Politics 62% of us agree on: Regulate tech companies offering bank products

We’ve been doing a series of posts on Apple banking. The latest below runs down Morning Consult data about how the Apple seeds of banking are growing fast.

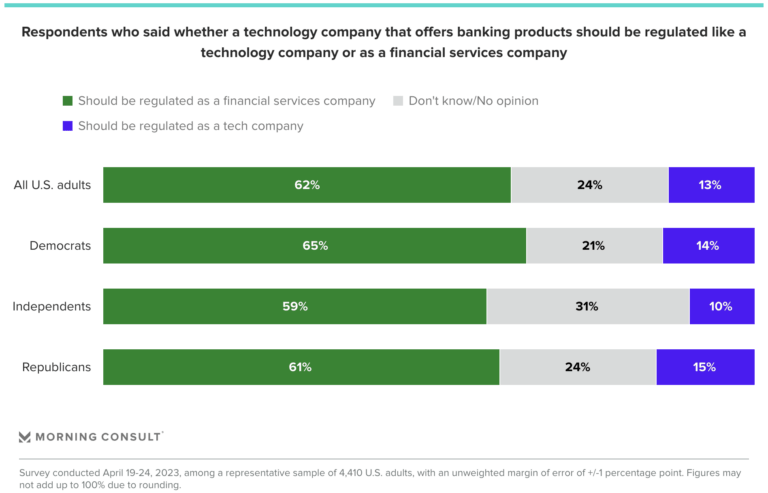

Using the same Morning Consult survey, I want to call out a political stat we can finally all agree on:

If a tech company is offering financial services, they need to be regulated accordingly.

Among the groups who believe this:

– 62% of U.S. adults

– 65% of Democrats

– 61% of Republicans

– 59% of Independents

As for Apple, Goldman Sachs powers its Apple Card and savings account.

But what if future Apple Pay Later or other Apple banking plans change course?

Is Apple itself — or a future subsidiary — open to becoming a regulated financial institution?

As I noted in the link above, I attribute Apple’s success in fintech and consumer banking not just to superior user experience.

It’s also a result of Apple’s steadfast commitment to privacy.

They’re arguably the only Big Tech firm that’s truly honored privacy, and this is EVERYTHING in winning trust with people’s money.

That’s why they’re doing so well with financial products.

For now, Apple outsources consumer banking risk to Goldman while they control user experience.

But to either grow financial products like they want or to keep consumer trust, they’d have to be regulated like a financial firm.

And my 2 cents is that Apple would be an ideal candidate for this.

They could show the rest of Big Tech how to behave like a responsible banking player.

___

Reference:

– Apple’s Savings Account: Consumer Interest and Demographics