Positive Regulation Coming For Credit Default Swaps

More than 1,400 banks and asset managers will adopt a new “big bang” protocol, which will make it easier for investors to know what will happen to credit derivatives contracts if debt defaults occur.

The US market will also introduce a standardised pricing system for CDS contracts, which have hitherto been run on an unregulated, freewheeling basis.

The moves follow mounting criticism of the credit derivatives world, which some regulators claim contributed to problems at AIG. The pressure for change was underscored at last week’s meeting of G20 leaders, which reiterated calls for more standardisation and transparency.

Robert Pickel, head of the International Swaps and Derivatives Association, argued that the reforms showed the industry was responding to these calls. “These measures provide a framework – it will bring more order. It is a significant step,” he said.

Nevertheless, some bankers admitted there could be teething problems implementing the new contracts, particularly since Europe is lagging behind the US in their adoption. There is also concern in some regulatory circles that the scope of reforms remains far too limited.

Bankers, however, stress that the “big bang” protocol is now occurring alongside other reform measures, such as a move to adopt centralised clearing for the first time. The InterContinental Exchange said this week that ICE Trust – the clearing house for credit derivatives it formed in collaboration with some of Wall Street’s biggest names – cleared 613 CDS transactions with a notional value of $71bn in its first four weeks of operation.

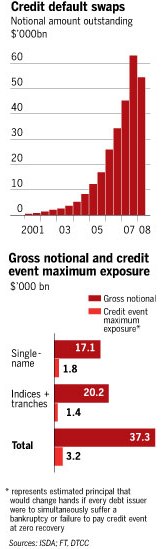

Separately, TriOptima, a trade processing group, said it had removed $5,500bn of redundant contracts from the market in the first three months of the year because banks had cancelled deals that offset each other. This process of “tearing up” – or offsetting contracts – has already cut the estimated size of the sector to below $30,000bn, less than half its level 18 months ago.

Raf Pritchard, chief executive at TriOptima North America, said the increased attention by regulators and balance sheet constraints at banks had heralded a big change in attitudes.