Rates Even After Home Price & New Home Sales Data

Rates even today as home prices fall at a slightly slower pace, new home sales chug along at low levels (but higher prices), and retail sales flat.

The FNMA 30yr 3.5% MBS coupon that lenders use as a benchmark for rate pricing is down 6 basis points, so there’s some upward rate risk of this gets worse, but so far we’re even on rates.

[UPDATE: negative rate repricing could be coming, FNMA 3.5 coupon now down 13 bps]

Here’s a rundown of today’s data.

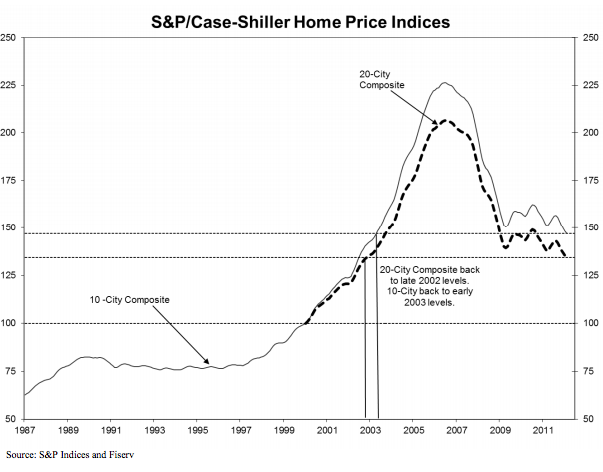

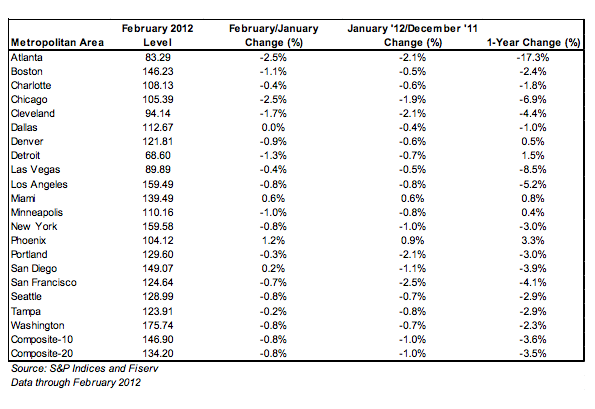

S&P Case-Shiller Home Price Index (February 2012)

– 20 City Month/Month Seasonally Adjusted +0.2% after a revision of previous from +0.0% to -0.1%

– 20 City Month/Month Seasonally Adjusted -0.8%

– 20 City Year/Year Seasonally Adjusted -3.5%

FHFA Home Price Index (February 2012)

– Month/Month Index was +0.3% after a revision of prior from +0.0% to -0.4%.

– This index is only for homes with Fannie/Freddie loans

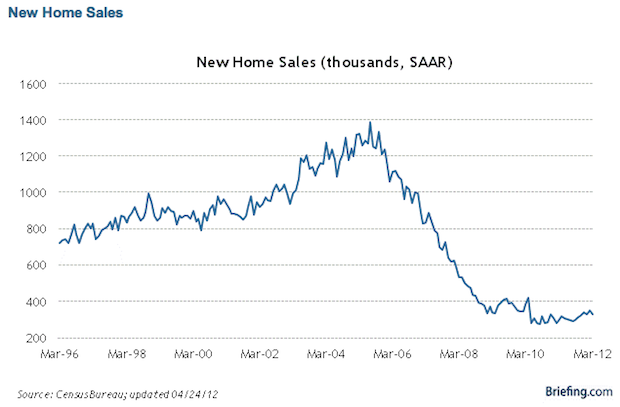

New Home Sales (March 2012)

– 328,000 Seasonally Adjusted Annual Rate

– Previous was revised to 353,000 from 313,000

– Median sale price $234,500

Retail (week ended 4/21/2012)

ICSC-Goldman Store Sales

– Week/Week +0.8%. Previous was -1.0%

– Year/Year +3.6%. Previous was +3.2%

Redbook

– 2.7% Year/Year. Previous was +3.0%.

Keep in mind the warning that these reports of sales in chain stores have inherent bias to the upside. They make no allowance for the survivor bias created when one store closes and its business moves to nearby outlet.

Consumer Confidence (April 2012)

– Index is 69.2 down from 70.2 revised to 69.5

Richmond Fed Manufacturing Index (April 2012)

– Index was 14. Previous was 7.

Considering how far we are into a recovery and how accomodative monetary policy is, this data is remarkably weak. An FOMC meeting starts today and the fact is that monetary policy can do little to correct irresponsible fiscal policy.

___

$TLT $MBB $XHB