-rich hallmarks like good college educations for your kids are getting more expensive.

However, new data from Bank of America says the kinda-rich aren’t scared by Bloomberg headlines. They’re actually pumped to take advantage of low interest rates to buy homes. Let’s look at the data:

A growing percentage of upper-middle class people making between $125k and $250k think now is a good time to buy, and they’re right. We’re having a few rare moments of homebuyer bliss right now, including:

– Super low interest rates

– Super low unemployment leading to talent wars and higher incomes.

– Rising home values (albeit at a slower pace now, but still rising).

– Sellers spooked by top of market fears, which gives buyers upper hand negotiating in many markets.

So if you’re lucky enough to be in that upper-middle class bracket, you’re in a good spot to buy a home.

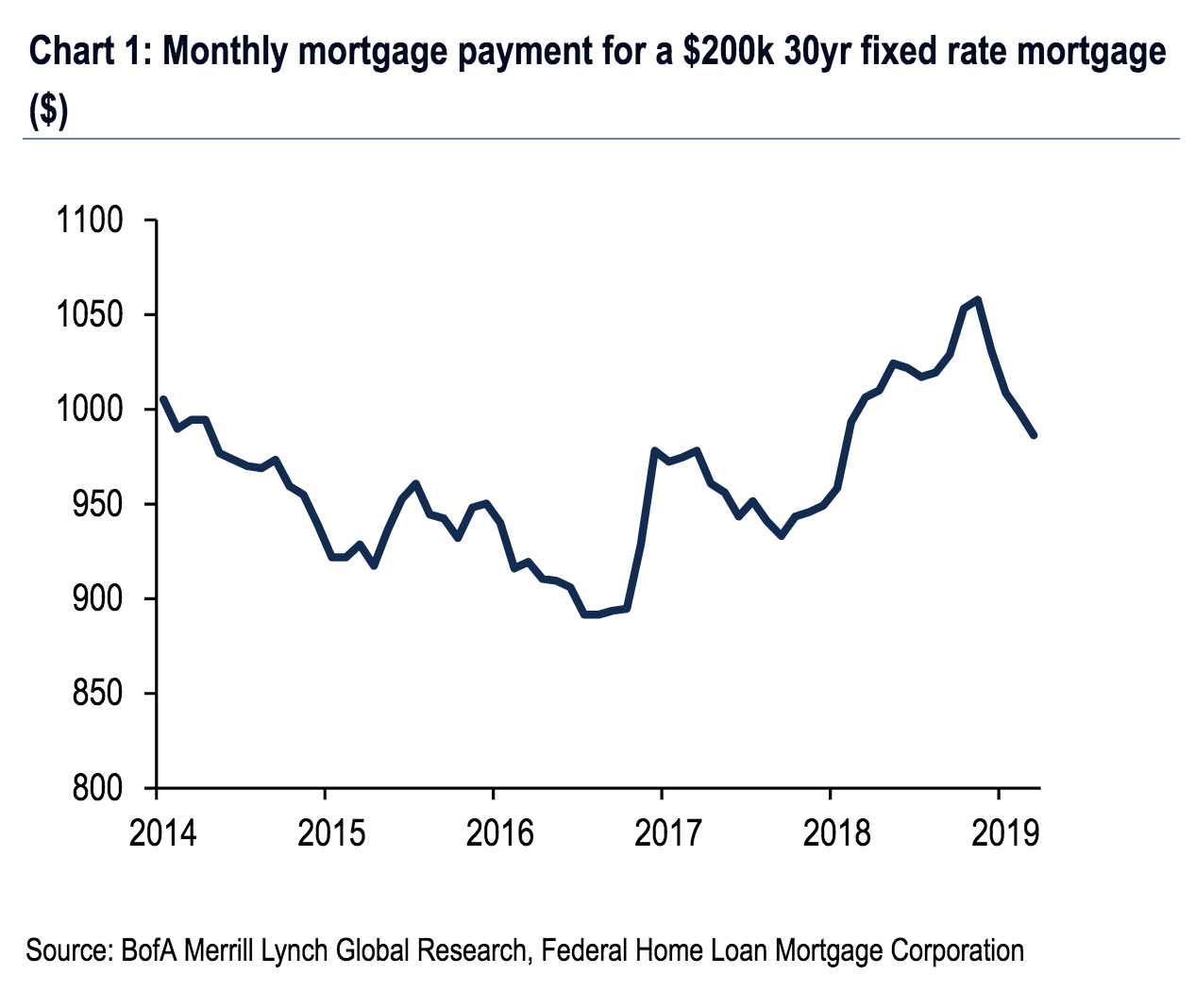

But it’s not just the well-off that benefit from all this. Since rates are low right now, homebuyers for lower-priced homes are looking at low monthly payments, too:

So if you’re confident you can qualify for a mortgage, now is a good time to dive into the market. Since it’s spring, sellers are eager to get their homes on the market. Happy house hunting.

+++

Also noteworthy about how these data are collected…

We’re pulling all this data from Bank of America research reports BofA sends us, but there’s a caveat. How does BofA collect this data? Well, from its latest report, it goes after people who are Super Online.

Our survey data is collected online by survey company RIWI using “Random Domain Intercept Technology” (RDIT). This directs respondents who enter an incorrect or lapsed URL address to a randomized survey site. The individuals who make these errors should constitute a random and representative sample of the US online population.

Wait, so those pop-up surveys you get when you mistype a website are informing one of the world’s most powerful banks?! What?!

Well, maybe we need to take all this with a salt shaker since I doubt many people taking random online surveys are being 100% truthful. But if BofA trusts it, who am I to criticize?

Chew on this data as we dive in deeper. For now, keep in mind that the next random online survey you fill out might have a bigger impact than you think…