Linkage: mortgage regulation roundup

This was a huge week for the CFPB, which is the mortgage industry’s new regulator and is arguably has the biggest impact on housing in the coming years. So today’s Originations linkfest, like Monday’s, is again mostly focused on new regs for the mortgage industry. A lot of good work and analysis being done out there. Here’s the rundown for now (there’s more coming as more rules are announced)…

HOUSING REGULATION (INCLUDING CFBP’s QUALIFIED MORTGAGE RULES)

– Summary of final rule on loan originator compensation (CFPB)

– CFPB Comp Rules Shift Mortgage Brokers Direction (Kerri Ann Panchuk, HousingWire)

– CFPB in their own words: “New rules, fewer runarounds for mortgage borrowers” (CFPB)

– Future of mortgage industry to be decided in a tidal wave of regulations in the next 6 months (MortgageNewsDaily)

– How The Qualified Mortgage Rules Could Hit The Jumbo Market (Nick Timiraos, WSJ)

– We’ll need to rethink QM rules on interest-only jumbo mortgages (Dick Lepre)

– Housing Industry Awaits Down Payment Rule For Mortgages (Clea Benson, Businessweek)

– New Mortgage Rules Threaten Minority Homeownership (Liz Peek, The Fiscal Times)

– Rundown of new rules for mortgage servicers (Diana Olick, CNBC)

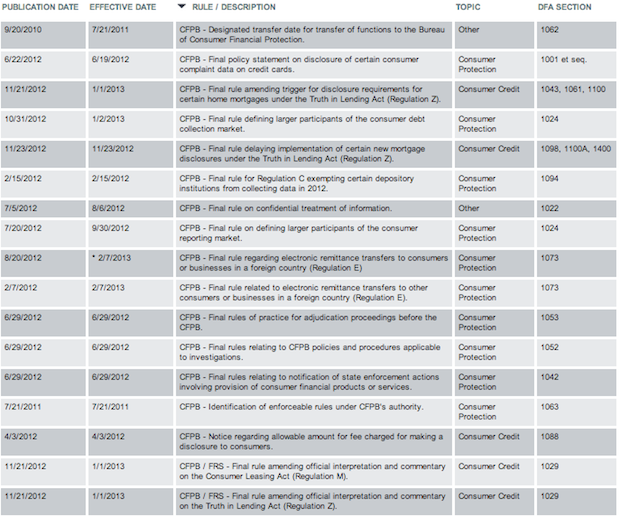

– St. Louis Fed’s list of upcoming Dodd Frank rules. Table below is CFPB’s rules only (and actually doesn’t include all the housing rules). And the link has rest of Dodd Frank broken down by agency (St. Louis Fed)

– CFPB To Cause Compliance Costs Spike? (Here’s Paul Muolo, InsideMortgageFinance:)

Certain mortgage bankers are using a four-letter word to describe the trifecta of “final” regulations unveiled by the CFPB the past two weeks, and as you might guess that word isn’t “love.” The rules – servicing, qualified mortgages and loan originator compensation – will shape the industry for years to come. Everyone knows that. But there’s a financial calculation involved as well: just how much more will all these regulations cost the industry? Will some decide to get out while the getting is good? A few months back we talked to the CEO of a Houston-based nonbank who told us he had almost 20 people working in his compliance department. Two years prior that number was five. Yes, mortgage lenders are going to pay more because of the new regulations – how much more remains to be seen. But it’s no secret how that cost will be funded: it will be passed on to the consumer…

– And don’t miss my QM 101 comments/links from Monday (TheBasisPoint)

OTHER GOOD STUFF

– San Francisco Bay Area Home Prices Surge Most Since 1998 (Nadja Brandt, Bloomberg)

– Difficult choices if U.S. hits debt ceiling (Annie Lowrey, NYTimes)

– Having Fits With Appraisal In Homebuying Process (Jonathan Miller, Matrix)

– Rental home bond deals need costlier structures (Jody Shenn, Bloomberg)

– What The Home Of The Future Will Look Like (Megan Rose Dickey, BI)

___

Follow The Authors:

@lizpeek, @TheFiscalTimes, @meganrosedickey, @mortgagenewsmnd, @cfpb, @JodyShenn, @AnnieLowrey, @NadjaBrandt, @nicktimiraos, @cleabenson, @diana_olick, @jonathanmiller, @stlouisfed, @PaulMuolo, @IMFPubs, @HousingWire, @Kerri_HSWire